Coinspeaker

ETH Price Grinds Higher amid Expected US SEC’s Decision on Spot Ethereum ETF Applications

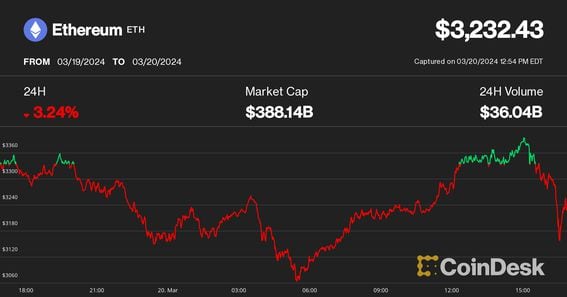

Ethereum (ETH), the undisputed world web3 leader that has facilitated over $279 billion in bridged total value locked (TVL) through its popular EVM, is about to enter the exciting phase of the macro bull run. The large-cap altcoin, with a fully diluted valuation of about $396 billion and a daily average traded volume of around $11 billion, rallied around 3 percent in the past 24 hours to trade about $3,249.

Having closed last week on a bullish outlook, with a Doji weekly candlestick, Ethereum price is aiming to retest its all-time high in the near term. Furthermore, short-term Bitcoin (BTC) holders have already begun distributing their profits to the altcoin market in the ongoing crypto cash rotation.

Spot Ethereum ETF Final Decision on the Horizon

The United States Securities and Exchange Commission (SEC) has a month to the official deadline for its decision on the spot Ether ETF applications. The multiple fund managers that received the green light to offer spot Bitcoin ETFs earlier this year are the same ones in the race to offer spot Ether ETFs.

Notably, the approval of spot Bitcoin ETFs was largely influenced by the court, which compelled the US SEC to use the same parameters for ETFs as the futures previously approved. With the US Ethereum futures having been in existence for several years, there is a high chance the US SEC could follow the same trend.

However, the agency has been arguing that Ethereum is more of a security than a commodity than Bitcoin. Some experts have argued that the US SEC might not want to approve the spot Ether ETFs as other altcoins will follow the same path led by Ripple-backed XRP, Solana (SOL), and Dogecoin (DOGE), among others.

Meanwhile, Grayscale Investments LLC filed with the SEC its form S-3 prospectus on April 23 in its bid to convert its Ethereum Trust to a spot Ether ETF. Notably, Grayscale now has all the required documents filed with the US SEC, thus leaving the agency to decide.

The company also filed an S-1 for a mini Ethereum ETF under the ticker ETH, similar to its BTC mini ETF that is yet to be approved by the US SEC.

🚨NEW filings from @Grayscale:

The asset manager has just filed its Form S-3 with the @SECGov, a registration statement for the conversion of its Ethereum Trust to a spot $ETH ETF. Unlike the other ETH ETF issuers, Grayscale does not have to file an S-1 because its Ethereum…

— Eleanor Terrett (@EleanorTerrett) April 23, 2024

On Tuesday, BlackRock Inc (NYSE: BLK) filed an amendment to its spot Ether ETF application through form 19b-4. The increased engagement follows the delayed decisions by the US SEC on two spot Ether ETF applications; by Grayscale and Franklin Templeton.

Ether Price Action

Ethereum price is hovering at a major crossroads in its Bitcoin pair.

If $ETH breaks through 0.05 BTC, it's party time. pic.twitter.com/QHnPnwo6Iu

— Michaël van de Poppe (@CryptoMichNL) April 24, 2024

According to a popular crypto analyst Michaël van de Poppe, the anticipated altseason will begin as soon as the ETH/BTC pair rebounds from the current levels. Furthermore, Bitcoin dominance has been eating into altcoins since early last year.

ETH Price Grinds Higher amid Expected US SEC’s Decision on Spot Ethereum ETF Applications