The FUD surrounding Ethereum remains incessant.

While on the one side, the XRP army has been accusing the US Securities and Exchange Commission of displaying favouritism towards ETH. On the other hand, the SEC appears poised to not only publicly claim that Ethereum is a security, but also reject spot Ether ETFs in May.

The Ethereum price has impressed the bulls with its resilience as it continues to trade above $3100. However, analysts are cautioning investors regarding the possibility of ETH falling to $2700 in the coming weeks.

$ETH / $USD - Update Worse case i expect us to dip lower to $2700 support zone in time. Will take a few months, but failing to get over $3,600 would enable this pic.twitter.com/YLT8VaU3Nm

— Crypto Tony (@CryptoTony__) April 26, 2024

Consensys Lawsuit Reveals SEC Is Coming After Ethereum

Blockchain software company and the parent company of MetaMask - Consensys - sued the US Securities And Exchange Commission over “unlawful seizure of authority”.

Consensys had previously received a Wells Notice by the SEC on April 10th, accusing the company of breaching the Securities Act via its MetaMask wallet.

Looks like @Consensys received a Wells notice from the @SECGov in regards to its @MetaMask wallet so it’s chosen to sue the regulator first, asking a court to determine $ETH status. The question @GaryGensler has refused to answer may now ultimately be answered by a court. https://t.co/DKzZAbW03P

— Eleanor Terrett (@EleanorTerrett) April 25, 2024

In response, the former has gone on the offensive, suing the Commission for overreaching its authority. Consensys wants the court to declare that Ethereum is not a security and that decentralized wallets such as MetaMask could not be security brokers.

SEC chairman Gary Gensler has traditionally remained wishy-washy regarding ETH’s security status, even in various Congressional hearings.

Gensler also previously hinted that while ETH was initially a commodity, the Ethereum merge - which changed its consensus mechanism from proof-of-work to proof-of-stake - could have made it a security.

Needless to say, Ethereum being declared a security could be catastrophic for its price.

The SEC is also set to reject all spot Ethereum ETF applications, including BlackRock’s. It is unclear whether this decision is already priced in by the market or whether the second-largest cryptocurrency will take another hit in May.

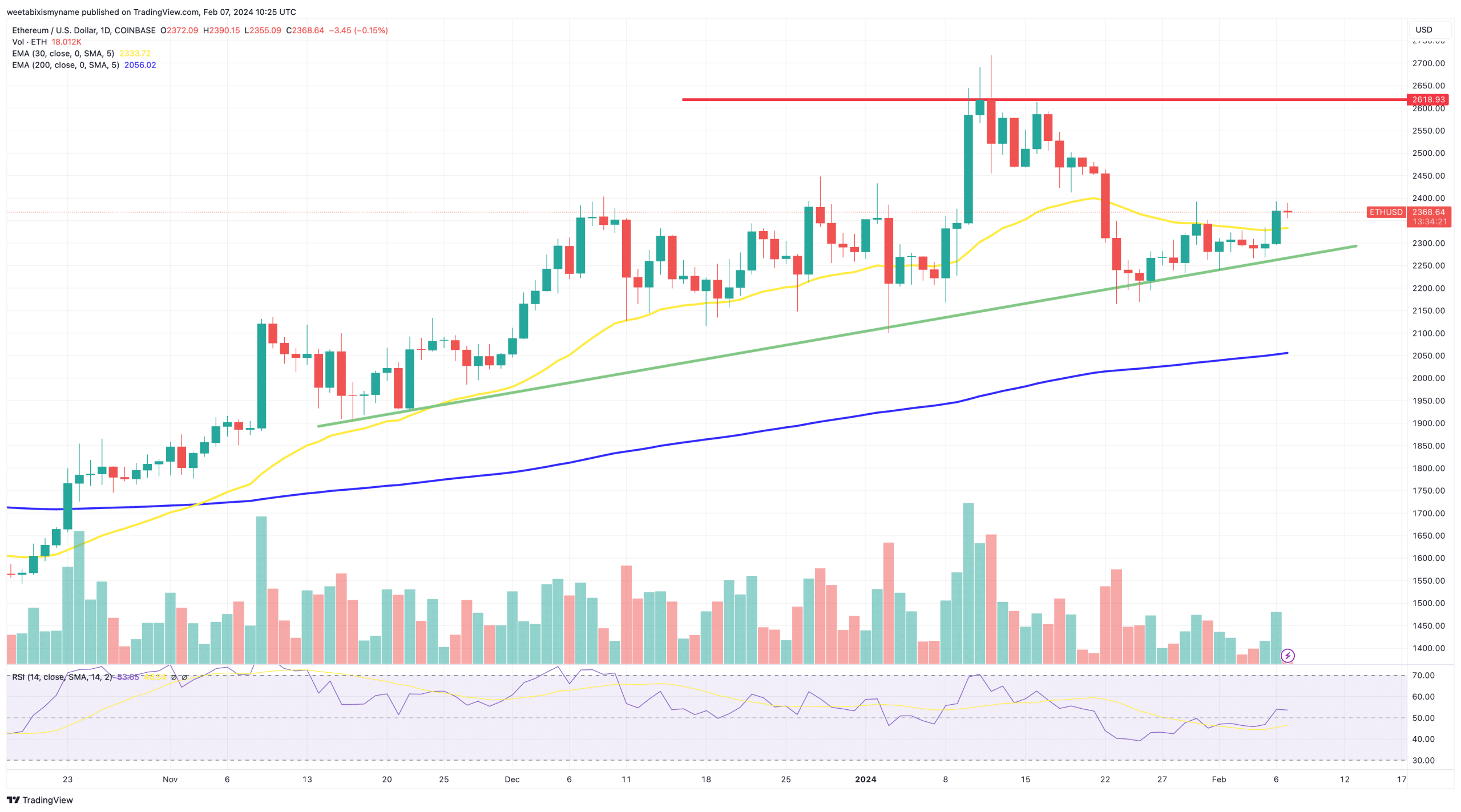

Ethereum Price Forecast - Is ETH Headed To $2700?

ETH has shown resilience, much to the delight of the bulls.

A look at the Ethereum price chart showcases that while it did plunge 6% on Thursday, it has managed to trade above the $3,100 support - at $3,150 at press time.

However, popular trader Crypto Tony reveals that Ethereum needed to flip the $3600 resistance into support to resume its bullish trajectory. Now that this looks like a distant dream, he projects the ETH price to gradually dip to the $2700 support.

Analyst Benjamin Cowen also expects the ETH/BTC trading pair to remain bearish. In a recent X post, Cowen highlights how the ETH/BTC chart shows weakness in the second financial quarter before hitting a bottom in June.

New Meme Coins Could See Higher Demand If Ethereum Rally Halts

It is unlikely for Ethereum to show a sudden sharp decline in light of the SEC vs Consensys lawsuit.

Most market participants saw this legal battle coming from a long way, as could also be the case with the rejected spot ETH ETFs.

However, these two factors, in addition to the continued macroeconomic risks, could lead ETH to adopt a consolidatory price action with a slightly bearish trajectory to $2700. A tepid Ethereum also reduces the possibility of an altcoin season.

In such a scenario, investors could once again turn to new meme coins for potentially higher volatility and greater returns.

Could WienerAI Be The Next 100x Meme Coin?

New Ethereum-based meme coin WienerAI is off to a strong start in its presale, raising over $375k on the very first day.

The WienerAI meme coin claims to be represented by the first AI-powered sausage dog, one that has already captured the imagination of investors through its hilarious portrayal.

After all, the new motto in the meme coin community has become, “If it makes me laugh, I’m buying”. Notably, one of the earliest investors in Dogwifhat ($WIF) - trader Blockgraze - revealed he invested in the meme coin simply because the dog had a hat.

Therefore, the strong early demand for the first Wiener/Dog/AI-inspired meme coin is not out of the ordinary.

However, the new meme coin also has utility. Being an Ethereum-powered meme coin, it allows token holders to stake their holdings. According to the WienerAI staking dashboard, the current reward rate is over 1800%.

However, this yield percentage is set to decrease as an increasingly higher number of tokens are staked, giving an advantage to the early buyers.

Investors can purchase WienerAI by visiting its website and using the over-the-counter widget to swap ETH, BNB or USDT tokens. They could also use a bank card.

They can learn more about the meme coin through its whitepaper or by following its X or Telegram account.

Disclaimer: This is a sponsored article and is for informational purposes only. It does not reflect the views of Crypto Daily, nor is it intended to be used as legal, tax, investment, or financial advice.