Mastering the art of credit card arbitrage can feel like finding a hidden treasure map in the world of finance. But it’s not for the faint of heart. Let me tell you about a guy—an experimental physicist, no less—who turned this concept on its head. His story is basically a David versus Goliath tale of battling the IRS and winning.

This physicist, curious as a cat and sharp as a tack, wondered if he could spin his credit card points into gold. He set his sights on American Express (Amex), a company known for its reward programs. Amex was offering a whopping five percent cash back on purchases at grocery stores.

So, what did our man do? He stormed the grocery aisles, but instead of filling his cart with food, he loaded up on Visa prepaid gift cards. Every swipe at the register was more money in his pocket, thanks to that five percent kickback.

The Loop of Lucrative Returns

Here’s where it gets clever. He didn’t just stockpile these gift cards under his mattress. He turned them into money orders, then deposited those into his bank account. This wasn’t money laundering; it was money cycling — turning plastic into cash, then using that cash to pay off the credit card bill. Rinse and repeat.

The fees for buying the gift cards and converting them to money orders were peanuts compared to the cash back he was raking in. We’re talking about a net gain of around three percent per cycle, which added up to a cool $300,000 to $310,000 in profit. That’s not chump change by any stretch.

But when the IRS got wind of his scheme, they weren’t throwing confetti. They wanted him to pay taxes on his windfall. Our physicist wasn’t having it. He argued that credit card cash backs are merely discounts, not income. Guess what? The tax court agreed. He walked away with his earnings, tax-free. Boom!

The Risk and Reward of Credit Card Arbitrage

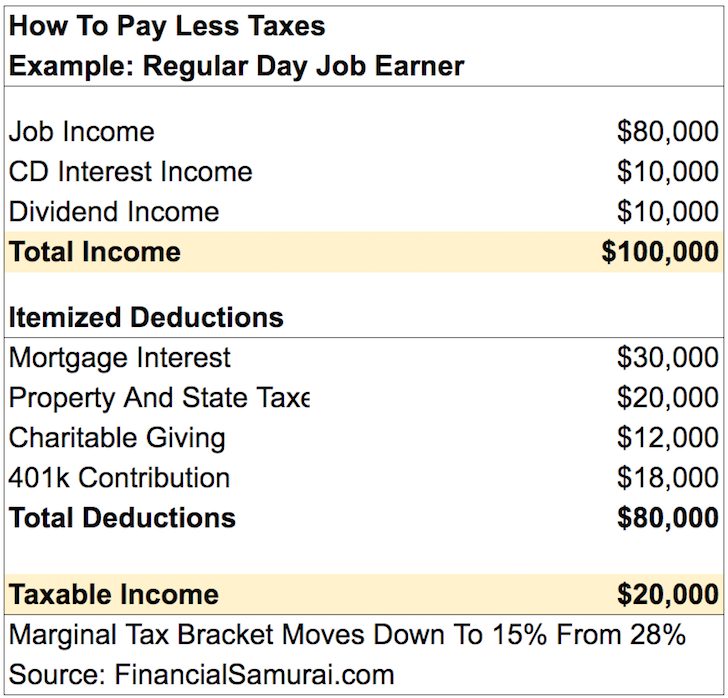

Now, if you’re thinking about trying credit card arbitrage yourself, you need to understand the basics. It usually involves taking advantage of a zero percent introductory APR on balance transfers. You transfer a huge sum from the new card, then invest that money in something safe like a savings account or a CD, which earns you a bit more interest than what you’re paying on the card.

But here’s the catch. You need to be on point with your payments. Miss one, and not only do you get slapped with a late fee, but your sweet zero percent interest rate could skyrocket to 30 percent faster than you can say “bankruptcy.”

Suddenly, you’re paying about $4 a day in interest on that initial $5,000. And if you think you can just pull your money out of the CD early, think again. There’s a penalty for that, costing you a chunk of the interest you’ve earned.

Credit card arbitrage isn’t a walk in the park. It’s more like a tightrope walk over a canyon. The potential profits might not always be worth the stress and the risk. After all, even if you play your cards right, taxes will nibble away at your earnings.

For example, if you make $100 in interest, expect the government to take about $24 if you’re in the 24 percent tax bracket, plus whatever your state taxes are. That slices your net gain down significantly, often making the whole venture more trouble than it’s worth.

In the end, while our physicist friend hit a home run with his credit card gymnastics, this game isn’t for everyone. It’s a high stakes play that requires nerves of steel and a flawless execution plan. You could end up a few hundred thousand dollars richer, or you could get caught in a spiral of debt and fees.

So, guys, listen to me. Weigh your options, consider the risks, and maybe—just maybe—you’ll find your way to a treasure chest of credit card arbitrage gold.