Uniswap price analysis shows that the UNI/USD pair is currently in a bearish cycle. The value of Uniswap has been reduced to $6.31, after finding support at $6.27. The market is expected to correct higher, but Uniswap is facing resistance at $6.49. Since yesterday, the UNI price has been in a downtrend. It started the day at $6.30 and reached a low of $6.27 before correcting higher.

The UNI/USD pair is down by 1.52% in the last 24 hours. The digital asset’s 24-hour trading volume is $96 million, and it has a market capitalization of $4.80 billion.

UNI/USD 4-hour price chart: Prices retrace lower after a strong rejection at $6.49

The hourly chart for Uniswap analysis shows that the pair has formed a bearish trend line, which is currently being tested for support. The price is also below the moving average, which is another bearish sign. The RSI indicator is currently at 37.79, which indicates that the market is in bearish territory. The MACD indicator is also bearish, as the MACD line is below the signal line.

Looking at the 4-hour chart for UNI/USD, we can see that the volatility has been reduced in the market, as prices have been consolidating between $6.27 and $6.49. The market is expected to correct higher from current levels, but it faces strong resistance at $6.49. A break above this level could see Uniswap prices rally toward the $6.55 resistance level. However, if the bears gain control of the market, we could see Uniswap prices fall to the $6.27 support level.

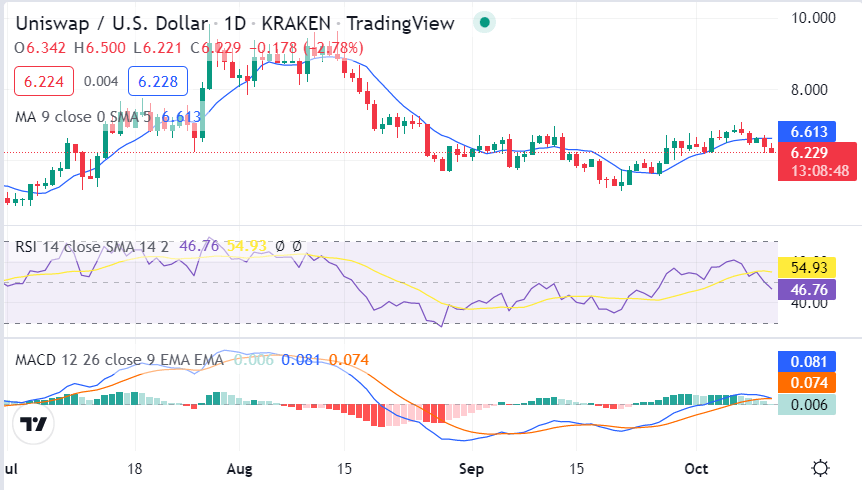

Uniswap price analysis 1-day price chart: UNI/USD pair in a bearish trend

On the 1-day chart for Uniswap price analysis, we can see that UNI/USD has been following an ascending parallel channel over the weekend and had even managed to break out of it briefly. However, the bulls were unable to sustain this momentum, and Uniswap fell sharply today. The cryptocurrency is currently trading just below the middle line of the channel, and a break below this line might send Uniswap all the way down to the $6.27 level.

The 50-day moving average is currently at $6.61, and the 200-day moving average is $6.22. The relative strength index (RSI) has been slipping lower from overbought levels and is currently at 54.93. The MACD in line blue is currently at 0.01, which is an indication that the market is in a bearish phase.

Uniswap price analysis conclusion

Overall, the market sentiment for Uniswap is bearish, and we can expect the prices to fall further in the near term. From the above 1-day and 4-hour price charts, it is evident that Uniswap is in a downtrend and is facing strong resistance at $6.49, which is preventing it from correcting higher. A break below $6.27 could see the Unsiwap prices tumbling lower in the near term.

Disclaimer. The information provided is not trading advice. Cryptopolitan.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.