Hong Kong’s Harvest Global Investments is teaming up with Singapore’s MetaComp to shake up the crypto scene. They’ve got a deal to push out cryptocurrency spot ETFs in Singapore. It’s all written down in a memorandum of understanding, which pretty much means they’re serious about making it happen.

MetaComp, with its tech savvy and a platform called Camp by MetaComp, will let investors in Singapore buy into Harvest’s crypto ETFs. They’re saying this move could make these ETFs big news globally, and it’s also a chance for MetaComp to stack up its offerings with some top-tier financial products.

Expanding Horizons

Harvest isn’t new to the game. It’s part of a trio of Chinese asset managers stretching their legs internationally, with Bosera Asset Management and China Asset Management. Just on April 30, they launched a couple of ETFs each for bitcoin and ether. Bosera’s playing ball with HashKey Capital on this one.

But it’s not just about selling ETFs. Harvest and MetaComp are plotting to weave Harvest’s asset management smarts into MetaComp’s services. MetaComp’s also set to amp up its digital payment token services, which is just part of how deep this partnership goes.

They’re not just thinking about their current customers either. They’re eyeing new markets, folks who are all about blending traditional and crypto finance. Bo Bai, the big boss over at MetaComp, threw down some serious talk about bridging old school finance with the crypto world. With Harvest’s know-how and MetaComp’s tech, they’re looking to deliver some serious value.

Regulatory and Market Moves

MetaComp’s got the green light from Singapore’s authorities, being all licensed and above board with the Monetary Authority of Singapore. They’re not just playing local either. This deal has them set to start trading these shiny new cryptocurrency spot ETFs on the Hong Kong Stock Exchange starting April 30, 2024.

It’s a pretty ambitious plan aiming to sprinkle some of that crypto magic around, especially with these products expected to pull in investors far and wide.

Now, despite all the hype, the kickoff in Hong Kong was a bit of a slow burn. The city launched three bitcoin ETFs and three ether ETFs, but the trading floor wasn’t exactly on fire. We’re talking about HK$43 million changing hands for bitcoin and just HK$5.5 million for ether on one of the days. Even though that sounds like a lot, it’s pretty chill compared to the fanfare on the first day.

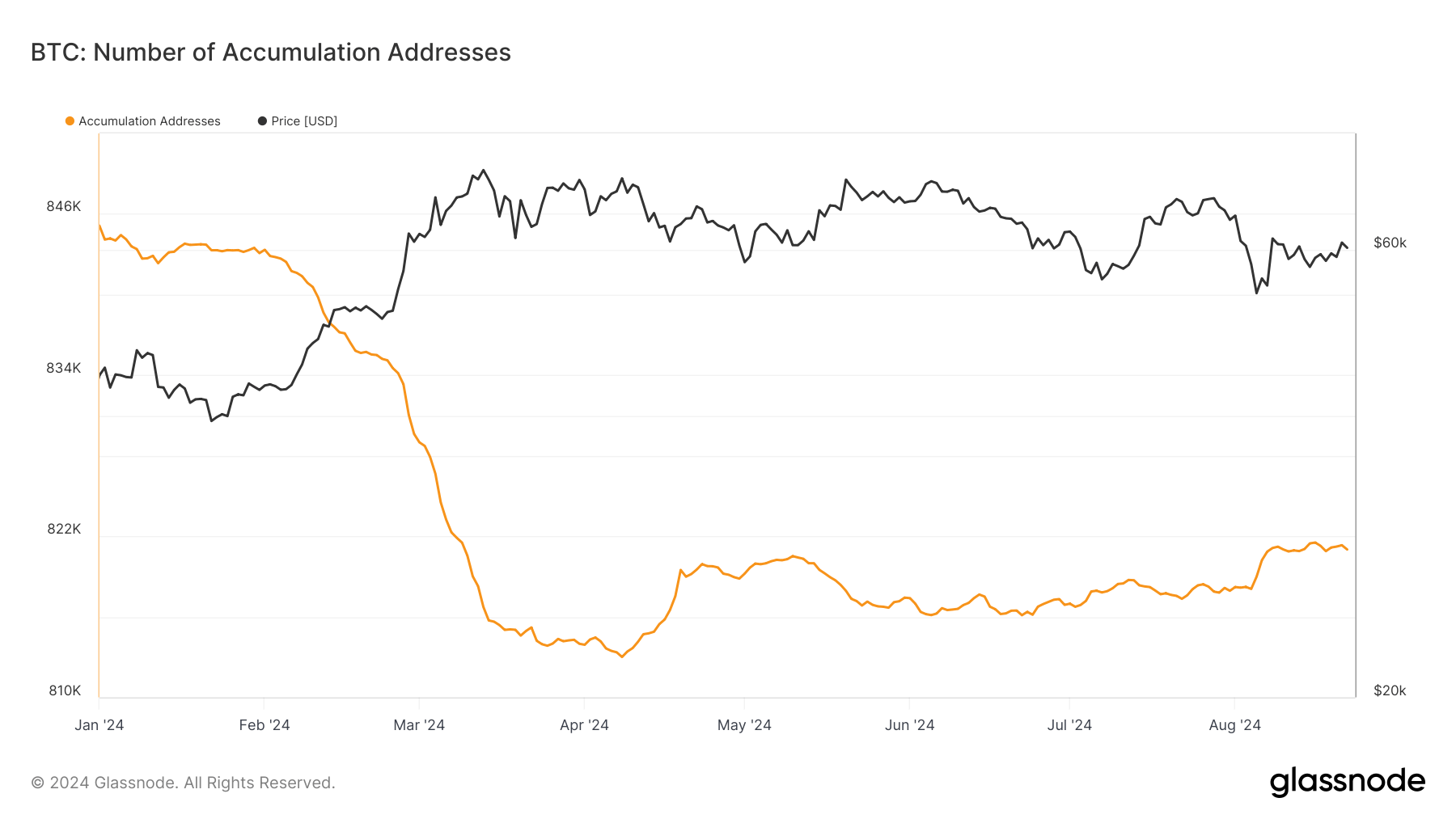

Cryptocurrency ETFs are usually all about drawing in the mainstream investors, giving the prices a bit of a boost. But with the trading volumes looking a bit thin and global crypto markets taking hits left and right, it’s been tough. Bitcoin itself has been on a rollercoaster, dipping below US$60,000 and shedding value faster than you can say ‘sell’.

And it’s not just in Hong Kong. Over in the US, even the big names like Fidelity and BlackRock saw some hefty pullouts from their bitcoin ETFs.

But, despite the lukewarm start, there are some optimists in the mix, seeing this as just the beginning of something bigger. It’s a rocky start, but who knows? With all this setup and strategic partnerships, there could be brighter days ahead for crypto ETFs in Asia.