The Solana price analysis shows that SOL prices have been on a rocky ride over the past two days, with prices swinging between gains and losses. However, the overall trend remains bearish, and prices have now broken below key rejection levels. The SOL/USD pair is currently trading at around $31.45, after falling in a steep correction from highs of over $32.86.

The correction has been swift and sharp, with prices falling by over 3.96 percent from highs of $32.86. However, the corrective move may not be over yet, as the SOL/USD pair remains at risk of further losses in the near term. The current support is at the $31.27 level. If prices break below this level, the next key support level to watch out for is $31.00.

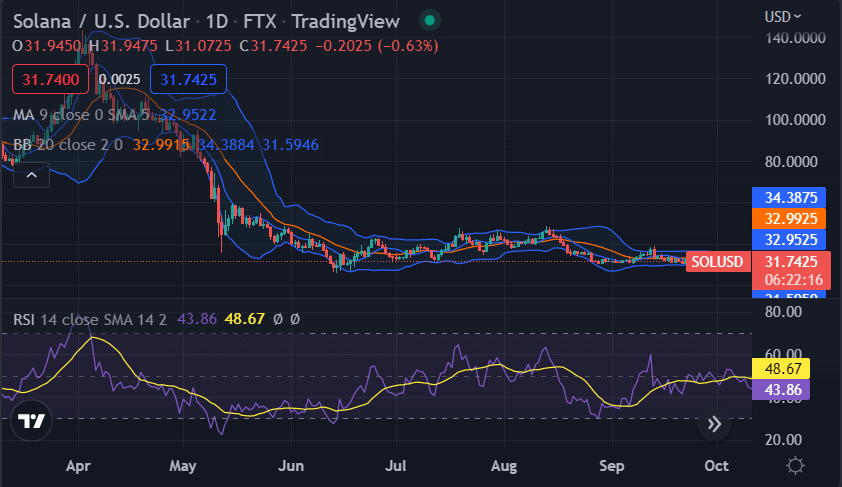

Solana price movement in the last 24 hours: Bearish engulfing candlestick pattern

The Solana price analysis indicates the prices have followed a declining market trend as more selling pressure is seen in the market. The prices have been trading between a range of $32.86 and $31.27 in the past 24 hours. The SOL/USD pair has formed a bearish engulfing candlestick pattern on the 1-day chart, which is a bearish signal.

The technical indicators signal a continuation of the bearish trend as the RSI indicator is under the 50 level and heading towards oversold conditions. The sell-off from the highs has taken SOL prices below the key support level at $31.27 and also below the 20-day moving average (MA) at $32.95.The 20-day moving average (MA) and the 50-day MA are trending southward, which is a sign that the bears are in control of the market. The Bollinger bands have also widened, which is an indication of high volatility in the market.

Solana price analysis on a 4-hour price chart: SOL prices remain at risk of further losses

The 4-hour SOL/USD chart shows a descending channel as the price is trading inside the descending channel. The descending channel is a bearish pattern and has been formed as the price action has made lower highs and lower lows over the last few hours. The SOL/USD pair is currently trading close to the lower boundary of the descending channel, which is likely to act as a strong resistance.

The upper Bollinger band is at $32.86, which is act as stiff resistance for SOL prices. The lower boundary of the Bollinger band is at $31.27, which is likely to act as strong support for SOL prices in the near term. The Relative Strength Index (RSI) indicator is at 38.05 and is currently below the 50 level, which is a sign that the market is in bearish territory. The 20 MA is at $32.43, and the 50 MA is at $31.94, which is a sign that the market is in bearish territory.

Solana price analysis conclusion

Solana price analysis shows a bearish market sentiment formed during today’s opening of the market as bears continue to dominate the market. The technical indicators are also indicating a bearish market and further price decline is expected in the near term. Bulls might make an attempt to take control of the market if they manage to push prices above $32.86.

Disclaimer. The information provided is not trading advice. Cryptopolitan.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.