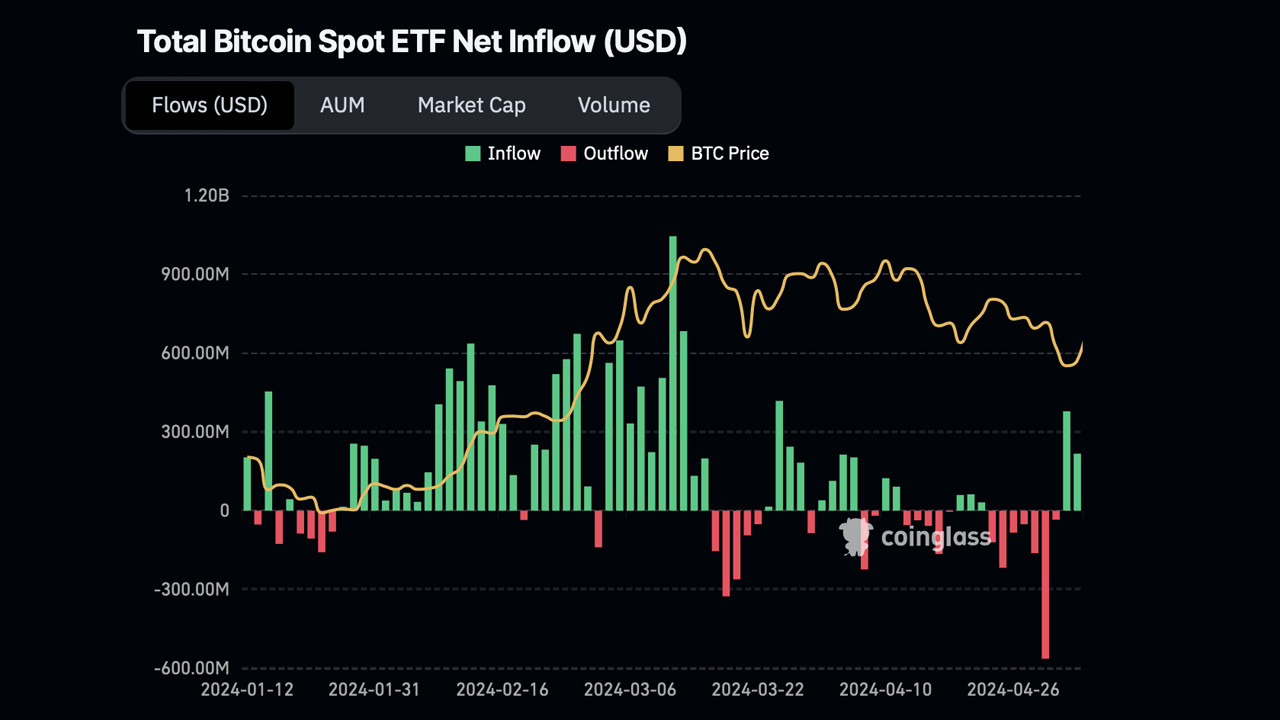

Four successive days of positive inflows into the US Spot Bitcoin ETFs have coincided with positive growth in the Bitcoin price. Are the institutions returning to buy $BTC now that the price correction appears to be ending?

Second wave of institutional buying inbound?

Bitcoin (BTC) is fast putting the last 10 weeks of corrective price action behind it. Institutions are buying again and positive sentiment is starting to flood back into the crypto market, with the Fear and Greed Index back into greed territory.

A further $257 million flowed into the US Spot Bitcoin ETFs on Thursday, and this followed $303 million on Wednesday, $100 million on Tuesday, and $66 million on Monday. The institutions are interested again, and this could be the beginning of the second big wave of buying.

Bitcoin compared to Beanie Babies

At a time when pension funds, family offices, banks, and asset managers are buying bitcoin because they have finally realised its potential, the voices against bitcoin are heard even more vociferously. Fed President Neel Kashkari recently compared bitcoin with Beanie Babies, saying that it “has still shown no actual usefulness in the real world”.

A hedge against currency debasement

All the leaders of the aforementioned institutions would very likely disagree with him. Hedging against further debasement of fiat currency is a particularly salient use case.

Jack Mallers, CEO and Founder of Zap, the bitcoin investment and payments company, put Kashkari’s comments into perspective when he recently said:

“Our governments have borrowed a tremendous amount of time and energy from our future in the form of money with no way of paying it back.

Governments plan to realize that loss by debasing the currency.”

$BTC assault on all-time high

Source: Coingecko/TradingView

The weekly chart for $BTC is looking more and more promising. Friday has seen the $BTC price rise up to touch the top of the bull flag at $66,800. With the weekend to come, the bulls would love to see the price pierce this resistance and the weekly candle close above. This could set the stage for $BTC to then make an assault on its all-time high of around $73,600.

Besides the institutional inflows into the Spot Bitcoin ETFs, the bulls have another trump card up their sleeve in the form of a cross up in the weekly stochastic RSI. The momentum from this indicator, especially as it crosses the 20 level, can add rocket fuel to the $BTC price over the next several weeks.

Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.