Coinspeaker

Ethereum Options Turn Bullish as ETH Price Jumps 20% on Spot Ether ETF News

In the last 24 hours, Ethereum (ETH) price has witnessed a massive run-up by 18% shooting all the way past $3,650 levels and the daily trading volume jumping by a staggering 250%.

This development came as Bloomberg analyst Eric Balchunas upgraded the odds of approval of spot Ethereum ETF from 25% earlier to now at 75%. Furthermore, the analyst also noted that the US SEC has asked exchanges like Nasdaq and NYSE to submit their 19b-4 filings. Balchunas noted that the US SEC is likely acting under political pressure since there was little engagement between the regulator and the issuers, a day before.

However, the ETF Store President Nate Geraci stated that even if the issuers submit the 19b-4 filings, the final decision regarding the registration requirement for individual funds (S-1s) would be still pending.

The SEC might approve the exchange rule changes (19b-4s) separately from the fund’s registration (S-1), potentially delaying the latter beyond the May 23 deadline for VanEck’s Ethereum spot ETF request. This approach gives the regulator more time to review and approve the necessary documents.

A Look at Ethereum Options Expiry

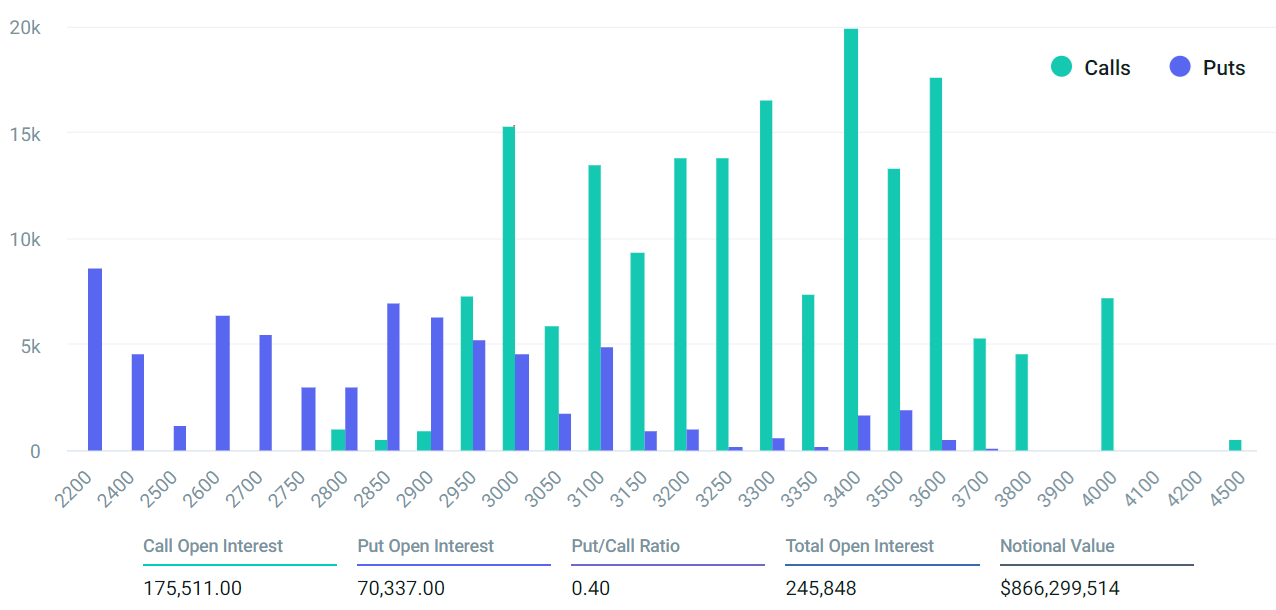

The share surge in the ETH price following growing interest in spot Ethereum ETF has boosted interest for the weekly and monthly ETH options expiries. For the May 24 expiry, the data at crypto exchange Deribit records the open interest at $867 million, while the open interest for the May 31 expiry is at a staggering $3.2 billion.

Similarly, the open interest for CME’s monthly ETH options stands at just $259 million, while for OKX, it’s at $229 million. The call-to-put ratio at Deribit strongly favors call (buy) options, indicating that traders are more active in purchasing them compared to put (sell) options.

If Ether’s price stays above $3,600 on May 24 at 8:00 am UTC, only $440,000 worth of put options will be relevant for the expiry. In this scenario, the right to sell ETH at $3,400 or $3,500 becomes irrelevant if it trades above these levels.

Meanwhile, holders of call options up to $3,600 will exercise their right, capitalizing on the price difference. This would result in a substantial $397 million open interest favoring call options if ETH remains above $3,600 at the time of the weekly expiry.

Ethereum Options Turn Bullish as ETH Price Jumps 20% on Spot Ether ETF News