Bitcoin bulls have strong incentives to push the BTC price above $70,000 on May 31, but the clock is ticking.

Bitcoin (BTC) investors are typically bullish, and despite multiple failed attempts to sustain prices above $71,000, derivatives betting on $80,000 and $90,000 continue to proliferate. This behavior is driven by expectations of high-volatility events such as geopolitical tensions, socio-political changes, U.S. presidential support, and increased corporate adoption of Bitcoin.

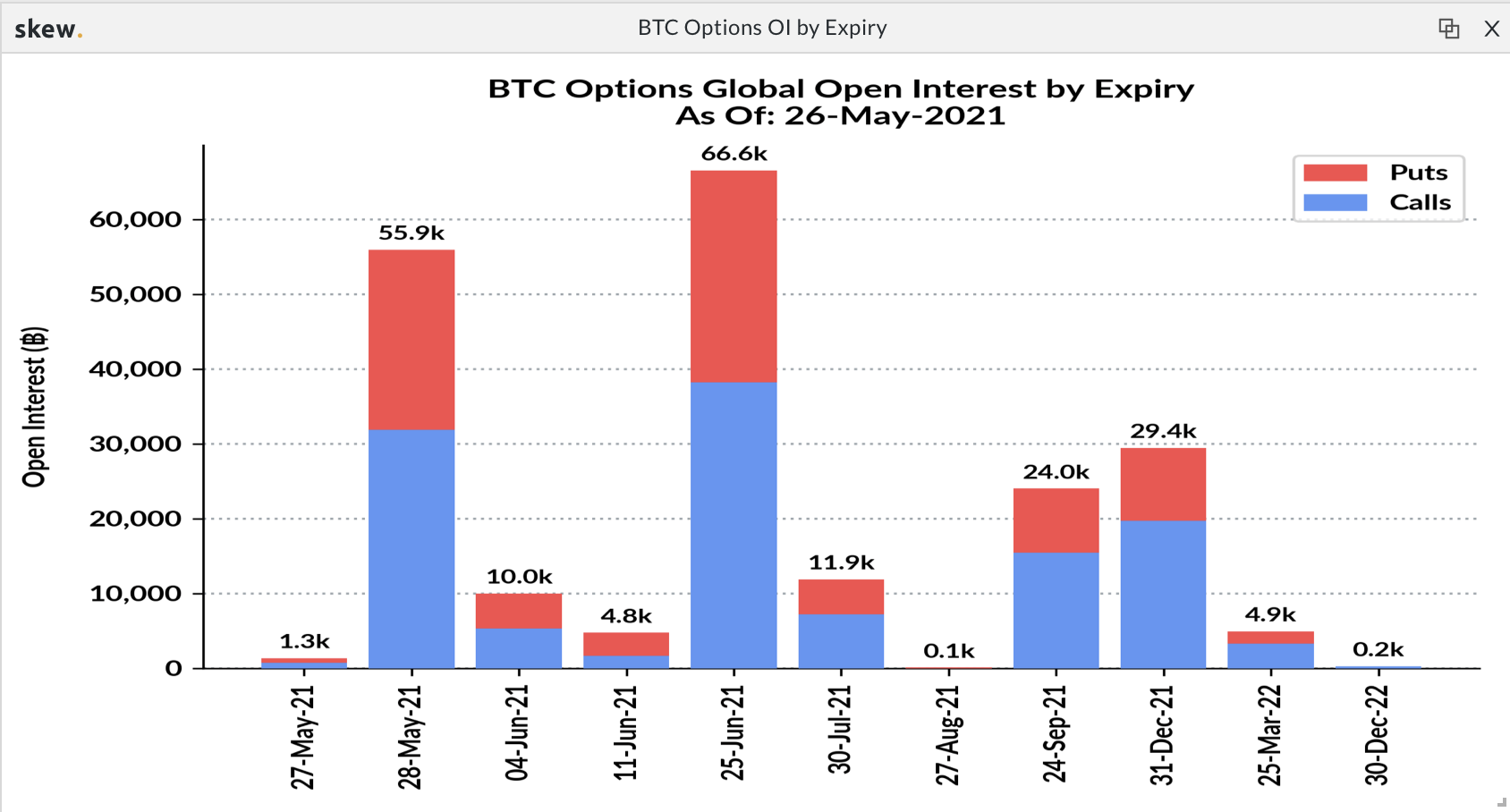

Bitcoin’s $6.5 billion options expiry on May 31 is no different. However, given the inability of bulls to break the $70,000 resistance over the past week, it's likely that these excessively optimistic call (buy) options will become worthless. To illustrate, 91% of these instruments were placed at $72,000 or higher, meaning bulls were counting on a sustained rally ahead of May 31. As the deadline approaches, it seems more likely that Bitcoin bears will avoid significant losses.

Contrary to what many Bitcoin-only investors believe, BTC's price is heavily influenced by external factors such as monetary policies, economic and inflation trends, unemployment, and confidence in the government’s ability to issue bonds successfully. Regardless of how Bitcoin temporarily correlates with the stock market and gold, investors typically hold cash positions and short-term U.S. Treasury bonds when market fear prevails.