The CEO of the world’s largest crypto exchange Binance Changpeng “CZ” Zhao addressed the bailout happening in the industry. As a result of the recent downside trend across the market, the collapse of the Terra ecosystem, and high leverage positions, several companies need financial rescue.

Related Reading | Bitcoin Trading Volume Nears One-Year Highs As Volatile Market Continues

Exchange platform FTX and its CEO Sam Bankman Fried (SBF) have taken the spotlight on the issue of bailouts. The exchange has provided relief and credit lines for crypto companies, such as BlockFi and Voyager, to say in the business. SBF has been praised for its actions.

“Sam Bankman-Fried (@SBF_FTX) is the new John Pierpont Morgan — he is bailing out cryptocurrency markets the way the original J.P. Morgan did after the crisis of 1907” – @Scaramucci https://t.co/CiDg5rbvEN

— SkyBridge (@SkyBridge) June 21, 2022

However, Bitcoin and the crypto industry were created as a result of the 2008 financial crisis. At that time, central governments were forced to rescue financial institutions that took too many risks to the detriment, as many in the space believe, of the general public.

In that sense, CZ acknowledged that large players have a “responsibility” but believes there are projects that might not deserve to be “saved”. Binance’s CEO established three distinctions for projects which could be in need of a bailout: the poorly designed, managed or operated.

About the first, CZ said the following:

In short, they are just “bad” projects. These should not be saved. Sadly, some of these “bad” projects have a large number of users, often acquired through inflated incentives, “creative” marketing, or pure Ponzi schemes.

There are projects that fall into these categories, projects where “bailouts don’t make sense”. They should be allowed to fail, in the words of the Binance executive, which is a position opposite to the one practice by entities within the legacy financial system.

CZ highlighted what should exchanges and what other actors do in the face of these projects:

or users who fall victim to these, education is the best protection. We (industry players, schools, and governments) need to educate people on financial literacy, risk management, diversification, and, most importantly, how to evaluate fundamentals (users, revenue, etc.)

Who Should Receive A Bailout In The Crypto Industry?

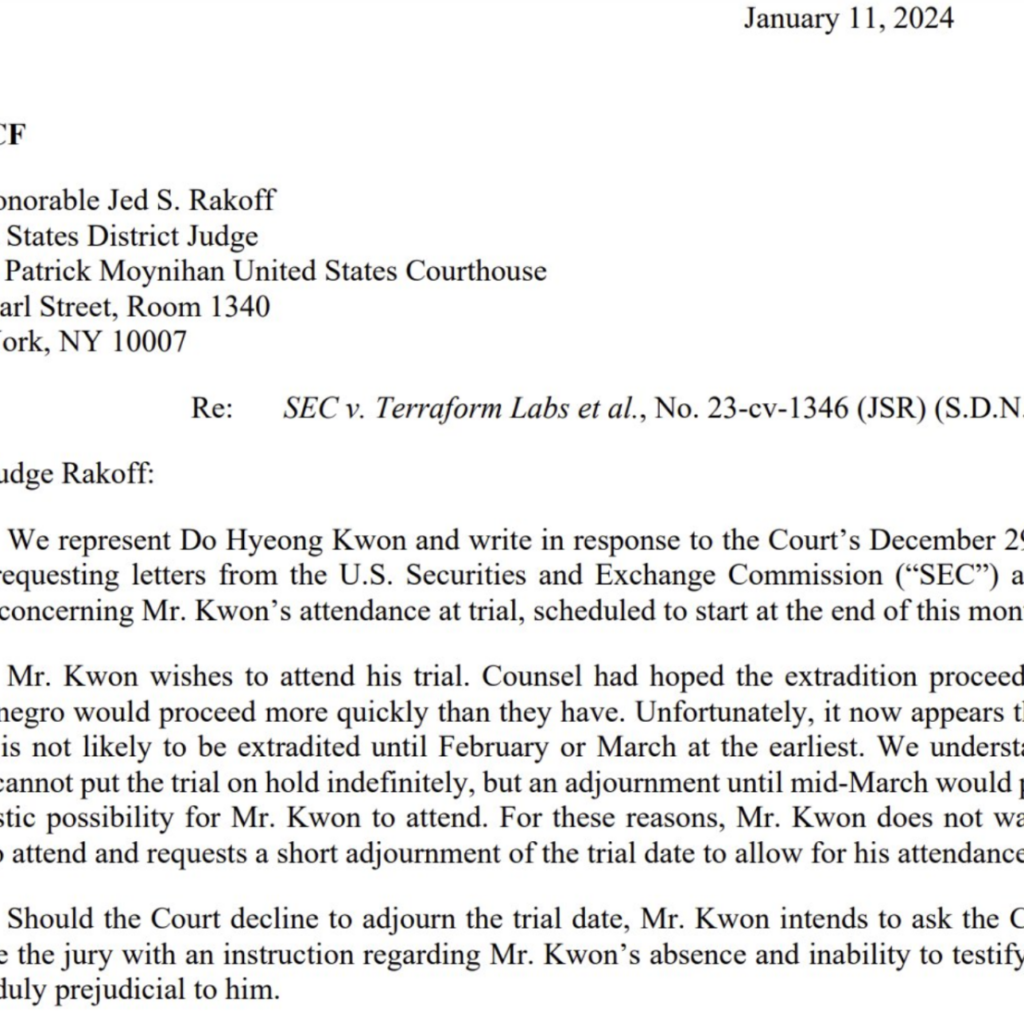

CZ could be referring to the events related to the collapse of the Terra ecosystem, and two of the biggest companies affected by these events, Celsius and Three Arrow Capital (3AC). Both have a large stake in LUNA and, according to recent reports, allegedly have poor risk management practices.

The other two types of bailouts, CZ explained, are for companies with low cash reserves and those that made “small mistakes”. Binance has received offers from projects seeking financial assistance, most believe that they are in these last two categories, but each need to be looked at “in detail to decide”, CZ said.

The executive concluded:

If two years ago, on March 12, 2020, you told me bitcoin’s price would be $20,000 in June 2022, I would be pretty happy. So, why not zoom out for a more balanced perspective? With this in mind, let’s take the situation as a chance to reiterate proper risk management and educate the masses.

Related Reading | Bitcoin Selloff Sends Google Trends Search Term To New 2022 Record

At the time of writing, BTC’s price trades at $20,600 with a 3% in the last 24 hours.