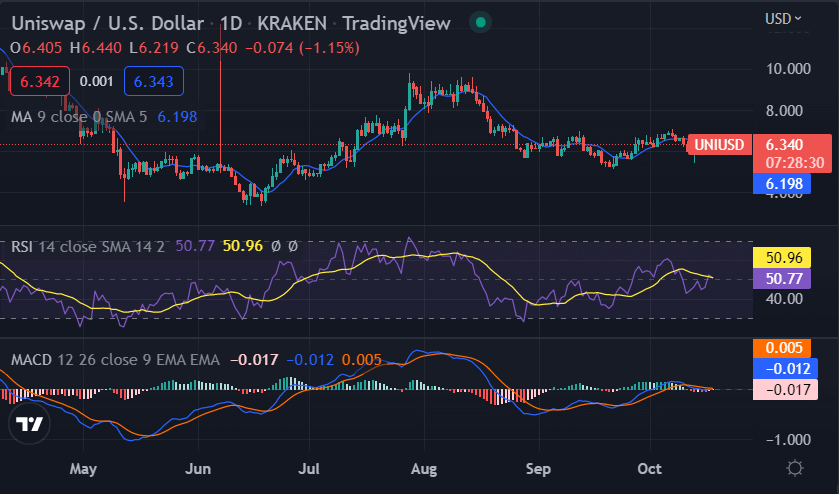

Uniswap price analysis shows a bearish trend that has brought the UNI/USD value down to $6.34. The market had a breakout to the upside that found resistance at $6.43, which caused the market to roll over and head back down. The market is trading below the $6.25 level, which is a key support area that was broken yesterday. If the market can hold above the $6.43 level, there is a chance for the market to find support and move back up. However, if the market breaks below the $6.23 level, it is likely to head toward the $6.20 level.

The overall market for the UNI/USD pair is in decline as selling pressure intensifies.UNI/USD pair is showing a solid bearish momentum as the digital asset declined by nearly 0.77 percent in the last 24 hours. The market cap for the digital asset has also declined and is currently trading at $4,797,260,859 while the 24-hour trading volume is at $94,487,286.

Uniswap price on 1-day analysis: Cryptocurrency value slips back to $6.34 margin

On the daily chart, Uniswap price analysis shows that the coin is following a clear downtrend as it has made lower lows and lower highs. The UNI/USD market had a breakout to the upside as it reached highs of $6.43 but failed to hold on to the gains and pulled back sharply. The bears and the bulls are currently battling for control of the market as the digital asset trades at $6.34. The moving averages are pointing to a bearish trend as the 50-day MA is below the 200-day MA. This indicates that the path of least resistance is to the downside and that Uniswap price is likely to continue its decline.

The RSI indicator is currently at 50.96 and is showing no clear signs of either oversold or overbought conditions. This indicates that the market is currently in a neutral zone as the bulls and the bears battle for control of the market. The MACD indicator is currently in the bearish zone as the MACD line is below the signal line. This indicates that the market is likely to continue its decline.

Uniswap price on 4-hour analysis: UNI/USD pair facing resistance at $6.43

On the 4-hour chart, Uniswap price analysis shows that the market is following a clear downtrend as the UNI/USD has formed a bearish flag pattern which is a continuation pattern that is likely to see the market head lower.

The 50-day MA and the 200-day MA are both showing a bearish trend as they are both pointing to the downside. The RSI indicator is currently in the oversold zone as it is at 54.31 and is showing no clear signs of either overbought or oversold conditions. The MACD indicator is currently in the bearish zone as the UNI/USD pair is currently trading below the $6.34 level.

Uniswap price analysis conclusion

Uniswap price analysis shows that the UNI/USD pair is in a bearish trend as prices decline below the $6.34level. Prices have recently found support at the $6.23 level as buyers step in to defend this key level. The market is highly volatile as prices fluctuate in a wide range. The bulls are seen to be stumbling to defend the $6 level as selling pressure intensifies. The bears are seen to be in control of the market as they aim to push prices lower.

Disclaimer. The information provided is not trading advice. Cryptopolitan.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.