Coinspeaker

Crypto Fear & Greed Index Falls 10 Points to 64, Signalling Decreased Sentiment

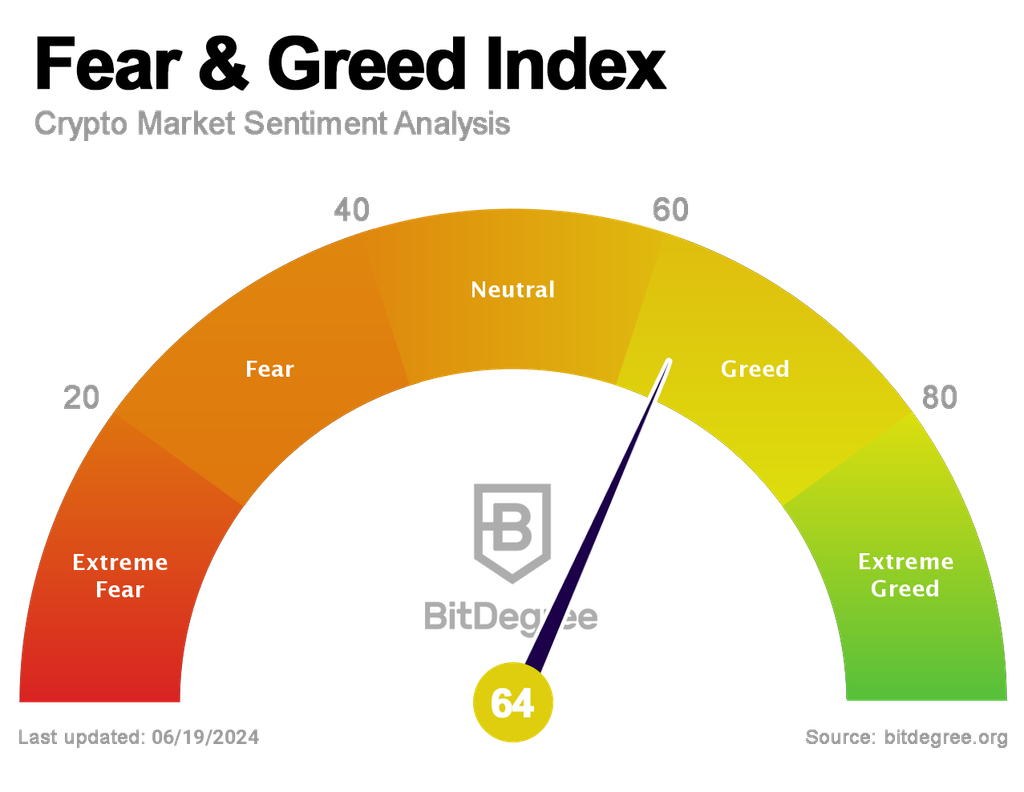

According to data from software development platform Alternative, the metric has declined from 74 yesterday to 64 today. While it’s still within the “greed” range, this decline suggests a growing sense of caution among crypto investors.

Significance of the Crypto Fear & Greed Index

The Crypto Fear & Greed Index ranges from 0 to 100, with 0 indicating extreme fear and 100 indicating extreme greed. The index is based on six factors: volatility (25%), market momentum/volume (25%), social media (15%), surveys (15%), Bitcoin dominance (10%), and Google Trends (10%).

The current reading of 64 shows a notable shift towards fear compared to previous levels. Historically, the Fear & Greed Index has provided valuable insights into market movements. For example, in the bull market of late 2017, the index surged to extreme greed levels above 90, coinciding with Bitcoin’s meteoric rise to nearly $20,000.

Conversely, during the market crash in March 2020, the index plummeted to around 10, reflecting widespread panic as Bitcoin (BTC price data) dropped below $4,000. These historical examples highlight how the index can serve as a barometer for market sentiment and potential turning points.

Factors Behind the Decline

The decline in the index is primarily fuelled by the massive token slump witnessed in the past few days. Despite favorable regulatory conditions and growing investor interest, the cryptocurrency market has experienced a massive downturn.

Markus Thielen, founder of crypto analytics firm 10x Research, has pointed out key issues affecting the market. According to Thielen, an analysis of 115 cryptocurrencies shows that, on average, tokens have fallen by 50% from their 2024 highs. 73% of these 115 tokens peaked in March.

Thielen attributes these declines to token unlocks and poor liquidity conditions, which have put significant pressure on altcoin prices. Token unlocks, where large amounts of previously restricted tokens become tradable, have exerted downward pressure on cryptocurrency prices. In June, more than $500 million in tokens are set to be unlocked.

Combined with existing liquidity constraints, these factors have contributed to a broader market downturn. Thielen warns that unless liquidity conditions improve, further declines in token values could persist, prolonging market instability

Buy the Dip or Exit the Market?

Investors often use the Crypto Fear & Greed Index to gauge market sentiment and make informed decisions. Historical patterns suggest that periods of extreme fear can present buying opportunities. Legendary investor Warren Buffett’s advice encourages investors to consider entering the market when sentiment is low. However, this strategy requires a thorough analysis of current market conditions and individual risk tolerance

On the other hand, some investors may prefer to exit the market during times of heightened fear to safeguard their investments from further declines. This cautious approach can help protect capital but might result in missed opportunities if the market rebounds.

Crypto Fear & Greed Index Falls 10 Points to 64, Signalling Decreased Sentiment