The economic crises in Venezuela and Argentina have forced many citizens to turn to crypto as a savior. Plagued with runaway inflation and unstable local currencies, they have no choice but to use crypto to maintain their savings and even carry out daily transactions.

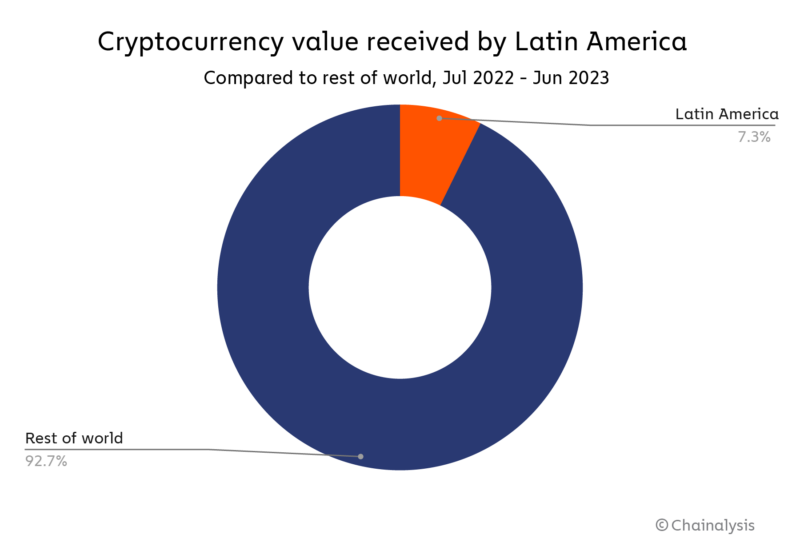

Chainalysis reports that Latin America has the seventh-largest crypto economy globally, ahead of only Sub-Saharan Africa. Despite having a way smaller economy than other regions, the adoption is inherently stronger.

Brazil, Argentina, and Mexico rank in the top 20 of the Global Crypto Adoption Index. Argentina has been battling severe currency devaluation for over three years now. President Javier Milei has said before that he is interested in using crypto to save the economy.

Venezuela’s crypto revolution

Venezuela’s economic disaster under Nicolás Maduro’s has triggered an insane hyperinflation and the complete collapse of the Bolívar. According to Chainalysis, 92.5% of all Venezuelan crypto activity happens on centralized exchanges.

Venezuelan opposition leader Leopoldo López has shared how crypto has helped many Venezuelans preserve their savings. He stated that Venezuela experienced one of the worst hyperinflation rates ever, exceeding 1 million percent.

Stablecoins have been a hedge against this devaluation. López believes crypto helps a lot with remittances. Meanwhile, about 25% of the population has left the country since 2020.

Still. The interim government used crypto to help doctors and nurses during the pandemic. Cryptocurrency was the best option due to Maduro’s control over the banking system. Medical professionals were earning as little as $3 to $5 per month.

Argentina’s crypto dependence

As for Argentina, the country has been facing economic challenges for decades now. The peso has decreased by 51.6%. But Argentina was still leading Latin America in raw transaction volume, with an estimated $85.4 billion.

Like Venezuelans, Chinalaysis discovered that Argentinians also use stablecoins to protect their savings from devaluation. Citizens often convert their paychecks into USDT or USDC to maintain their purchasing power.

As the peso lost value, crypto purchasing increased, spiking when inflation crossed 100% for the first time in three decades.

Brazilians and Mexicans join the party

Brazilians and Mexicans have also been heavily dabbling with crypto. Chainalysis reports that Brazil has a strong love for decentralized finance. Unfortunately, large institutional-sized transfers have declined. This has affected overall crypto activity a little bit.

But Brazil’s professional and retail-sized transaction volume has remained steady. Chinalysis says the “middle class” of high-value crypto traders and basic retail users are still trading and investing.

Still, though. The demand for stablecoins in Brazil is lower compared to Argentina and Venezuela.

Data shows that Brazilians prefer Bitcoin and altcoins for long-term investment and even trading. But Argentinians and Venezuelans heavily prefer stablecoins due to currency devaluation.

Mexico has also embraced crypto-based remittances. The country receives an estimated $61 billion in remittances annually, mostly from the United States.

Daniel Vogel, CEO of Mexican exchange Bitso, claims that his company saw $3.3 billion in crypto remittances from the U.S. to Mexico in 2022. This is 5.4% of the total market.

Reporting by Jai Hamid