Cardano price analysis shows that the price is currently in a bullish trend as it has broken out of the descending triangle formation. The next level of resistance is at $0.3466, and if the price can sustain its current momentum, it is likely to test this level in the near future. However, if the price starts to retrace from its current levels, support is likely to be present at $0.3554. Overall, the bias is currently bullish for ADA/USD.

The digital asset has been on a tear in recent times as it surged from $0.34 to $0.35 levels in the past few days. The bulls have been in control of the market and are currently looking to push the price higher. However, the bears are also starting to show some signs of life and are looking to take control of the market. The market has increased by 0.13 percent in the past 24 hours and is currently trading at $0.3511. The 24-hour trading volume is $341 million, and the market capitalization is $341 million.

Cardano price analysis on a 1-day price chart: ADA/USD gains value

Cardano price analysis on the 1-day price chart shows that the price is currently facing rejection at the $0.3554 level. If the price can break out of this level, it is likely to test the $0.3580 level in the near future. The current price surge has taken the prices to the upper limit of the consolidation range and a further move up may take place in the near term as the price is currently trading at the $0.3511 mark.

The Bollinger Bands on the 1-day chart for ADA/USD is widening which shows that the market is volatile. The upper limit of the Bollinger Band is $0.3551, and the lower limit is at $0.3465. The Relative Strength Index (RSI) is currently at 27.28 which shows that the market is in a bullish zone. The moving average convergence divergence (MACD) on the 1-day chart for ADA/USD is currently in the bullish zone as the MACD line is above the signal line.

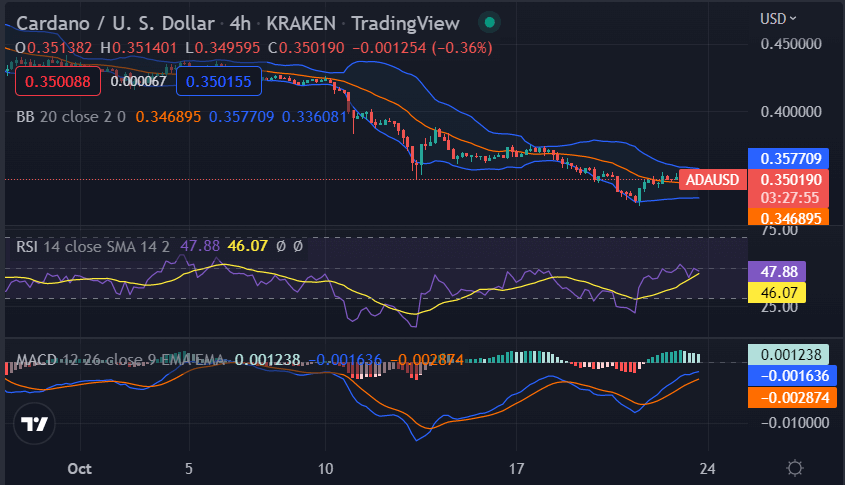

Cardano price analysis on a 4-hour chart: Recent development and further technical indications

Cardano price analysis on the 4-hour chart, ADA/USD is seen trading inside an ascending parallel channel as prices corrected lower after hitting the upper limit of the channel. The current move can be considered a retracement as the prices are still trading inside the bullish channel.

The Bollinger bands have contracted which indicates that the market is consolidating. The upper limit of the Bollinger Band is $0.3567, and the lower limit is at $0.3468. The RSI is currently at 46.07, and it shows that the market has cooled down from the overbought levels as the prices retraced lower. The histogram of the MACD is seen contracting which indicates that the bullish momentum is cooling down.

Cardano price analysis conclusion

Cardano price analysis concludes that ADA prices are currently trading in a bullish manner and are likely to move higher in the near term as the bulls remain in control of the market. However, the bears are also starting to show some signs of life and a breakout above the $0.3554 level is needed for ADA/USD to move higher.