Since the Federal Reserve suggested it might be done with hiking interest rates, everyone’s been waiting to see when they’ll finally start cutting them.

Borrowers are looking for relief, but Chair Jerome Powell and his team have made it clear that they need solid proof that inflation is really cooling down to their 2% goal before they can consider cutting rates.

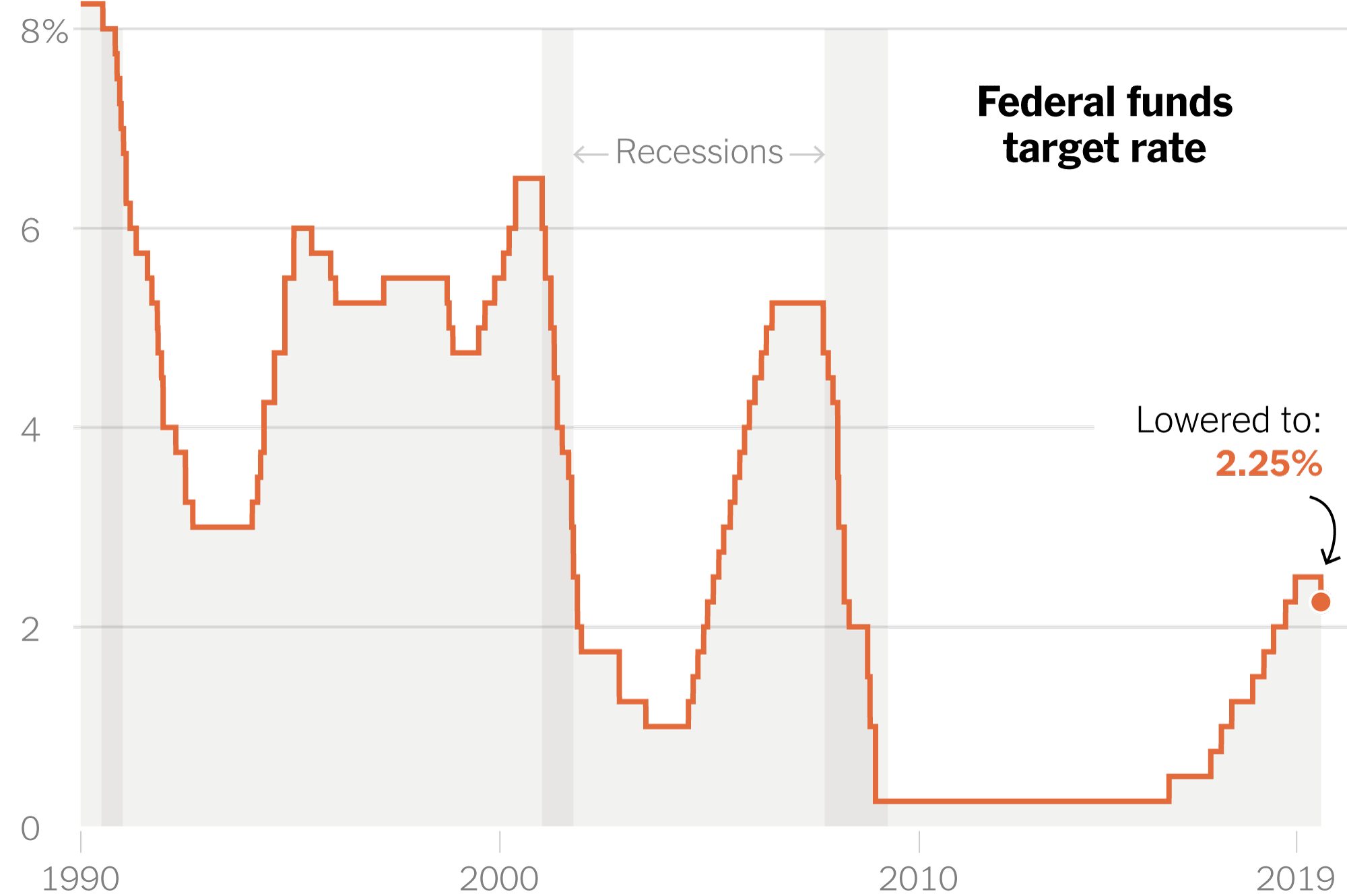

We’ve seen some good signs lately – inflation data looks promising, and the job market isn’t as overheated. But the Fed isn’t ready to celebrate yet. They believe there are good reasons to hold off a bit longer before cutting the rates from their current 5.25 to 5.5% level.

Skipping a rate cut in July allows the Fed to gather more solid data. Powell mentioned in a recent congressional hearing that they need to see more consistent good news before making a move.

By September, they’ll have two more sets of inflation and jobs reports. This extra time is to convince some officials who are still on the fence about cutting.

Earlier this year, Powell and his team were caught off guard when inflation unexpectedly spiked again, which made them rethink their plans. The first three months of the year showed price pressures rising again, and that shook their confidence.

Although this spike is now seen as a blip, it has made the Fed cautious about moving too quickly. Still though, it’s looking more likely they might do so in September.

Traders are betting that September could be when the Fed finally cuts since it will be when the last meeting before the presidential election happens. They’re expecting at least two quarter-point cuts in 2024, but who knows?

Meanwhile, John Williams of the New York Fed and Christopher Waller have hinted that they’re getting closer to where they want to be to start cutting rates.

Job conditions have softened, hiring isn’t as strong, and more people are applying for unemployment benefits. Wage growth has also slowed down, which is another sign that inflation is probably easing.

However, there’s still a concern that it could get stuck above the target. The Fed is also worried about not letting the job market deteriorate further. They believe they can bring inflation back to their target without causing massive job losses.

But it’s a delicate balance, and Powell says he doesn’t want to make any hasty moves. Kamala Harris is gaining support among Democrats, and traders are considering how this political shakeup might affect the economy and the Fed’s decisions.

Yields on bonds have been rising, setting the stage for a series of auctions and economic reports this week. With Joe Biden stepping out of the race, some traders think the upcoming election could be a tighter contest that we initially thought.