Coinspeaker

US SEC Approves Spot Ethereum ETF but Ether Price Drops in Sell-the-News Event

The spot Ethereum ETFs are finally all set to resume trading on Tuesday following the approval nod from the US Securities and Exchange Commission (SEC). On Monday, the securities regulator approved applications from Bitwise, 21Shares AG, BlackRock Inc, Invesco, Fidelity Investments, Franklin Templeton, and VanEck.

This will be the second spot crypto ETF to launch in the US within a span of just six months. Thus, it highlights the softening of the US regulatory climate for the digital assets industry. Interestingly, the development comes at a time when Joe Biden has stepped out of the Presidential race and Republican candidate Donald Trump is pushing ahead with his pro-crypto agenda. In a statement to Bloomberg, Jay Jacobs, US head of thematic and active ETFs at BlackRock said:

“Our clients are increasingly interested in gaining exposure to digital assets through exchange-traded products (ETPs) which provide convenient access, liquidity and transparency.”

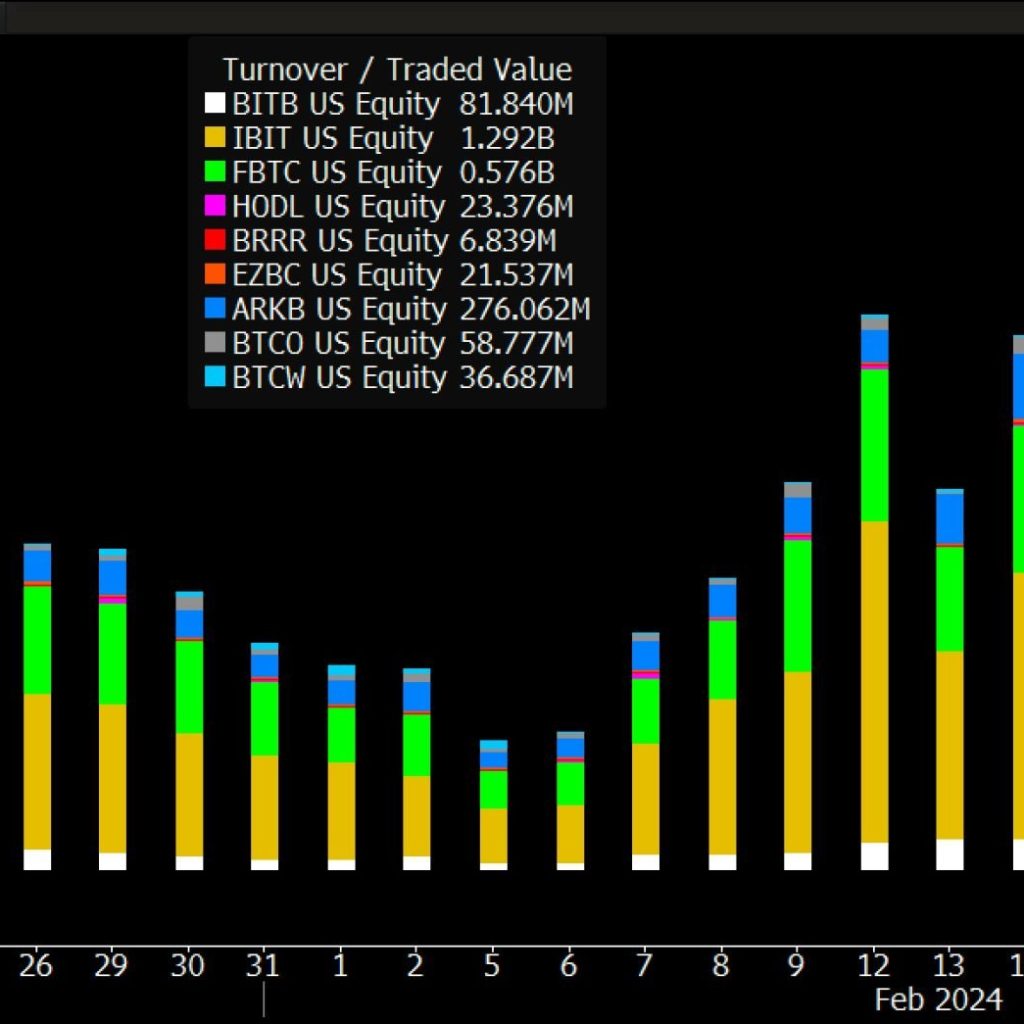

The launch of the spot Bitcoin ETFs earlier this year in January took the crypto industry by storm. It will be interesting to see whether or not the spot Ether ETFs could replicate a similar success in the months to come.

Several issuers, such as BlackRock and Fidelity, are temporarily waiving fees, either partially or entirely, on Ether ETFs to attract assets.

Ethereum Price Corrects Before Ethereum Trading

Despite the ETF approval on Monday, the Ethereum price faced some selling pressure correcting an additional 1.4% and slipping under $3,450 levels. On Monday, July 22, Kaiko Research published a report stating that the ETH price would be sensitive to the spot Ether ETF inflows amid the poor demand for the Ethereum futures products late last year. Bloomberg ETF strategist Eric Balchunas has been predicting inflows to the tune of $4 billion in the first six months of launch.

In their report on Monday, Kaiko’s head of indices Will Cai said:

“The launch of the futures-based ETH ETFs in the US late last year was met with underwhelming demand, all eyes are on the spot ETFs’ launch with high hopes on quick asset accumulation. Although a full demand picture may not emerge for several months, ETH price could be sensitive to inflow numbers of the first days.”

Cai noted that one of the most significant price impacts is anticipated from the “potential” outflows from Grayscale’s Ethereum Trust (ETHE). The conversion of ETHE into a spot ETF will enable easier trading, prompting many investors who previously bought ETHE shares to cash out after its transition to a spot product on July 23.

Eth ETF race has already begun w/ a transfer from $ETHE to its mini-me = $ETH gonna begin its life w/ $1b and a category-low 15bp fee. That’s a new variable in this race that we didn’t have in btc race. https://t.co/7v6kh8Kw5Q

— Eric Balchunas (@EricBalchunas) July 22, 2024

However, unlike Bitcoin, it might not be a similar case with Grayscale Ethereum Trust. The reason is that Grayscale will also be launching Ethereum mini Trust which has just a 15 bps management fee, purportedly kept to attract inflows. Reportedly, Grayscale has already moved $1 billion worth of ETH to mini Trust in order to provide seed capital.

US SEC Approves Spot Ethereum ETF but Ether Price Drops in Sell-the-News Event