- Riot Platforms announced its acquisition of Block Mining on July 23.

- The bitcoin miner said the transaction involved $18.5 million in cash and $74 million in Riot common stock.

- Riot will add 60 megawatts of capacity to its operational capacity, with a potential to grow that to over 300 MW.

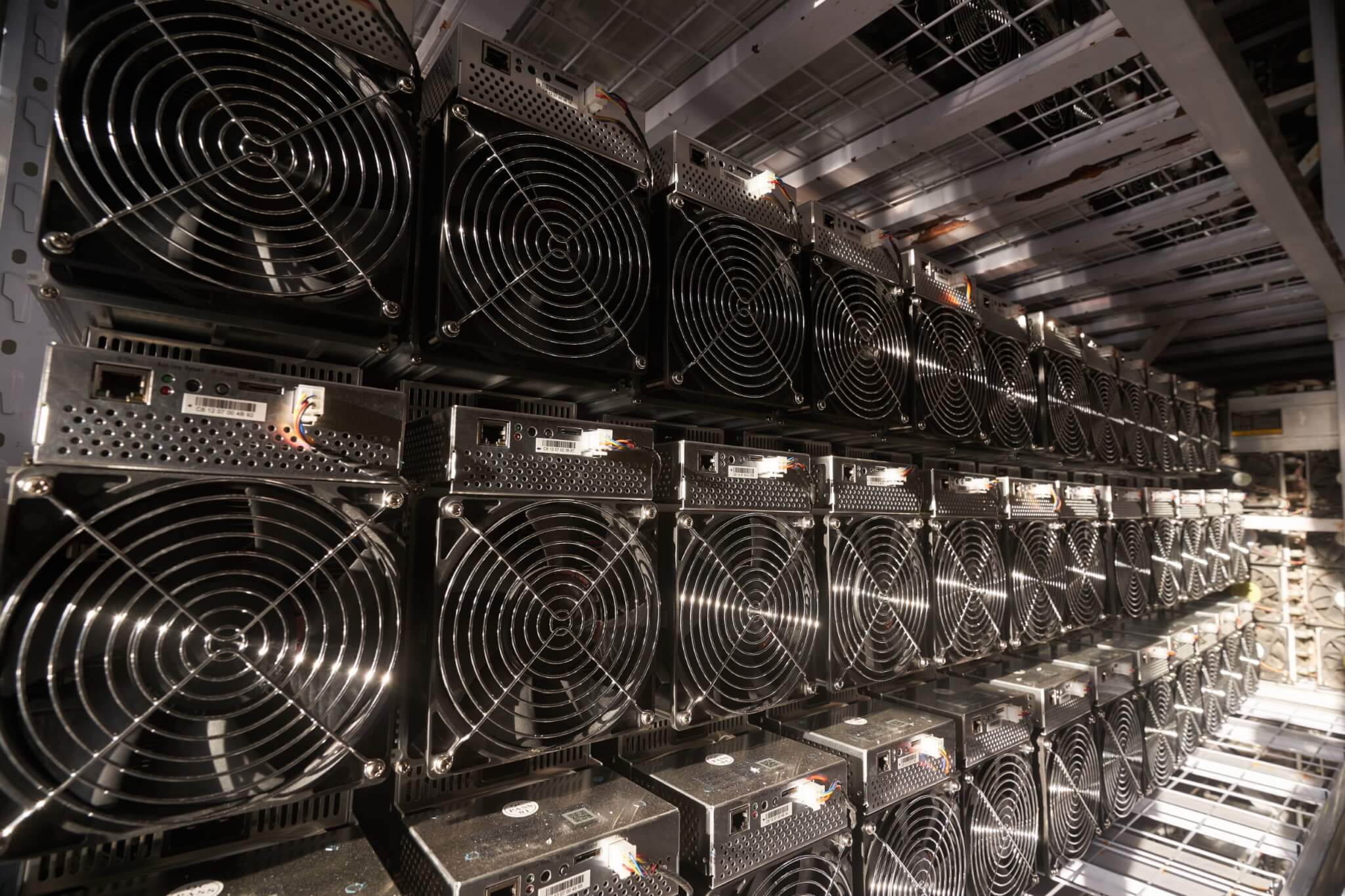

Riot Platforms has acquired Block Mining, a Kentucky-based Bitcoin mining firm in a cash plus stock deal totaling $92.5 million.

The acquisition will expand Riot’s operations, with 60 megawatts of capacity added as the firm eyes expansion to 110 MW by the end of the year.

According to a press release on July 23, the deal immediately expands Riot Platforms’ self-mining hashrate by 1 E/Hs. Under existing agreements, the company will look to push the Kentucky operation to over 300 MW by end of 2025, which could see its self-mining hashrate hit 16 EH/s by end of December 2025.

Jason Les, CEO of Riot, commented:

“This transaction allows us to diversify our operations nationally and accelerate Block Mining’s expansion in Kentucky. With a combined 60 MW of existing developed capacity, and a pipeline to rapidly scale to over 300 MW, this acquisition expands our operations and further enhances our path towards our growth target of 100 EH/s.”

$92.5 million transaction

Riot said in its announcement that the company paid $18.5 million in cash and $74 million in its common stock to acquire Block Mining. The Riot common stock transaction was based on the stock’s volume weighted average price (VWAP) over the 20-trading-day period ending on July 18, 2024.

The Kentucky-based miner can also access up to $32.5 million in additional payments through 2025, with the earnings related to completion of additional power purchases as agreed with Riot.

Riot’s deal for Block Mining comes on the back of the publicly traded Bitcoin miner’s pursuit of a deal for rival Bitfarms.

The post Riot announces acquisition of Bitcoin miner Block Mining appeared first on CoinJournal.