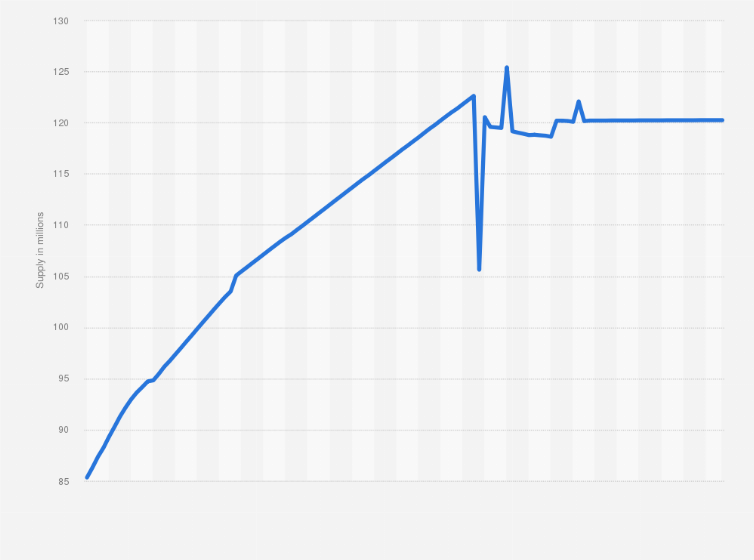

Ethereum (ETH) is showing a small, but persistent inflation. By the end of 2024, the token’s supply may expand to a new high.

Ethereum (ETH) is already feeling the effect of scaling, as traffic flows to some of the L2 networks. This trend was long greeted as a solution to high fees for using Ethereum directly to trade on DEX or swap NFT. However, the shift may have long-term effects for Ethereum’s performance over time.

The total supply of ETH is not capped and has reached an all-time high of 120,532,000. That supply arrived at the end of mining, as Ethereum’s chain switched to proof-of-stake and started burning a part of the transaction fees.

The Ethereum network struck a balance between new token production and burns, destroying a total of 4,479,978 ETH. As a result, the supply fell to a low of 120.07M in April 2024. Since then, Ethereum has returned to inflationary periods, increasing the total supply to 120.25M tokens. In the whole of Q2, ETH added 120,818 tokens to its supply.

At this rate of growth, the network may break its previous supply record by the end of 2024. Ethereum’s network turned inflationary in all of Q2, as the transaction burn rate slid by as much as 66.7%. Average transaction fees are still relatively high, reaching above $10 during times of more active network usage. In the past few weeks, Ethereum fees ranged between $2 and $4, while Solana’s fees only reached $0.02.

In the past three months, the growth rate of new supply has accelerated. While year-on-year supply growth is just 0.03%, the past month produced around 60K new tokens. For now, the ETH market can easily absorb the assets, either through ETF sales, liquid staking or other lockups in smart contracts. The gradual inflation is the price to pay for being able to run scalable chains.

Annualized inflation for Ethereum’s network is now at 0.63%. The Ethereum chain now carries a baseline of 1.2M transactions per day, with much rarer days of peak activity. For now, Ethereum supporters see the chain as reaching a balance between high fees and scalability, with a reasonable inflation rate.

Layer 2 transactions doubled their activity compared to 2023 baseline levels. In Q2, activity rose by another 37%. L2 chains also turned competitive, with traffic moving to the best and most liquid chains. As a result, Ethereum users moved assets to L2 chains, with the biggest net inflows for Optimism, Arbitrum and Base.

Metrics (for those who care)

Supply (ATH): 120,532,000

Supply (Current): 120,234,629

Diff: 297,371Growth (30d): 60,000

Months until ATH: 4.95 pic.twitter.com/gCD71i8hor

— BREAD (@0xBreadguy) July 25, 2024

Q2 inflation coincided with top L2 usage

The inflationary trend shows a correlation to even more active L2 usage. The Ethereum ecosystem still hinges on Polygon for most of the scalable apps. The rise of Base also took traffic from the main net, tapping meme token traders with much lower fees.

Polygon now carries around 22M weekly transactions, with 26M for Base. Arbitrum carries around 10M weekly transactions. The Ethereum mainnet still logs around 420K daily users and 1M daily transactions.

More than $12B has been locked in bridges between Ethereum and other L2 projects. Most of the bridged assets include ETH in wrapped forms, as well as ERC-20 tokens and stablecoins.

ETH price showing signs of bouncing from lows

In the past month, ETH failed to rally despite the launch of the first batch of ETFs. ETH even turned into the worst-performing asset among top 50 coins and tokens for the past month. ETH is also showing signals of touching its long-term trendline, potentially expecting a bounce.

The Ethereum inflation of 60,000 tokens for the past month is still relatively small compared to rapid selling from Grayscale’s wallets. Grayscale has divested 24% of its holdings since the launch of the ETHE ETF.

ETH has historically underperformed in August for the past years. This time, ETH has a unique set of price factors, as traders wait to see more ETF inflows. Traders see ETH entering re-accumulation with a brief dip under $3,000, and resistance levels at $3,800. On the upside, ETH may attack short positions around $3,400.

Cryptopolitan reporting by Hristina Vasileva