When it comes to trading platforms, Bybit vs eToro is a comparison that many traders are looking for. Both are popular platforms for buying, selling, and trading crypto, but they each cater to slightly different audiences. So, which one is right for you?

In this guide, we’ll break down the key features of Bybit and eToro, making it easier for you to decide. We’ll compare fees, payment methods, security measures, and more.

Key Takeaways:

- Bybit supports over 1,250 cryptocurrencies, while eToro offers a wider range of 5,000+ assets, including stocks, ETFs, crypto, and commodities. However, it supports only 100+ crypto assets.

- Bybit excels in advanced crypto trading with features like margin trading and 100x leveraged futures trading, while eToro is renowned for its social trading functionalities.

- The Bybit exchange has lower crypto trading fees at 0.1% compared to eToro’s 1%, but eToro offers commission-free stock and ETF trading.

Bybit vs eToro: Overview

| Bybit | eToro | |

| Founded | 2018 | 2007 |

| Headquarters | Dubai | Israel |

| Best For | Crypto Derivatives Trading | Copy Trading |

| Asset Variety | 1250+ cryptocurrencies | 5000+ assets (stocks, ETFs, crypto, commodities) |

| Key Features | Perpetual contracts, trading bots, Launchpad | Social trading, fractional shares, Smart Portfolios |

| Trading Fees | 0.1% for spot trading | 1% for crypto, commission-free stocks and ETFs |

| Deposit Methods | Crypto, credit/debit card, bank transfer, third-party payments | Bank transfer, credit/debit card, PayPal, Skrill, Neteller |

| User Interface | User-friendly but advanced | Intuitive and beginner-friendly |

| Security Measures | 2FA, cold storage, KYC, hardware authentication | 2FA, segregated accounts, insurance fund, SSL encryption |

What is Bybit?

Bybit is a popular cryptocurrency derivatives exchange established in 2018. It is headquartered in Dubai and serves a global market of over 160 countries. The platform provides various trading services, including spot trading, margin trading, and perpetual futures trading.

The exchange supports 1250+ cryptocurrencies, including BTC, ETH, SOL, and several other major altcoins. It regularly adds new coins and tokens to its trading platform to meet market demand. The exchange’s matching engine is super fast – it can handle 100,000 transactions per second, which means no price slippage.

Bybit goes beyond just buying and selling. They’ve got a program called Bybit Earn, where you can actually earn interest on your crypto holdings. Experienced traders can even connect their trading bots to the platform via API integration, allowing them to automate their trading strategies.

Pros of Bybit

- 1,250+ tradable digital assets, including many low-cap altcoins

- There are various advanced order types, such as trailing stop orders, iceberg orders, and TWAP orders.

- Advanced trading features, such as futures trading with 100x leverage, are available.

- A rapid and reliable matching engine ensures smooth order execution with minimal latency.

- User-friendly interface for beginners

Cons of Bybit

- Bybit primarily focuses on crypto-to-crypto trading with limited fiat deposit options.

- Due to regulatory restrictions, it is not available for US customers.

What is eToro?

eToro, founded in 2007, is a multi-asset online brokerage platform that caters to both trading and investing. It is one of the best copy trading platforms. The platform provides a tool named “CopyTrader” that enables you to automatically replicate the trades of seasoned investors.

eToro offers a wide variety of more than 5,000 financial assets for you to invest in. This includes stocks, cryptocurrencies, ETFs (Exchange Traded Funds), indices (like the S&P 500), forex (like USD and EUR), and commodities (like gold and oil). You can also choose between investing with or without leverage. In terms of cryptocurrency trading, it offers over 100+ digital assets, including popular ones like BTC, ETH, and LTC.

For beginners, eToro provides a virtual portfolio feature. You receive $100,000 in virtual assets to practice trading, which helps you gain experience without financial risk.

Pros of eToro

- There is a wide range of assets to trade, including stocks, ETFs, cryptocurrencies, commodities, indices, and options.

- Social trading features, such as CopyTrader, allow you to replicate the trades of experienced investors.

- You can invest in fractional shares, which allow you to buy a portion of a share instead of needing the full amount.

- Offers commission-free stock and ETF trading.

- The platform is known for being user-friendly and intuitive, even for beginners.

Cons of eToro

- There is a limited selection of cryptocurrencies for trading, with only 100 coins available.

- There are high fees, up to 1%, on crypto trading.

Bybit vs eToro: Features

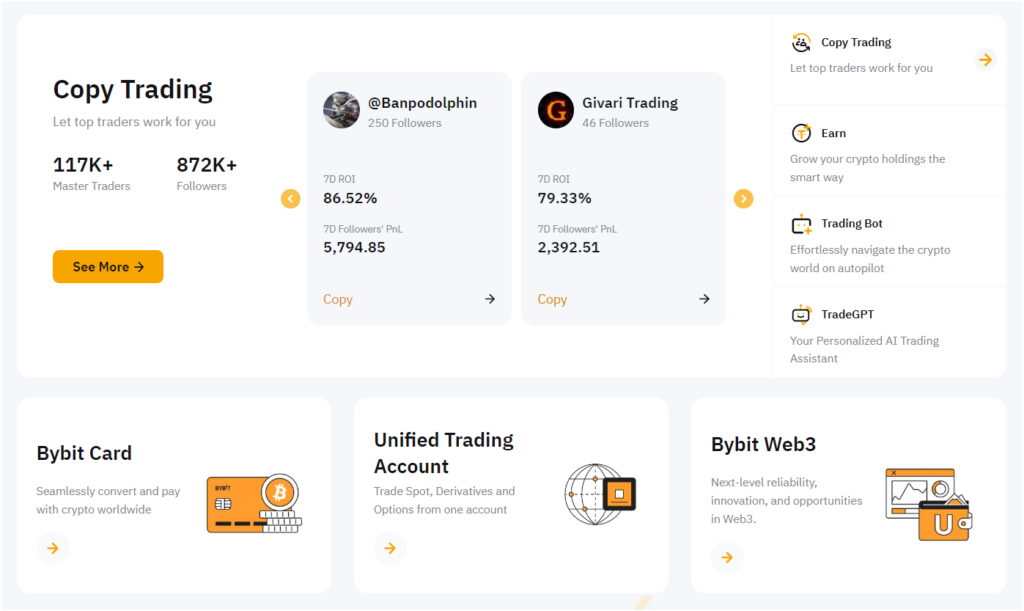

Bybit Standout Features

- Perpetual Contracts: Bybit’s core offering consists of derivative contracts that mimic futures contracts but do not expire. This allows traders to hold positions indefinitely and magnify profits using leverage up to 100x.

- Trading Bots: It caters to automated trading with its bot functionality. You can design or choose pre-made bots that execute trades based on set parameters, helping with strategies and saving time. It supports DCA, grid trading, and martingale bots.

- Launchpad: Bybit Launchpad allows early access to promising new cryptocurrency projects. This is an opportunity to invest in tokens before they hit the mainstream market.

- P2P Trading: The exchange facilitates zero-fee peer-to-peer (P2P) trading, connecting buyers and sellers directly. This allows you to bypass traditional markets and potentially find more favorable exchange rates.

- Web3 Portal: Bybit integrates with the Web3 world, offering access to DeFi (Decentralized Finance), NFT marketplaces, and decentralized exchanges.

eToro Standout Features

- Social Trading: You can connect with a community of over 30 million users. Learn from experienced traders and automatically copy their investment strategies using the innovative CopyTrader feature.

- Fractional Ownership: Unlike some brokers, eToro allows you to buy fractions of shares. This makes it easier to invest in expensive stocks or build a diversified portfolio even with limited funds.

- Smart Portfolios: These are professionally managed portfolios that aggregate various assets based on specific themes or strategies. The investment team at eToro regularly rebalances and optimizes these portfolios using machine-learning algorithms.

- Advanced Tools: These include ProCharts for technical analysis, allowing in-depth study of market trends. Multiple watchlists enable convenient tracking of desired assets. Additionally, eToro provides risk management features like stop-loss and take-profit orders to help control potential losses and secure profits. For more flexibility, traders can utilize the Trailing Stop Loss, which automatically adjusts the stop price as the market moves favorably.

Bybit vs eToro: Fees

Bybit Fees

Bybit charges a maker-taker fee structure. This means that makers (who add liquidity to the order book) receive a discount on fees, while takers (who remove liquidity) pay a higher fee.

For spot trading, the base maker fee is 0.1%, and the base taker fee is also 0.1%. However, Bybit offers discounts on these fees based on your 30-day trading volume or your VIP level, whichever is higher. The biggest discounts are offered by Supreme VIP (0.03% maker fee and 0.045% taker fee).

Here’s a quick overview of Bybit fees:

| VIP Level | 30–Day Spot Trading Volume (USD) | Taker Fee | Maker Fee |

| Non-VIP | – | 0.1% | 0.1% |

| VIP 1 | ≥ 1,000,000 | 0.08% | 0.0675% |

| VIP 2 | ≥ 2,500,000 | 0.0775% | 0.065% |

| VIP 3 | ≥ 5,000,000 | 0.075% | 0.0625% |

| VIP 4 | ≥ 10,000,000 | 0.06% | 0.05% |

| VIP 5 | ≥ 25,000,000 | 0.05% | 0.04% |

| Supreme VIP | ≥ 50,000,000 | 0.045% | 0.03% |

Bybit’s futures trading fees are 0.055% for taker orders and 0.02% for maker orders. These fees apply to inverse perpetual, USDT perpetual, and USDC perpetual contracts.

Options trading on Bybit has a fee of 0.02% for both taker and maker orders. Additional fees, such as settlement fees for inverse futures contracts, may apply but are not charged for USDC futures contracts. Check out the full Bybit fee rates page here.

eToro Fees

eToro charges a variety of fees for its services, including:

- Trading Fees: eToro does not charge commissions on real stocks and ETFs, making it an attractive option for stock traders. A 1% fee applies to cryptocurrency transactions. CFD trades incur spreads, which vary depending on the asset.

- Investment Account Fees: A withdrawal fee of $5 is charged for each withdrawal. If there is no trading activity for 12 months, an inactivity fee of $10 per month is applied.

- Other Fees: Transferring cryptocurrencies from eToro to an external wallet incurs a 2% fee. Additionally, UK stock purchases are subject to stamp duty (up to 0.5%). Overnight fees, also known as rollover fees, apply to CFD positions held overnight.

Read the complete eToro fee structure here.

Winner: Bybit charges lower crypto trading fees than eToro (0.1% vs 1%). It also has zero deposit and withdrawal fees, whereas eToro charges a $5 withdrawal fee.

Bybit vs eToro: Security

Bybit Security Measures

- User Identity Management: Bybit has mandatory Know Your Customer (KYC) checks. This helps to prevent unauthorized account creation and identity theft.

- Hardware Authentication: It supports YubiKey hardware authentication, which provides an even stronger layer of 2FA security for your account.

- Fund Password: You can set up a separate password for withdrawals, adding an extra layer of security for your funds.

- Anti-Phishing Code: This is a unique code displayed on all your legitimate Bybit e-mails.

- New Address Withdrawal Lock: This security feature requires you to whitelist any new withdrawal addresses before you can withdraw funds to them.

- Cold Storage: The Bybit platform stores the majority of user funds in cold storage wallets.

- Threshold Signature Schemes (TSS): Bybit leverages TSS, a cryptographic technique that allows multiple parties to share a secret key without revealing the entire key to any one party.

eToro Security Measures

- Two-factor authentication (2FA)

- Segregated Accounts: It keeps your funds separate from their own company funds in top-tier banks.

- Insurance Fund: For users with larger balances, private insurance covers losses of up to 1 million euros/AUD.

- SSL encryption: eToro uses Secure Sockets Layer (SSL) encryption to protect your personal information when you transmit it over the internet.

- Security monitoring: The platform employs state-of-the-art monitoring tools to detect and prevent fraudulent activities.

- Licenses: eToro follows the strict regulations of several authorities, including FCA (UK), ASIC (Australia), CySec (Cyprus), GFSC (Gibraltar), FinCen, and FINRA (United States).

Bybit vs eToro: Deposit Methods

Bybit allows you to deposit existing cryptocurrencies you hold elsewhere into your Bybit account. You can also deposit fiat currencies using a variety of payment methods, including:

- Credit/Debit Card Payment

- Bank transfer (only in some countries)

- Third-Party Payment (Banxa, Simplex, MoonPay, etc.)

- Digital wallets (Apple Pay and Google Pay)

Plus, Bybit’s P2P marketplace offers a vast selection of over 300 local deposit methods, including debit cards, credit cards, and even in-person cash payments.

On the other hand, eToro is a more regulated broker. Therefore, it supports many fiat deposit and withdrawal methods. This includes:

- Bank Transfer

- Credit Card (Visa, MasterCard, Electron, Maestro)

- Debit Card

- PayPal

- Skrill

- Neteller

- iDEAL

- Klarna / Sofort Banking

- Przelewy 24

Winner: Both platforms support crypto deposits, but eToro supports more fiat deposit methods compared to Bybit.

Conclusion: Bybit or eToro, Which is Better?

When deciding between Bybit vs eToro, consider your trading needs and experience level. Bybit is perfect for those deeply involved in crypto trading who value advanced features, high leverage, and low fees.

On the other hand, eToro shines with its wide variety of financial assets and user-friendly social trading tools, making it an excellent choice for beginners and those looking to diversify their investments.

FAQs

Is Bybit a reliable and good exchange?

Yes, Bybit is considered a reliable cryptocurrency exchange, known for its robust security features, user-friendly interface, and advanced trading tools. It offers perpetual contracts, high liquidity, and up to 100x leverage, which appeals to experienced traders.

However, it is primarily geared towards advanced traders, and beginners may find the high-leverage options risky and advanced trading tools more complex.

Why is Bybit banned in the US?

Bybit is banned in the United States due to regulatory issues, as it does not comply with the stringent financial regulations set by U.S. authorities. The U.S. has strict rules for cryptocurrency exchanges, including requirements for licensing, anti-money laundering (AML) policies, and customer identity verification (KYC) procedures.

Bybit, like many other overseas crypto exchanges, has chosen not to operate in the U.S. market to avoid the complexities and costs associated with these regulatory requirements.

Is eToro available for US customers?

Yes, eToro is available for U.S. customers. The platform offers to invest in crypto, stocks, and ETFs, via its regulated US entities, eToro USA LLC and eToro USA Securities Inc. It is available in almost every state of the United States.