Dragonfly Digital Management and Crypto.com have linked up with Coinbase to push back hard against the CFTC’s new regulations on prediction markets.

The CFTC’s proposal, which wants to clamp down on prediction markets tied to political events and other big moments, isn’t sitting well with these crypto powerhouses.

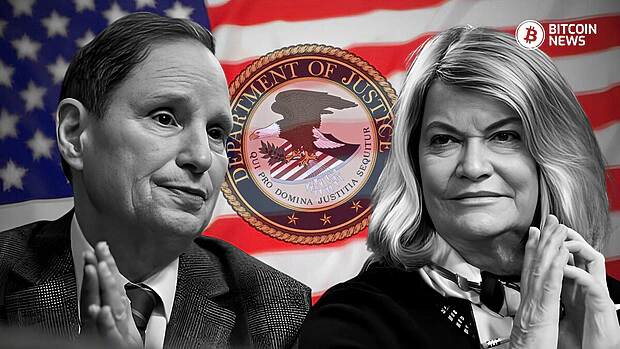

Jessica Furr and Bryan Edelman, representing Dragonfly, think the agency is way off the mark by lumping political event contracts with gambling. They argued that:

“Political event contracts should not be equated with gambling on games of chance like the Super Bowl. Rather, elections have significant economic implications.”

In their eyes, these contracts are important for hedging risks and are aligned with the Commodity Exchange Act (CEA). Plus, they see them as a goldmine for valuable predictive data that the public can actually use.

Dragonfly and Crypto.com fire back

Dragonfly’s beef doesn’t stop there. They’re calling out the CFTC for trying to blanket-ban prediction markets without even giving them a fair shot.

The timing of this rule, especially with the Supreme Court’s recent ‘Chevron’ decision that limits the agency’s power without a nod from Congress, seems like a serious overreach.

Crypto.com is just as fired up. Steve Humenik, their bigwig in charge of Capital Markets, claims the CFTC’s move is straight-up violating the rulemaking process laid out by the CEA.

The law demands that the CFTC follow a three-step process before shutting down a contract. First, they’ve got to decide if the contract deals with an excluded commodity.

Next, they need to see if it’s engaging in specified activities. Lastly, they have to figure out if it’s against public interest. Humenik added that:

“The CFTC must articulate its justification for determining that a given contract has an underlying excluded commodity. This should not be a foregone conclusion.”

He’s urging them not to cut corners and to stick to the rules. His bottom line? The CFTC needs to toss out this part of their notice of proposed rulemaking (NOPR).

Coinbase doesn’t like CFTC’s definition of ‘gaming’

In their letter to the CFTC, Coinbase also said they want the entire proposal pulled back, arguing that the CFTC is overstepping its statutory authority and ignoring how prediction markets could actually boost the economy.

Paul Grewal, Coinbase’s Chief Legal Officer, thinks the CFTC’s all-or-nothing approach is completely at odds with promoting responsible innovation and growth in regulated markets. He said:

“We firmly believe that this all-or-nothing approach to the treatment of event contracts is not consistent with the promotion of responsible innovation and growth in regulated, transparent markets with appropriate safeguards to protect market integrity and protect customers.”

He’s pushing for a more balanced approach that still protects public interest but doesn’t strangle innovation in its crib.

Grewal’s letter also slammed the CFTC for mixing up speculation and gambling. The agency’s proposal wants to label political contests, awards, and athletic events as “gaming,” but Coinbase is having none of it.

They think this broad definition of gaming is way off the mark and doesn’t match up with any reasonable understanding of the term. The CFTC’s own legislative history doesn’t support such a wide interpretation either.

Coinbase threw out an example to make their point: a vendor who prints t-shirts for a championship team. If that vendor wants to hedge their bets by taking a position against that team, that’s not gaming—it’s smart business.

But under the CFTC’s proposed rules, this type of market could get caught up in the same net as actual gambling. The whole idea of “gaming” that the CFTC is pushing is, in Coinbase’s view, totally flawed.