Everyone’s watching Jerome Powell tomorrow. The Federal Reserve’s annual symposium at Jackson Hole is where the big shots gather. Central bankers from around the world fly into Wyoming, making it the most economically-powerful stage on the planet.

We’re all hoping Powell’s words will give a clear direction on where inflation and interest rates are headed. Same time last year, Powell warned that taming inflation might hurt households and businesses. The S&P 500 tanked 3.4% that day.

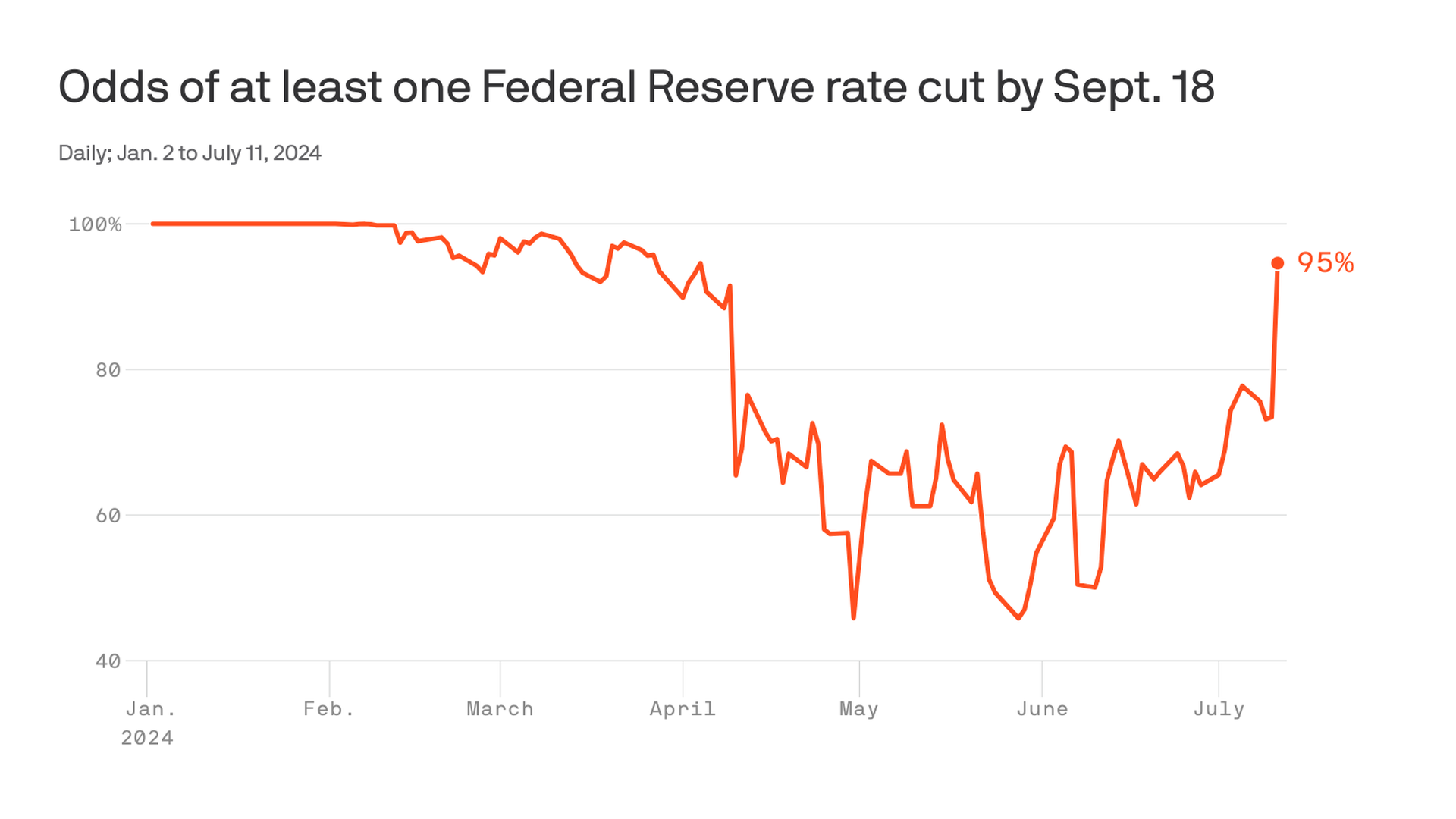

This year, everyone’s expecting him to hint at an interest rate cut. With inflation cooling off, some are hopeful, but the big question remains—will Powell ease up, or will he keep things tight to avoid unemployment skyrocketing?

Powell won’t pre-commit

Powell is playing it safe. He’s told us time and time again that he is not going to lock himself into any promises at Jackson Hole.

According to the man in charge of America’s economy, his decision on a rate cut will depend on the data coming in, and there’s plenty of that coming before the next Fed meeting in mid-September.

So, don’t have any big expectations.

That being said, market moves at Jackson Hole are rare but can be massive when they happen. Just look at the past. Back in 2019, the S&P 500 dropped 2.6% after Powell’s speech, though that was more about US-China trade tensions than his words.

Then there’s Ben Bernanke, Powell’s predecessor, who got markets buzzing in 2009 and 2010. In 2009, Bernanke wrongly predicted a quick rebound from the global financial crisis.

The S&P 500 still went up 1.8% that day. In 2010, he hinted at more bond buying, and the market responded positively with a 1.6% rise.

But it’s not all about stocks. In 2020, Powell changed the Fed’s interest rates strategy, saying they wouldn’t be hiked just because of a strong labor market.

That was a big deal—a major pivot from how the Fed usually does things. The market’s reaction? A mere 0.2% rise in the S&P 500. But the effects are still felt today.

What about Bitcoin?

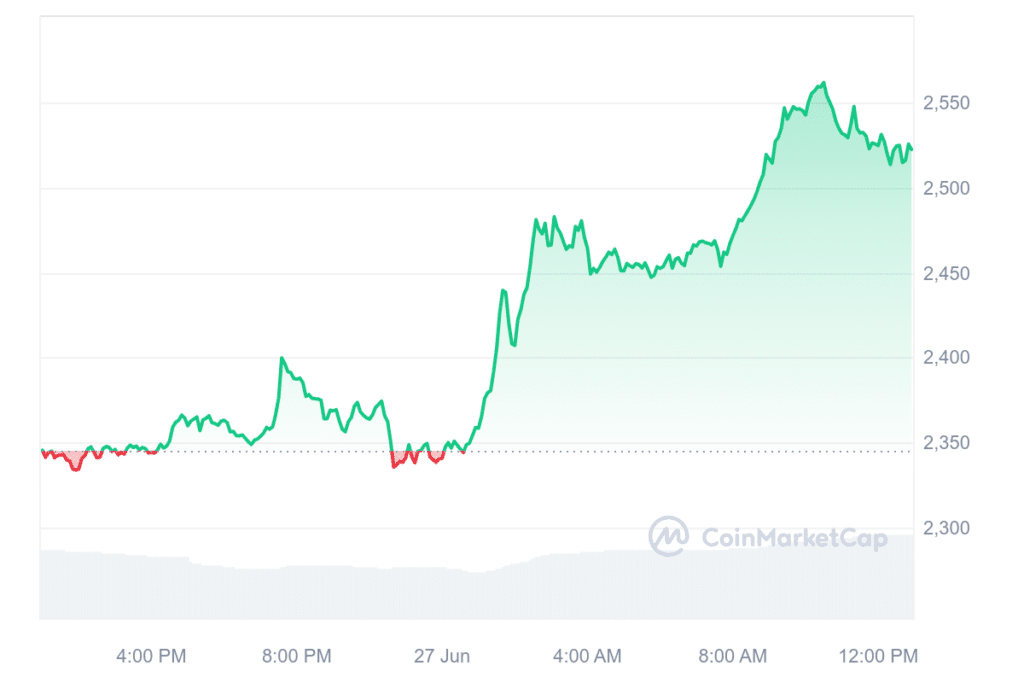

Now, let’s talk about how this might play out for Bitcoin. The crypto industry is itching to see how Powell’s speech will affect the markets. If he hints at a rate cut, it could be game on for Bitcoin.

Lower interest rates usually mean more liquidity in the market, and investors start chasing higher returns in riskier assets. That’s when Bitcoin shines.

We’ve seen it before—when the Fed cuts rates, Bitcoin often gets a boost as investors pump money into the crypto market.

But there’s more to it than just following stocks. Bitcoin has earned a reputation as a hedge against inflation. If Powell’s speech stirs up fears of inflation, investors might flock to Bitcoin as a way to protect their money from losing value.

The idea is simple: if traditional currencies lose value due to inflation, Bitcoin, being decentralized and finite, could hold or even increase its value. This narrative has been gaining traction, especially with the global economic uncertainties we’ve seen lately.

Let’s not forget Bitcoin’s volatility though. While rate cuts can send Bitcoin prices soaring, they can also lead to sharp drops. Speculation runs high in the crypto market, and any hint from Powell could trigger rapid price movements.

It’s a double-edged sword—big gains and big losses can happen in the blink of an eye.