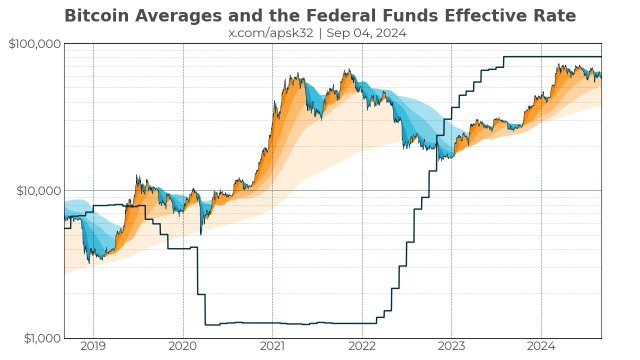

With the Federal Reserve (FED) interest rate cut fast approaching, discussion about the event’s impact on Bitcoin, the largest crypto asset has increased significantly within the community. However, a crypto analyst delving into the subject has predicted a similar price implication to that of past scenarios, particularly in 2019.

An Impending Pop And Drop Performance For Bitcoin

Apsk32, a crypto expert and engineer has offered insights on the aftermath of Bitcoin’s price performance following the Fed’s interest rate cut expected to take place on September 18. The expert predicts that Bitcoin could experience a similar price impact in 2024 to the one seen in 2019 after rates were reduced.

According to the crypto expert, when the Federal Reserve cut interest rates back in August 2019, Bitcoin witnessed a surge of about 20% in one week. However, about 3 months after the event, the digital asset lost its momentum and plummeted by over 33%, triggering pessimism in the industry.

Comparing the two eras, Apsk32 is confident that if the Fed decides to go toward monetary easing this year, BTC’s price performance might mirror the same positive and negative trend of 2019 post the event.

While the analyst believes that BTC might see a similar pop and collapse, he is unsure that the coin will fall by 33% from here. As a result, he has placed his base price for Bitcoin between the $45,000 and $55,000 level before ultimately seeing a rally in 2025, which is believed to be a promising year for the crypto asset.

Apsk32 appears to be very bullish about Bitcoin and its potential in the long term as evidenced by his previous audacious forecast where he envisions a $2.6 million per BTC in the future. His projection is based on the digital asset’s market cap, which is in alignment with a power law.

The expert pointed out that since 2011, a power law has governed the purchasing power of BTC’s market capitalization. Thus in the event that the pattern persists, the value of the coin will reach $2.6 million in the next 10 years.

A Wave Of Bullish Prediction For BTC

This stark optimism from Apsk32 matches that of asset management company VanEck, which also predicted a similar price range for BTC in the long term. The over $100 billion asset manager in its latest report projected BTC to be valued at $2.9 million by 2050, translating to an overall market cap of a whopping $61 trillion.

VanEck‘s prediction is fueled by the notion that Bitcoin could be used to settle about 10% of the world’s international trade and 5% of the world’s domestic trade by 2050, possibly leading to central banks securing 2.5% of their asset in BTC.

It is worth noting that the aforementioned price target is the firm’s base case scenario for BTC, while its worst and best-case scenario is pegged at $130,000 and $52.4 million respectively.