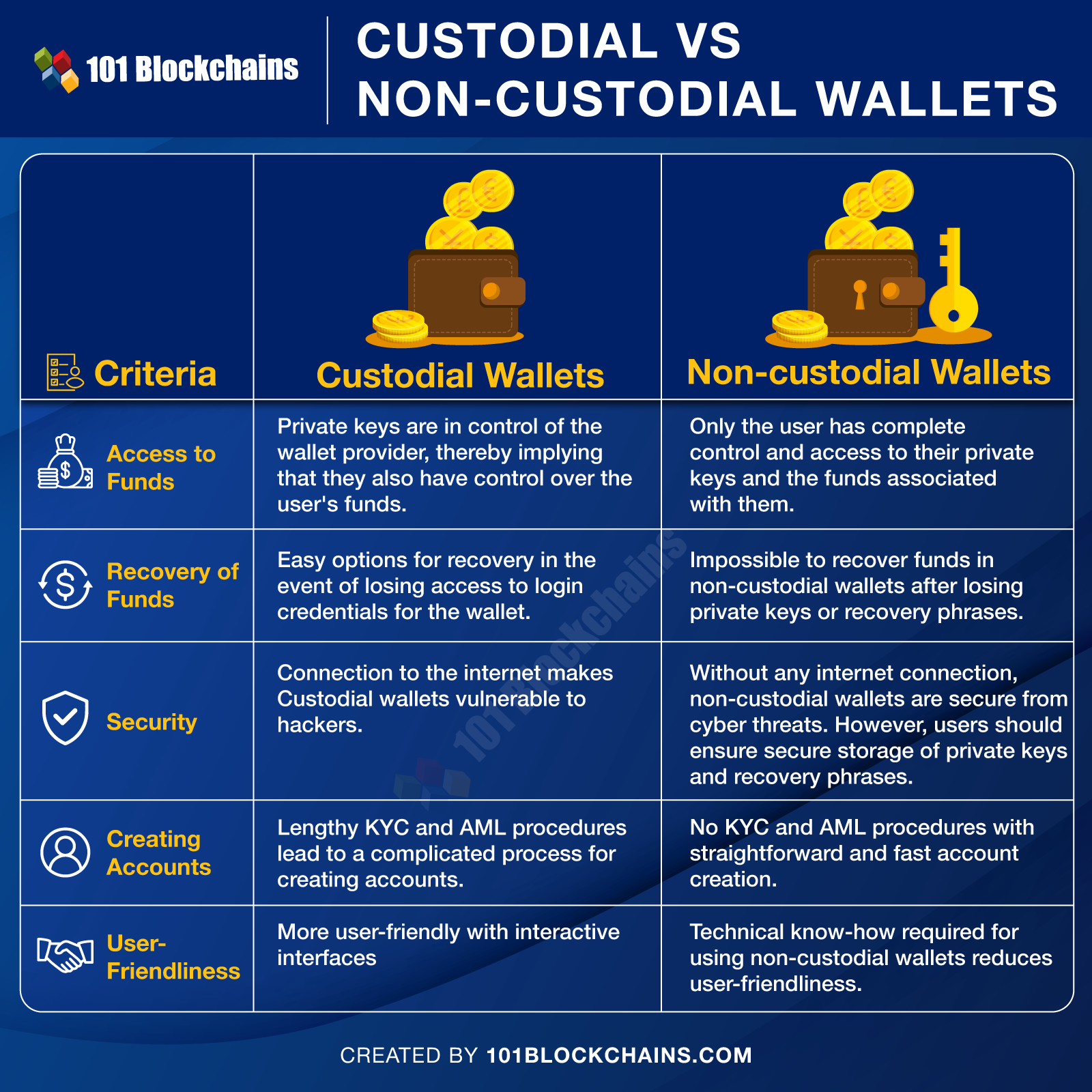

It’s a question that’s almost as old as crypto: should you self-custody your digital assets or should you entrust them to a specialist custodian such as an exchange? And while you might think the answer to the question can be distilled into a single sentence – “Use a non-custodial wallet if you understand the technology and keep your seed phrase safe, but opt for custodial if you’re unwilling to be solely responsible for your assets” – it’s not that simple.For one thing, non-custodial wallets have been getting a lot better and are no longer as complex to use as they once were; a number don’t even require seed phrase storage anymore, relying on traditional authentication methods such as email and password. But at the same time, custodial solutions have also gotten way better, with robust security and full insurance now routine.

The question might be old, then, but it requires a fresh review to get to the bottom of the matter. Custodial or non-custodial, what’s it gonna be?

The Pros of Going Non-Custodial

Yes, you know that non-custodial means your keys, your coins. Yes, it means “true” crypto, the way Satoshi always intended it. Let’s skip past the platitudes and get to some of the more compelling but less obvious reasons why storing your assets in a non-custodial – also known as self-hosted – wallet can be a smart choice.For one thing, doing so provides certainty of access. Not only can you restore access to your wallet if you accidentally delete it or lose the device it’s stored on, but if you’re using it as a hot wallet for trading, you can install the same wallet on multiple open-source wallet instances. For example, you can import the private key into a Telegram trading bot, a web extension, and a mobile wallet, all created by different developers. Should one wallet become temporarily unavailable – which routinely happens for any number of reasons – you can still access your funds.But there’s another, even more compelling reason why non-custodial is the supreme gentleman or gentlewoman’s choice. Today’s web3 wallets are much more than simply dumb GUIs for sending and storing crypto: they’re portals for exploring the multi-chain landscape through built-in dapp browsers, staking portals, integrated DEXs, and fiat pipelines. Pick a good non-custodial wallet and you can make it both your fortress and your playground. As the following examples show, the leading non-custodial wallets have gotten hella good.

Top Non-Custodial Wallets

The non-custodial wallet you choose will be dependent upon the blockchain network whose assets you wish to store. But in terms of interface, security, and UX, Tonkeeper is a good example of what a well-designed web3 wallet can provide. Available for desktop, web extension, and mobile, it’s easy to use and provides a gateway to the TON ecosystem with a built-in dapp browser and swap feature. For storing EVM assets and BTC, meanwhile, Exodus is a good option.

When choosing a non-custodial wallet, seek one that balances robust security, including a range of primary and secondary authentication mechanisms, with integrated token swapping and DeFi features. That way you can enjoy the upside to self-custodying your assets while retaining the freedom to trade them and to acquire new tokens when opportunities emerge.

The Pros of Going Custodial

Rather than repeat the same old truisms, let’s take a fresh angle on the case for entrusting the custody of your assets to a centralized platform. There’s actually a case for most crypto users – not just novices – entrusting a portion of their digital assets to a custodial solution. The key word being “portion.”

In crypto, as in so many other domains, it pays to keep one’s eggs in multiple baskets. Doing so not only protects you against worst case scenarios, such as an exchange becoming insolvent or exit scamming, but ensures that in the event of the platform going offline – which isn’t unheard of during peak volatility – you still have assets elsewhere you can trade with, be it to buy the dip or panic sell.That’s right: custodial crypto storage can actually be a sound hedging strategy. But it can also offer greater peace of mind for individuals who don’t sleep easy knowing that their net worth is scrawled on a dozen words and stashed in a drawer. (Yes, there are more secure ways of recording and concealing a seed phrase, but like creating a strong password, many users forgo security for convenience.)

Another compelling reason for going down the custodial route is the potential to increase your digital net worth in the process: many CEXs run staking programs and “CeDeFi” yield farming that can provide a reasonable APR, particularly if you’re holding PoS assets such as ETH or SOL. Yes, you can do all this yourself with a non-custodial wallet if you know what you’re doing, but there’s no denying that centralized solutions require less effort.

Top Custodial Wallet Solutions

If you do decide that a custodial wallet is the best option for you, obvious options include Coinbase Custody if you’re intending to store a significant amount of cryptocurrency, while for smaller amounts a regulated crypto exchange such as Bitget or Binance will suffice. If you’re willing to pay a premium for a best-in-class custodial service, expect your assets to be secured using advanced cold storage solutions by fully regulated companies that are also fully insured.Regulated crypto exchanges, in comparison, provide a free option since they don’t charge a fee for storing user deposits, but you are unlikely to be able to have your assets insured against loss or seizure. For this reason, very few holders store their entire crypto net worth on a CEX, despite the convenience it offers in terms of being able to trade instantly.

Just bear in mind that when using a custodian, you will be required to complete KYC. In theory, there are still a handful of unregulated exchanges that don’t enforce verification, but the odds of them disappearing with your funds are exponentially higher. If you’re going to take that risk just to stay anonymous, you’d be better going for a non-custodial wallet.

When choosing between custodial and non-custodial crypto wallets, it’s important to weigh the benefits and trade-offs based on your priorities – whether that’s security, convenience, or control over your assets. Neither answer is wrong. But there’ll be one answer that’s right for you.

Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.