Data shows Bitcoin miners have dumped around 7.7k BTC in the last week, resulting in an almost 10% decrease of their reserves in the period.

Bitcoin Miners Withdraw Large Amounts Following The Crash

As per the latest weekly report from Glassnode, the latest decline in the miner reserves is the sharpest since the September of 2018.

The “Miner Balance” is an indicator that measures the total amount of Bitcoin currently being held in the wallets of all miners.

When the value of this metric goes up, it means miners are transferring coins to their wallets right now. Such a trend, when prolonged, may hint at accumulation from these chain validators, and hence could prove to be bullish for the price.

On the other hand, a decrease in the indicator suggests miners are withdrawing their BTC from their reserves at the moment. Generally, miners transfer out of their wallets for selling purposes, and thus this kind of trend can be bearish for the crypto.

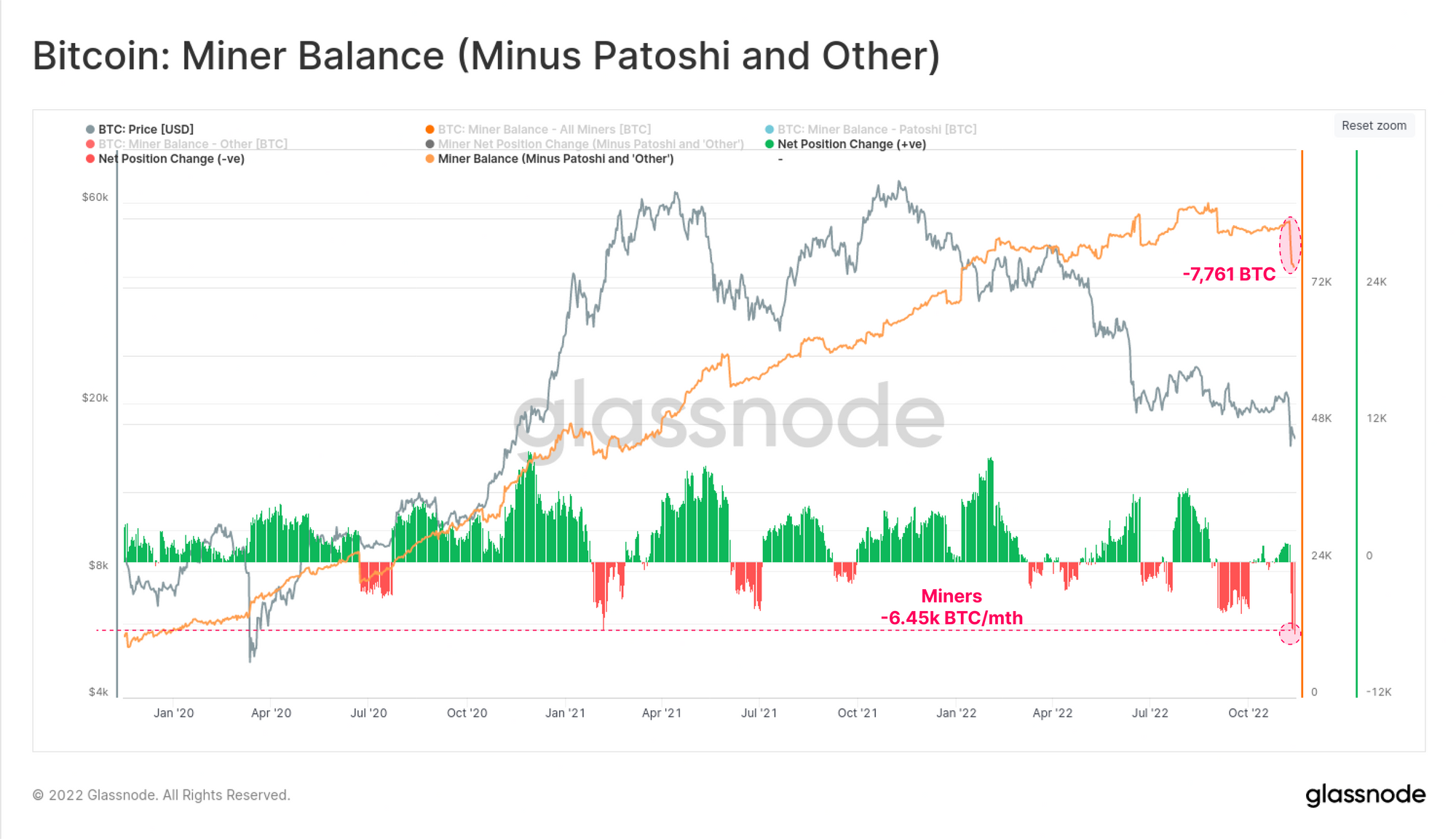

Now, here is a chart that shows the trend in the Bitcoin Miner Balance over the last few years:

As you can see in the above graph, the Bitcoin Miner Balance has plummeted recently as the crash due to the FTX crisis has taken place.

In the last week or so, the indicator’s value has dropped by 7.76k BTC, representing a total decline of around 9.5%.

The chart also includes the data for the “Miner Net Position Change” (or simply, the Netflow), which measures the total number of coins that miners are depositing to or withdrawing from their wallets.

According to this metric, miners are currently spending at a rate of 6.45k BTC per month, higher than during any selloff in the last few years.

In fact, the current monthly decline in the reserves of the miners is the sharpest it has been since September 2018.

Miners had already been under extreme pressure before the latest crash, as the long and deep bear market had been continuously shrinking their profits.

The new price plunge is bound to have left many miners with no choice but to liquidate their holdings now, which is what has lead to the sharp decline in the Bitcoin Miner Balance.

BTC Price

At the time of writing, Bitcoin’s price floats around $16.7k, down 15% in the last week.