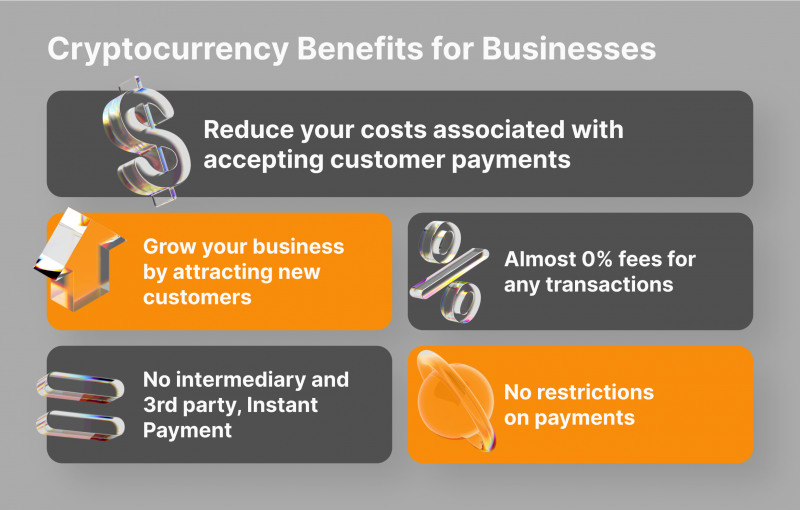

Why limit your business to just traditional methods when crypto payment processors offer so much more?

Businesses that are already taking advantage of crypto payments have not only expanded their customer base on a global level, but have also lowered the fees of their transactions, thanks to blockchain technology.

Below, we’re going to dive into some of the other main benefits of incorporating crypto payments into your business.

Top 5 Benefits of Using Crypto Payment Processors for Your Business

Lower Transaction Fees

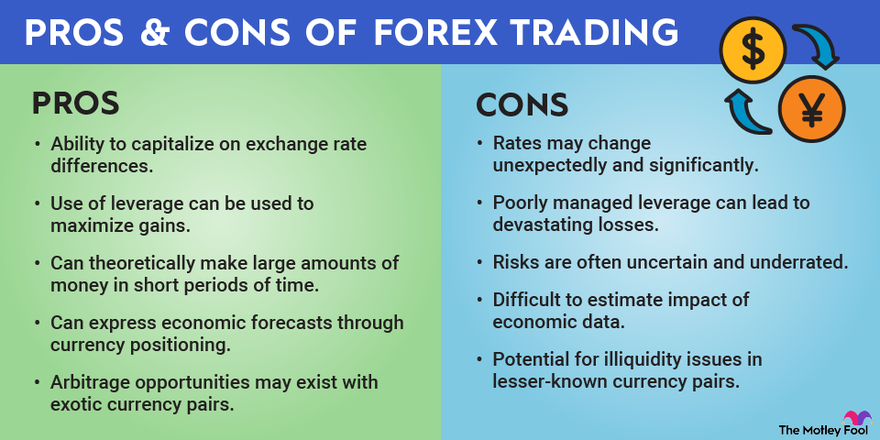

High transaction costs can eat into your profits big time.

Traditional payment methods like credit cards come with huge fees, but crypto payment processors usually charge less than 1%.

For example CryptoProcessing.com charges 0.8% or less.

Switching to crypto payments can significantly cut down on these expenses, which is especially important for businesses with high sales volumes.

Lower fees mean more money to reinvest in your business and stay competitive.

By using crypto payment processors, you not only save on transaction costs but also free up funds for growth and innovation.

Cutting costs in this area helps keep your business financially healthy and resilient.

Faster Transactions

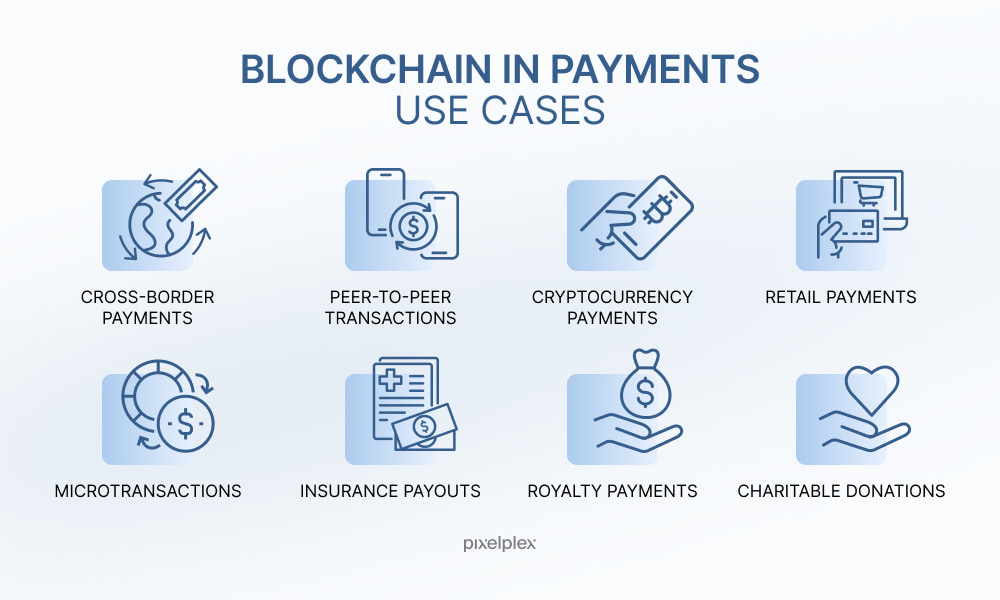

Traditional payments, especially international ones, can be slow and delay your cash flow.

Crypto payment processors speed things up, often completing transactions in minutes.

This boosts your cash flow and operational efficiency, letting you focus on growth.

Faster transactions can close deals quicker, improve customer satisfaction, and streamline processes that need immediate payment confirmations.

In today’s fast-paced, international business world, being able to adapt quickly is mandatory for sustained success.

By using crypto payment processors, you gain a competitive edge, not just in speed but by reducing payment delays, making your business more agile and forward-thinking.

Enhanced Security

Crypto payment processors use blockchain technology to provide top-notch security for your transactions.

Crypto payments greatly reduce the risk of fraud.

Blockchain’s unchangeable ledger ensures every transaction is transparent and secure, protecting you from threats like identity theft and chargebacks.

By adopting crypto payments, you protect your business from the billions lost to payment fraud each year.

As digital transactions become more common, prioritizing security helps build trust and strengthen your market position.

This “crypto shield” not only enhances your financial security but also boosts your brand’s reputation.

No Chargebacks

Crypto transactions are final once confirmed, freeing you from the hassle of chargebacks.

- Final Transactions: Once confirmed, crypto payments can’t be reversed.

- Predictable Finances: No surprise losses from fraudulent chargebacks.

- Stability and Trust: Provides a secure and reliable payment process.

Using crypto payment processors increases financial predictability and reduces potential losses.

This ensures business stability and builds customer trust.

Access to Global Markets

Crypto payment processors open up your business to a wider, more diverse customer base.

With cryptocurrencies, you avoid the hassles of traditional banking and currency conversions, attracting customers who prefer simpler transactions.

This can boost sales by reaching people who are unbanked or in countries with unstable economies.

Cryptocurrencies let you connect seamlessly with your audience.

By accepting crypto payments, you offer solutions that meet the needs of new markets and create a sense of accessibility for your global customers.

Using crypto payment processors helps you navigate new markets without traditional financial barriers, positioning you as a leader in the global digital economy.

This strategic move expands your reach and allows you to engage with crypto customers worldwide, transforming your business into a global entity driven by innovation.

Best Crypto Payment Processor – CryptoProcessing

CryptoProcessing by CoinsPaid stands out as the absolute leader in the cryptocurrency payment processing sector, thanks to its decade of experience in the space and record of handling high transaction volumes.

First off, it’s important to remember that CryptoProcessing.com serves over 800 clients with a monthly transaction volume exceeding €1 billion.

And the platform supports payments in over 20 cryptocurrencies, including Bitcoin, Ethereum, and Litecoin, and enables conversion to more than 40 fiat currencies.

Cost Efficiency

Offering competitive transaction fees capped at around 1,5%, CryptoProcessing.com allows businesses to reduce transaction costs by up to 80% compared to traditional methods, which can charge up to 3.5%.

Security and Reliability

With a 99% acceptance rate, the platform eliminates chargebacks thanks to its decentralized nature and transactions are secured through blockchain technology, ensuring transparency and minimizing fraud risk.

Conclusion

By integrating crypto payment processors, you can ensure that every financial transaction supports your bottom line.

The security offered by blockchain-based payments is unmatched, providing you with peace of mind and safeguarding your hard-earned assets.

Crypto transactions not only make your business agile but also fortify its reputation against fraudulent activities.

Seize the opportunity to expand into global markets, reaching customers you’ve never considered before.