Digital assets manager CoinShares says that institutional investors dropped nearly two billion dollars into crypto products last week.

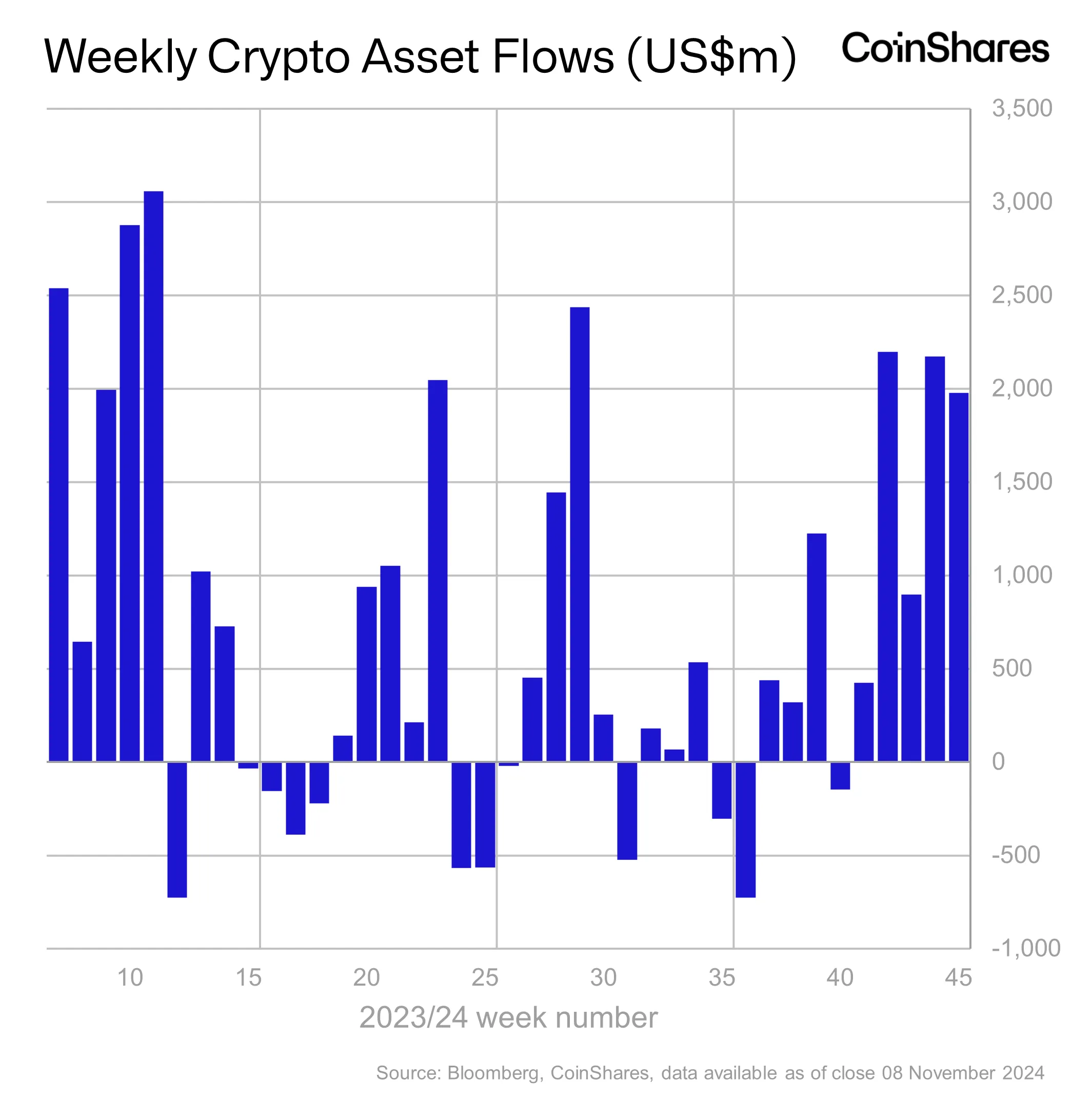

In its latest Digital Asset Fund Flows report, CoinShares says that institutional crypto investment products saw a surge in inflows to the tune of $1.98 billion on net last week.

CoinShares attributes the stream of inflows to “macroeconomic factors and US political shifts.”

“Digital asset investment products saw post-US election inflows of US$1.98bn, marking inflows for the 5th consecutive week with year-to-date inflows having reached a new record of US$31.3bn.

Global assets under management, following the price rises last week, also reached a new all-time high of US$116bn. Trading volumes rose US$20bn, not a new record but the highest since April this year.”

Most inflows came from the US, which provided $1.95 billion of the inflows. In other regions, Switzerland and Germany raked in $23 million and $20 million in inflows respectively.

Per usual, Bitcoin (BTC) was the focus of the lion’s share of inflows at $1.8 billion.

Says CoinShares,

“A combination of a supportive macro environment and seismic shifts in the US political system being the likely reason for such supportive investor sentiment.”

Ethereum (ETH) saw a trend reversal with inflows of $157 million, marking the smart contract platform’s biggest week of inflows since ETH’s first exchange-traded fund (ETF) product launched in July.

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inboxCheck Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Natalia Siiatovskaia/Warm_Tail

The post Institutions Pour Nearly $2,000,000,000 Into Crypto Products Amid Political and Macro Shift: CoinShares appeared first on The Daily Hodl.