Bitcoin price analysis is currently bearish. It was quite expected over the last few days that Bitcoin will retest the support at $15500. It appears to be headed straight to the region, currently only short of a couple of hundred dollars. Furthermore, there is no indication of the bulls taking control.

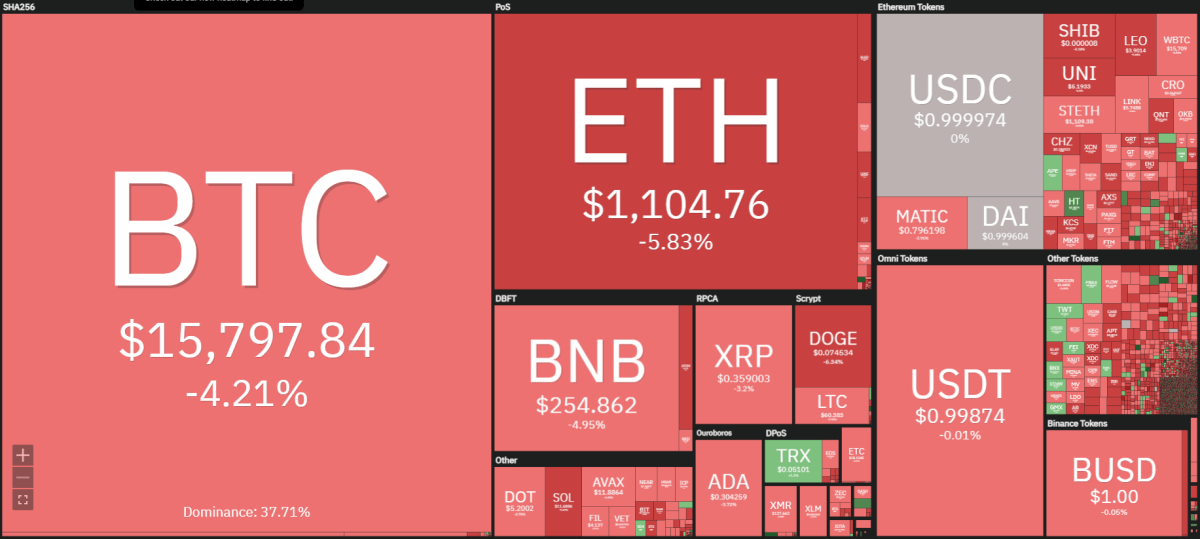

The crypto heat map shows that Bitcoin has marked a decrease of roughly 4.21 percent. At the same time, Ethereum has gone down by 5.83 percent. This has led the entire market into the red zone with all alts recording noticeable losses in their price.

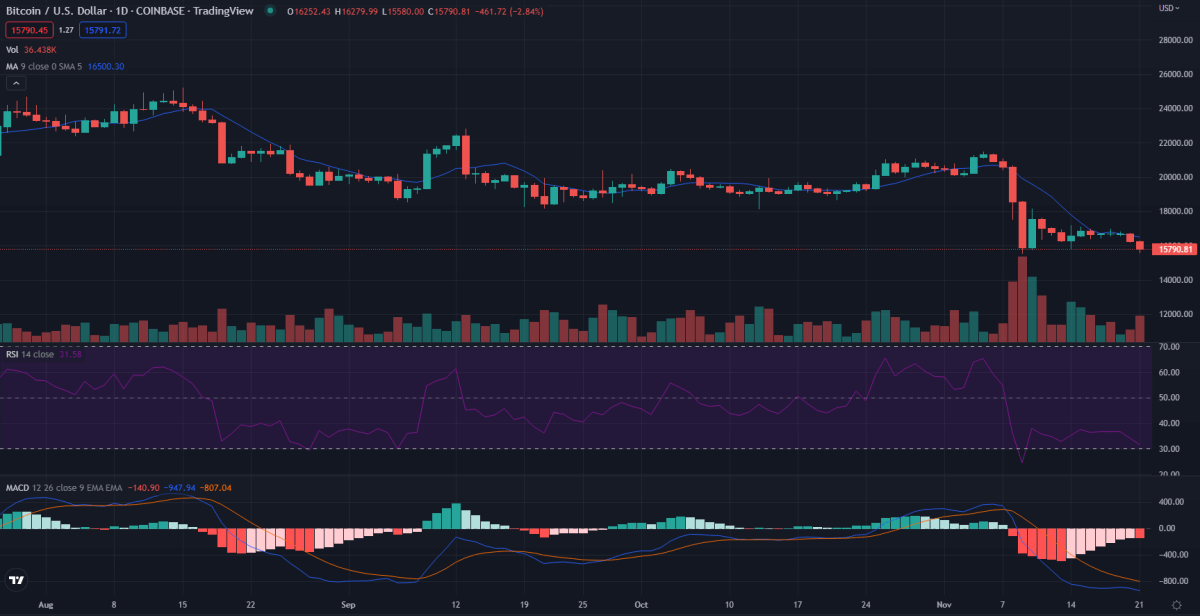

The daily chart of Bitcoin price analysis shows that this is the second time BTC/USD is testing the support at the $15500 mark. It was first tested on the 14th of November. However, BTC/USD retraced after touching $15790 at that time. But today, it has fallen lower.

RSI line on the daily chart shows that the market is oversold right now. Furthermore, the MACD also shows that the bears are not ready to give up. It has been several days since the histograms have not been in the green zone. This indicates that the next couple of days can be dry for Bitcoin.

Bitcoin 24-hour price movement

In the last 24 hours, Bitcoin’s market cap has reduced by 4 percent. At the same time, the trading volume has gone up by 85 percent. This has left the 24-hour volume-to-market cap ratio at 0.1219.

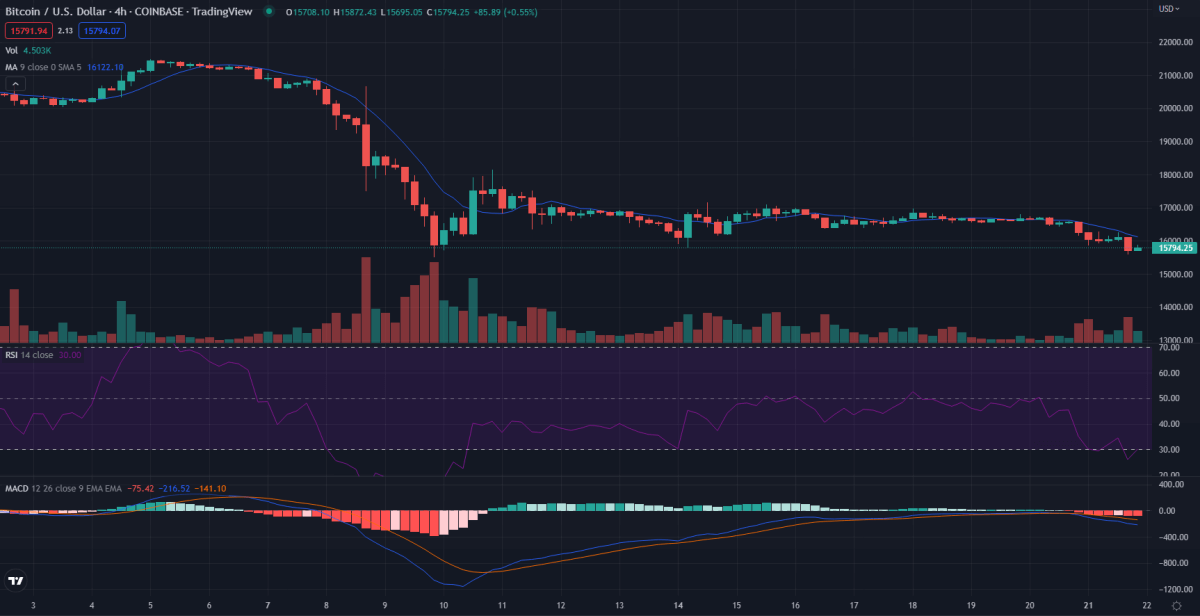

4-hour Bitcoin price analysis: Will Bitcoin retrace again?

On the 14th of November, Bitcoin retraced after testing support around $15700. However, today it seems that the downward momentum is much stronger. Bitcoin can certainly fall lower, especially since the RSI and MACD are not showing any positive signs.

We can see that the RSI is currently around 30. This means that the market is heavily oversold. On the other hand, the MACD is showing that the histograms are increasing in strength in the negative direction. What we are seeing is an indication that the bears have an upper hand.

Bitcoin price analysis: Conclusion

Right now, it is expected that Bitcoin will fall a little lower. Regardless, the market is quite uncertain. This might be a good opportunity for those investors who want to DCA (dollar cost average) into Bitcoin. However, traders who are looking for a short-term profit should not be investing in Bitcoin right now.

Disclaimer. The information provided is not trading advice. Cryptopolitan.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.