Following <a href="https://www.coindesk.com/markets/2024/11/22/bitcoin-nears-100k-with-crypto-market-cap-at-record-34t/" target="_blank">bitcoin</a> (<a href="https://www.coindesk.com/price/bitcoin" target="_blank">BTC</a>) and <a href="https://www.coindesk.com/markets/2024/11/22/solanas-sol-surges-to-record-high-above-260" target="_blank">solana</a> (<a href="https://www.coindesk.com/price/solana" target="_blank">SOL</a>) reaching all-time high prices earlier this month, the stablecoin sector has now joined crypto's record-breaking streak.

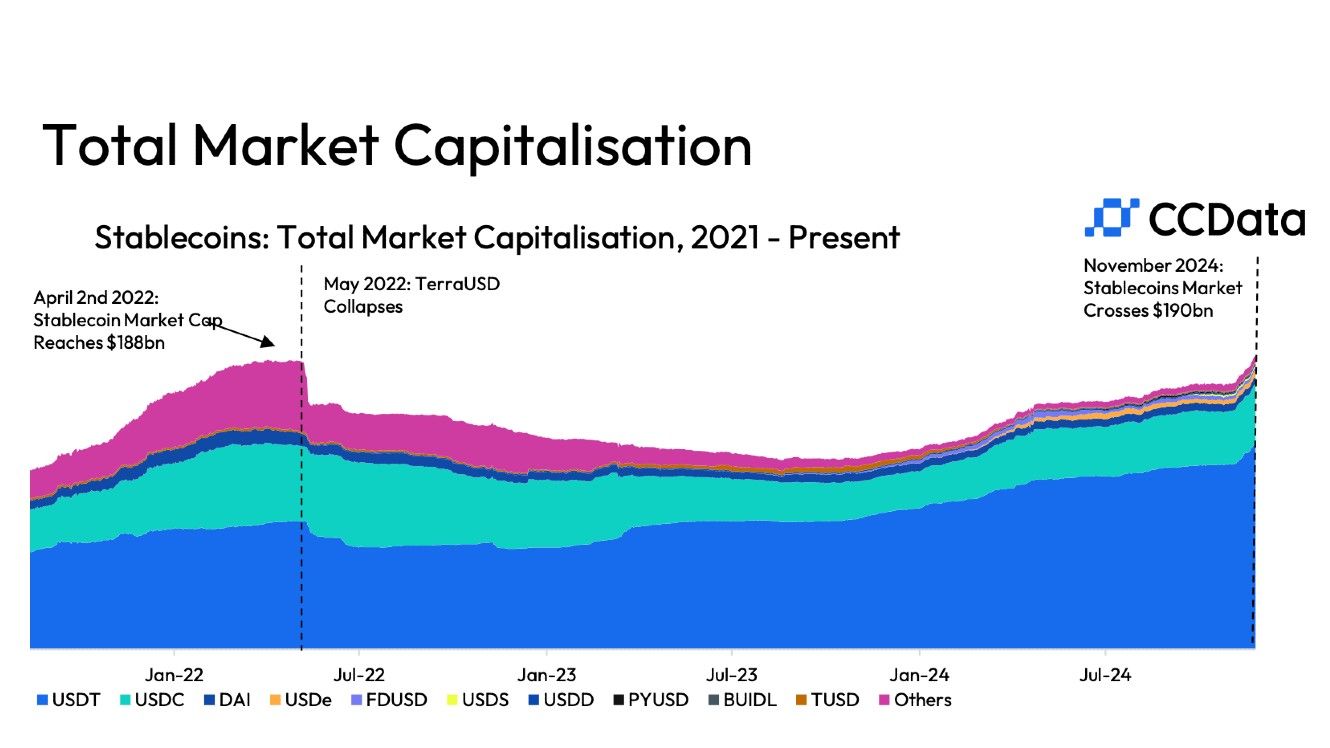

The combined market size of stablecoins hit $190 billion this month for the first time ever, Wednesday's <a href="https://ccdata.io/reports/stablecoins-cbdcs-report-november-2024" target="_blank">report</a> by digital asset analytics firm CCData noted. CCData is owned by Bullish, CoinDesk's parent company. The previous peak of $188 billion was recorded in April 2022, just before the cataclysmic implosion of the <a href="https://www.coindesk.com/learn/the-fall-of-terra-a-timeline-of-the-meteoric-rise-and-crash-of-ust-and-luna/" target="_blank">Terra-Luna stablecoin</a> that added fuel to the digital asset bear market now referred to as crypto winter.

<a href="https://www.coindesk.com/markets/2024/11/12/stablecoin-supply-expands-by-5b-since-us-election-as-investors-pile-into-crypto" target="_blank">Demand for stablecoins</a> soared as cryptocurrency prices exploded in November as investors rushed into crypto, expecting that the U.S. government will be friendlier toward the industry following Donald Trump's election victory. Stablecoins are a key piece of plumbing in the crypto ecosystem. With their prices anchored to an external asset, predominantly the U.S. dollar, they are a popular source of liquidity for crypto trading, serving as dry powder on exchanges.

Read more: <a href="https://www.coindesk.com/business/2024/09/12/stablecoins-increasingly-used-for-savings-payments-in-emerging-countries-but-crypto-trading-still-leads-report" target="_blank">Stablecoins Increasingly Used for Savings, Payments in Emerging Countries, but Crypto Trading Still Leads</a>

This year also brought an explosion of novel tokenized products with prices also pegged to $1, including tokenized money market funds like BlackRock's BUIDL and investment strategies wrapped into a token like Ethena's "synthetic dollar" USDe, which is backed by a crypto carry trade. The CCData report included these platforms in the tally.

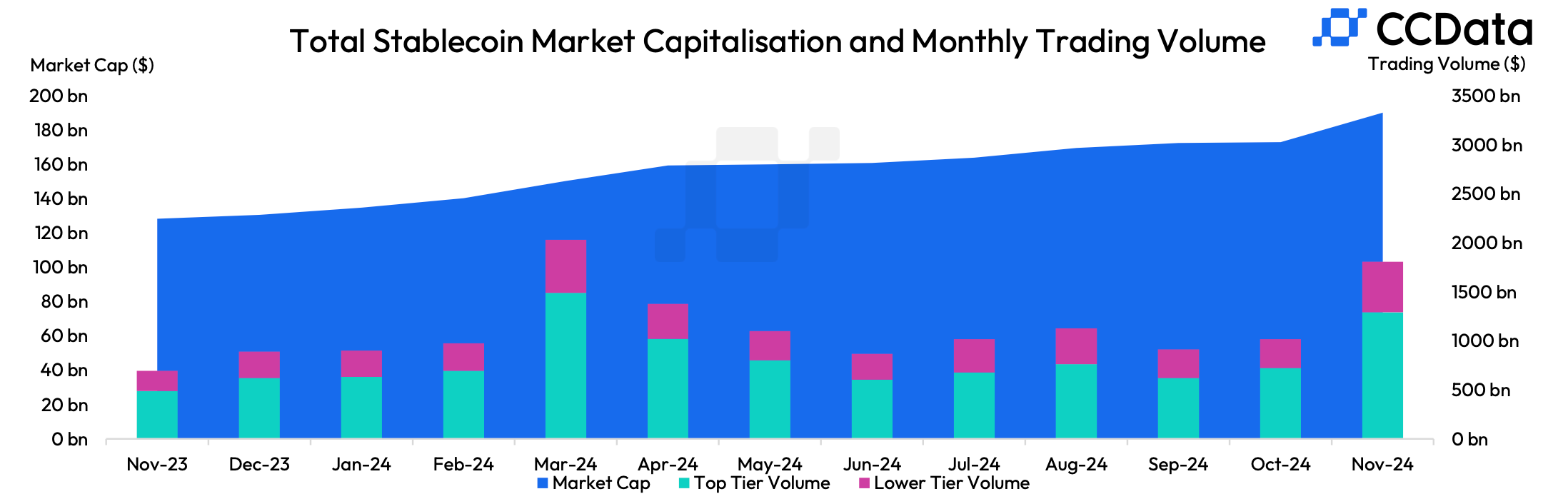

Tether's <a href="https://www.coindesk.com/price/tether" target="_blank">USDT</a> continues to dominate the stablecoin sector. The token's market cap rose 10% over the past month to a new peak of $132 billion, CCData noted. Meanwhile, Circle's <a href="https://www.coindesk.com/price/usd-coin" target="_blank">USDC</a>, grew 12% to a nearly $39 billion market cap, the highest since the March 2023 regional banking crisis that <a href="https://www.coindesk.com/markets/2023/03/11/usdc-stablecoin-and-crypto-market-go-haywire-after-silicon-valley-bank-collapses" target="_blank">heavily impacted</a> the token. USDT claims a 69.9% market share currently, while USDC is second-largest with a 20.5% share.

It was not just the top two that saw rapid growth: 38 of the nearly 200 tokens tracked made a new all-time high supply over the past month, CCData said.

Ethena's USDe, for example, saw a 42% increase to a new record of $3.8 billion in November. The token generates yield to investors by holding spot BTC and ETH and simultaneously shorting (selling) an equal amount of perpetual futures farming the funding rate. Ethena <a href="https://app.ethena.fi/" target="_blank">now</a> offers 25% annualized yield (APY) to token holders, as frothy crypto markets elevated funding rates, <a href="https://www.coindesk.com/markets/2024/11/19/ethena-sees-1b-inflows-as-crypto-rally-brings-back-double-digit-yields" target="_blank">benefitting the protocol</a>.

The broad-market crypto rally also boosted trading volumes with stablecoin pairs on centralized exchanges, rising 77% month-over-month to $1.8 trillion, the report said. USDT was responsible for about 83% of the volumes, followed by Hong Kong-based First Digital's <a href="https://www.coindesk.com/markets/2023/06/01/first-digital-unveils-usd-stablecoin-as-hong-kong-crypto-rules-kick-in" target="_blank">FDUSD</a> 9% and USDC's 8% share.