A massive $19.8 billion Bitcoin options expiry takes place on Dec. 27. Are bulls or bears better positioned?

Bitcoin (BTC) investors are bracing for the $19.8 billion options expiry scheduled for Dec. 27 at 8:00 am UTC. The recent rally above $100,000 has caught bearish investors off guard, creating an opportunity for bullish traders to capitalize and potentially fuel a new Bitcoin all-time high.

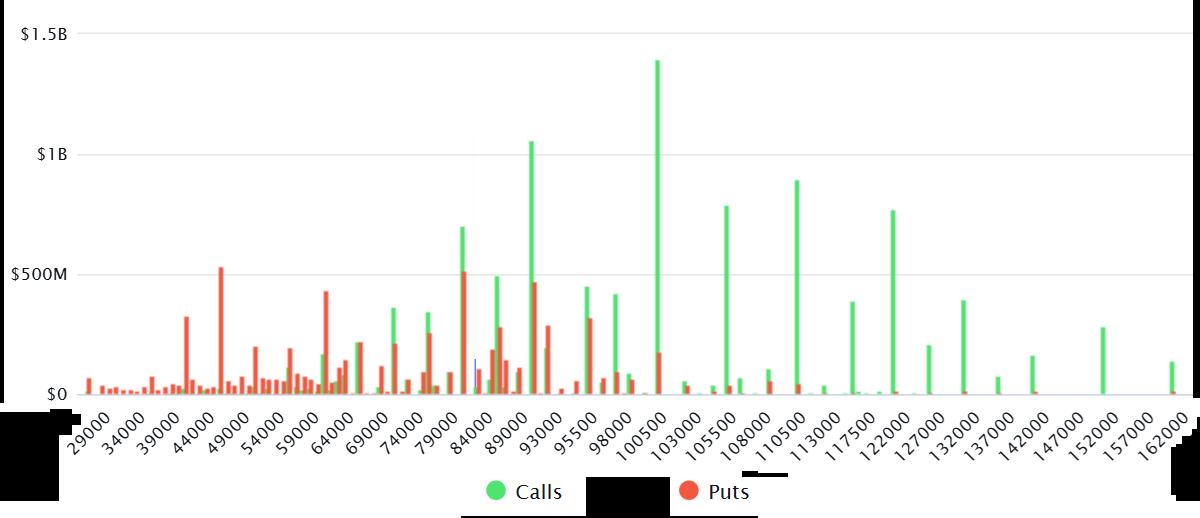

Aggregate Bitcoin options open interest for Dec. 27. Source: Laevitas.ch

Currently, total open interest for call (buy) options stands at $12 billion, while put (sell) options trail at $7.8 billion. Deribit dominates the options market with a 72% share, followed by the Chicago Mercantile Exchange (CME) at 12% and Binance at 9%. However, Bitcoin’s 68% price surge over the past three months has rendered most put options ineffective.