The choice between eToroX vs Coinbase shifts according to the different factors used in evaluating the crypto exchanges. In the section below, we will compare eToroX vs Coinbase based on several different features. An objective evaluation of different features works best for those wanting to make a critical choice for a specific purpose. Let’s see how we can do that.

Coinbase is among the most popular crypto exchanges. On the other hand, eToro is a broad-based broker that makes crypto trading easy for you. Considering the increasing popularity of crypto assets, eToro decided to launch its own crypto trading exchange called eToroX.

With the current crypto exchanges scandal, one finds TRUST scores as primary concern. eToro is considered low-risk, with an overall Trust Score of 93 out of 99. eToro is not publicly traded, does not operate a bank, and is authorised by two tier-1 regulators (high trust), one tier-2 regulator (average trust), and zero tier-3 regulators (low trust).

Coinbase tends to be more popular due to its versatility, including hosted checkout pages, multiple ecommerce integrations (Coinbase Commerce), a turnkey solution for brokerages, exchanges, and fintechs enabling them to offer customers crypto (Coinbase Prime), crypto asset custody (Coinbase Custody), and a wallet to self-store crypto (Coinbase Wallet). There have been many controversies attached to Coinbase, however. Despite that fact, Coinbase continues to expand.

Also Read:

- Best Coinbase Alternatives

- eToro Review: Pros and cons of using the platform

- Coinbase Vs Binance: What’S The Best Crypto Exchange?

- Coinbase Vs Robinhood: What’S The Better Crypto Trading Platform?

Coinbase history

Coinbase was established in 2012 as a platform for sending and receiving Bitcoin. The firm has expanded to accommodate scores of distinct cryptocurrencies and now employs over 2,750 people globally. Coinbase is a decentralized organization with no central offices. Coinbase has members in over 100 nations, and consumers transact around $425 billion every calendar quarter—a figure that is on course to reach $2 trillion annually. Coinbase oversees a thriving bitcoin industry that serves 9,000 financial firms.

Coinbase has two distinct marketplaces, as well as a discrete Bitcoin wallet service. You’re likely to encounter all you need to create and maintain a Bitcoin account or trading strategy among the Coinbase offerings. Coinbase is an investing and financing website that allows users to purchase, trade, and trade around 100+ tradable cryptocurrencies, including Bitcoin, ETH, and Dogecoin. Coinbase is a major corporation with over 73 million active traders and a market worth $255 billion.

eToro History

eToro, on the other hand, was established in 2007 and is located in the United Kingdom. Since 2018, eToro has had more than 17 million users in nearly 100 countries, comprising millions of registered members in 43 U.S. states. Washington, D.C. eToro began as a graphics-intensive forex model. It has repurposed those features for cryptocurrency trading. Customers outside the United States may trade other assets such as contracts for difference (CFDs) and stocks on several exchanges.

The eToro platform contains traders who want to be copied and who adhere to risk-management guidelines. This accessibility, therefore, enables retail customer accounts to seamlessly and in real-time replicate the deals and trading techniques of the most profitable customers. It should be remembered as copy trading does not ensure either profits or losses.

Residents of Delaware, Minnesota, New Hampshire, New York, Nevada, Puerto Rico, or Tennessee may set up an account but cannot trade. Customers from Hawaii, Guam, American Samoa, and the U.S. Virgin Islands are not permitted. All other states have certified the business, enabling citizens to create accounts and trade.

The platform is well-suited to people with a fundamental grasp of F.X. and crypto trading. The much-despised withdrawal cost has been removed for U.S. consumers, but there is still a $5 tax for consumers in other nations.

eToroX Features

- Primary platform features include: an easily operated brokerage and social trading platform, the opportunity to engage with some other traders, and the option to purchase money via PayPal

- Fees include a $5 withdrawal charge for non-US users, a $10 fee after a year of dormancy, and exchange fees for non-USD deposits.

- 18 coins are accepted.

- Security features include 2FA authentication, cold storage, USD balances FDIC-insured, multi-signature, vital personal capabilities, and KYC.

- Transaction options supported: buy, sell, exchange, and limit orders

- Maximum trade volume: $500,000

Coinbase Features

- Primary Coinbase account characteristics include beginner-friendly crypto exchange with an easy-to-use interface and the ability to withdraw cash to PayPal.

- Fees: 0.50 percent per transaction, 3.99 percent for credit card payments, 1.49 percent for Coinbase wallet fees or bank account purchases, and $10 for deposits and $25 for withdrawals for wire transfers.

- 51 coins are supported.

- Security features include two-factor authentication (2FA), fingerprint logins, KYC, FDIC-insured USD balances, cold storage, and AES-256 encryption for digital currencies wallet.

- Transaction types allowed include: buy, sell, transfer, receive, and conversion.

- Maximum trading funds: The maximum trading amount varies depending on your mode of payment and region.

eToro’s Pro and Cons

Pros

- There are no commissions on non-leveraged trading even though leverage involves significant risk.

- There are several methods to deposit monies, and there are no fees for investing U.S. dollars.

- PayPal may be used to purchase cryptocurrency (outside the U.S.)

Cons

- Uncertain, unpredictable fees due to a changeable spread

- A $50 least deposit is required for U.S. customers, while substantially greater guarantees are required for overseas residents.

- Customer service is unresponsive.

Coinbase Pro and Cons

Pros

- Intended for rookies

- Possibility of withdrawing payments to PayPal

- Intensive cryptocurrency selection

Cons

- A more expensive and convoluted fee structure

- Only Coinbase Pro allows for limited orders.

- No phone line client service

eToroX vs Coinbase Ease of Deposit and Withdrawal

Coinbase is available in over 100 countries and 49 U.S. states, and has a lot of active traders. On the other hand, eToroX is available in over 140 countries including EU countries and 43 U.S. states.

However, Coinbase is unavailable in Hawaii, and eToroX is unavailable in Delaware, Minnesota, New Hampshire, New York, Nevada, Hawaii, or Tennessee.

Both come with basic trading features and offer a digital wallet. Furthermore, Coinbase Pro and eToroX trading platforms provide sophisticated features for serious crypto investors.

You may deposit funds on Coinbase wallet using a credit card, debit card, ACH, or wire transfer. You can also make a crypto purchase or sell crypto from your Coinbase wallet any time of the day.

On the other hand, eToroX accepts the following payment method options:

- Credit and debit: USD, EUR, and AUD

- PayPal: GBP, EUR, and AUD.

- Neteller: USD, GBP, and EUR.

- Skrill: USD, GBP, and EUR.

- Bank Transfer: USD, GBP, and EUR

- iDeal: EUR

- Klarna/Swiss Bank: EUR

- Online banking in Malaysia: MYR, IDR, THB, PHP, and VND

Residents of the United States may only trade cryptocurrency on eToroX, while foreign crypto investors trade ETFs and equities also.

Residents of the United States may only trade cryptocurrency on eToro, while foreign traders can participate in exchange-traded funds (ETFs), products, and equities. The following are the top eToro features:

- Crypto CopyPortfolios: A preset investing plan is used in the asset management solution. To seamlessly reproduce the portfolio, customers must commit a minimum of $2,000 to $5,000, based on the portfolio.

- Copytrading: View real-time trades made by various investors, monitor, and copy traders with a $500 minimum deposit per trader you want to replicate.

- Demo account: Play using $100,000 in fictitious funds to simulate market exchange and see how you fare before committing real money.

A digital wallet is available on both platforms. For certified eToro platform users, eToro offers a hot eToro wallet. It allows over 120 coins and lets users save, receive, buy, rapidly transfer, or exchange over 500 different currency pairings. Unlike eToro, the Coinbase wallet is a stand-alone hot wallet that does not need a Coinbase profile to utilize. Coinbase makes it easy to store digital collectibles, including all ERC-20 tokens and BTC, BCH (Bitcoin Cash), ETH, ETC, and LTC.

Coinbase is a straightforward platform, and its functionality reflects this. Accounts on Coinbase include:

- The opportunity to earn cryptocurrency by viewing brief videos

- A coin watchlist with alerts via in-app or smartphone

- A crypto and business news stream

eToroX vs Coinbase Accepted Currencies

eToro has over 100 cryptocurrency trading pairs, while Coinbase has roughly 54, based on your region, and both platforms allow you to acquire currency fractions. Coinbase supports fiat money such as the U.S. dollar, the British pound, and the euro. In contrast, eToro funds may be withdrawn in USD, EUR, GBP, CAD, AUD, JPY, RMB, and RUB.

Both services provide mainstream currencies, but Coinbase has a more excellent selection of emerging alternatives. eToro is a multi-asset platform that allows you to trade 19 currencies, but you won’t be finding NEO, MIOTA, or TRX on Coinbase’s list of 51. Among the 19 eToro coins are:

| BTC | LTC | ADA | BNB |

| XRP | DASH | MIOTA | LINK |

| ETH | XLM | ZEC | UNI |

| BCH | NEO | TRX | DOGE |

| ETC | EOS | XTZ |

eToroX vs Coinbase Regulation & Security

| Security Measure | eToroX | Coinbase |

| 2FA authentication | Yes | Yes |

| Biometric security | Yes | Yes |

| Storage | Unspecified proportion of assets in cold storage | 98% of crypto assets in cold storage |

| Regulation | Gibraltar (FSC) | Regulated in 45 States in the USA |

| FDIC protection | up to $250 | up to $250 |

eToro Security Features

- 2-Factor authentication (two-factor authentication): eToro customers may activate two-factor authentication (2FA) through SMS.

- Fingerprint access (smartphones): eToro’s mobile app offers biometric authentication through fingerprint scanning.

- Cold storage: eToro claims that most of their bitcoin is held offline but does not specify the proportion.

- FDIC protection (up to $250K): eToro provides FDIC insurance on all USD funds up to $250K. This does not provide insurance for your bitcoin assets.

Coinbase Security Features

- Two-factor authentication: Coinbase goes a step farther than eToro in terms of login security, supporting 2FA through SMS as well as the Google Authenticator app.

- FDIC protection (up to $250K): Coinbase, like eToro, provides FDIC insurance on USD deposits up to $250,000.

- Cold storage and crypto vaults: Coinbase keeps 98 percent of its cryptocurrency assets offline in cold-storage vaults. This keeps assets off the internet and out of the hands of hackers and cybercriminals.

- Coinbase also provides a bitcoin vault, which needs clearance from numerous users before you can withdraw your assets.

- Coinbase includes an ERC-20 wallet that allows customers to move assets from the exchange to their account using an ERC-20 compliant wallet for Ethereum-based apps and decentralized crypto exchanges.

Both cryptocurrency exchanges offer mobile apps where you can directly sell and buy crypto. However, the main website of eToroX might be intimidating to rookies due to its complicated interface.

Users who join up for eToroX must provide evidence of identification in the form of an I.D. card and proof of residence, which may be as easy as a snapshot of a utility bill.

After that, you may add a payment option (bank details or credit/debit card) and begin buying and selling crypto. Coinbase has a similar simple sign-up procedure, but users must verify their identity with a picture I.D.

However, the entire customer experience on Coinbase is significantly easier than that of eToroX, making it straightforward and straightforward for institutional traders to buy, sell, or trade virtual cryptocurrency.

Coinbase does not provide complex trading or margin, which makes it more affordable to newcomers.

As eToroX allows users to withdraw crypto assets via the platform’s wallet, the wallet cannot be utilized on blockchain apps or exchanges. Coinbase’s ERC-20 wallet, on the other hand, maybe used with any Ethereum-built application.

eToroX vs Coinbase Payments & Minimum Deposits

Here is a quick overview of the fees on each trading platform:

| Platform Fees | eToroX | Coinbase |

| Deposit fee | 0% | 0% |

| Account fee | 0% | 0% |

| Inactivity fee | 0% | 0% |

| Bank transfer withdrawal fee | $5 | 1.49% |

| Debit/credit card withdrawal fee | $5 | 3.99% |

| Debit/credit card purchase fee | 1% | 3.99% |

| Platform Features | eToroX | Coinbase |

| Minimum deposit amount | $50 | $25 |

| Maximum trading amounts | $50,000 every transaction + $200k sending limit per day | Limits vary. Maximum $25,000 ACH transfers |

| Supported platforms | Browser, smartphone | Browser, smartphone |

| Supported crypto coins | 28 | 170 |

| Maximum trading accounts | 1 | 1 |

| Base account currencies | US dollars and 6 crypto coins | USD, GBP, EUR AUD, and crypto |

Fee schedules change between Coinbase and eToro. Users on Coinbase pay a spread of around 0.50 percent for bitcoin purchases and transactions, although the exact amount varies based on market swings. In addition to the spread, the network charges a Coinbase Cost, a flat fee, or a percentage depending on the form of payment. For example, a $100 purchase is subject to the spread cost and a payment-based charge. The Coinbase fee is $2.99 if you pay through ACH. However, if you pay with a credit card, you will be charged 3.99 percent of the purchase price.

Traders on eToro do not pay commissions, but they pay charges for a variable spread, which may range from 0.75 percent to 5.0 percent, depending on the currency and market. Other costs charged by eToro include a conversion fee for changing other fiat currencies to USD, a $10 dormancy fee for accounts with no activities for 12 months, and a $5 withdrawal fee for foreign clients. eToro, on the other hand, charges the spread just once when you acquire the asset, while Coinbase fees a space on each transaction.

Overall, the eToro platform has lower costs. For instance, if you use a credit card to purchase $100 of Bitcoin on eToro, you’ll pay a 0.75 percent spread against a 0.50 percent + 3.99 percent spread on Coinbase.

eToroX vs Coinbase Usability

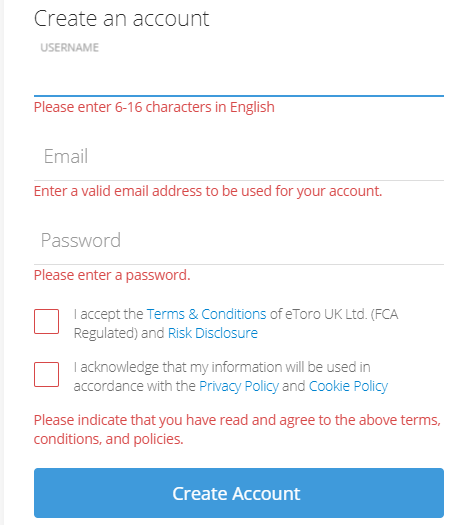

Whereas eToro made it easy to join up with an email, username, and passcode, the website is not ideal for novice crypto investors. eToro might be intimidating to rookies due to its many trading possibilities and its assets.

Users who join up for eToro must provide evidence of identification in the form of an I.D. card and proof of residence, which may be as easy as a snapshot of a utility bill. After that, you may add a payment option (bank details or credit/debit card) and begin buying and selling cryptocurrency.

Coinbase provides a similar simple sign-up procedure, but users must verify their identity with a picture I.D. However, the entire customer experience on Coinbase is significantly easier than that of eToro, making it straightforward and straightforward to buy, sell, or trade currencies. Coinbase does not provide complex trading or margin, which makes it more affordable to newcomers.

eToroX vs Coinbase Most Outstanding Features

As eToro allows users to withdraw cryptocurrency via the platform’s wallet, the wallet cannot be utilized on blockchain apps or exchanges. Coinbase’s ERC-20 wallet, on the other hand, may be used with any Ethereum-built application.

Direct crypto trading and crypto exchange

Coinbase makes it simple to swap one cryptocurrency for the other directly on its system, allowing customers to save money when selling one cryptocurrency to purchase another.

Access informative tutorials: Coinbase provides teaching videos on several supporting currencies, allowing newcomers to learn more about the currency. The website even offers additional crypto prizes when you complete a simple exam to demonstrate what you’ve learned.

How to Apply for an eToroX Account

Applying for an eToroX account is simple. However, you must fulfill the following requirements:

- Above 18 years of age

- Be a resident of a country where eToroX offers its services

- A working phone number

- A working email address

If you fulfill all these requirements, follow these steps: Head to eToroX’s website and click on the sign-up button.

- The next step is to verify your identity. Click on the verify button.

- eToroX will ask you a series of questions. Make sure to fill every detail as accurately as possible. Then, you will be asked to verify your phone number via an SMS code.

- Once your phone is verified, you will have to share proof of identity by uploading an image of your valid passport from both sides.

- The final step is to verify your address by sharing a proof of address. You can share copies of documents issued by government agencies, utility companies, or banks.

- However, they must contain the current address, date of issue, your name, the name of issuing authority, and a reference to the authority. Once your account is approved, you can start trading cryptocurrency assets.

How to Apply for a Coinbase Account

The process of applying for a Coinbase account is similar to eToroX. You must fulfill the following criteria:

- Possess a government photo ID

- A computer or smartphone with internet connectivity

- A working phone number

- A working browser or Coinbase app

If you fulfill all these requirements, follow these steps: Open the Coinbase website and create an account. It is recommended you either use the browser on a Windows or Mac PC or use the app on a smartphone.

- Before you can proceed, you will have to verify your email.

- After verifying your email, hop into your account and click on the verify button.

- This will lead you to the phone verification section, where you can verify your phone number by entering an SMS code.

- The final step is to add all your personal information as shown on the government issued picture ID. This includes your first name, last name, address, and date of birth. Enter all information accurately and correctly.

- Coinbase will also ask you for additional information such as your intentions of using Coinbase, source of funds, occupation, employer details, SSN, and more.

- Finally, you can upload an image of your government-issued photo ID and complete your identity verification process. Once completed, your Coinbase account will become fully functional and you can trade crypto right away.

eToroX vs Coinbase: Which is best for you?

Because of its straightforward interface and educational tools, Coinbase is an excellent location to begin investing in bitcoin. If you want to invest a small sum of money in the form of Bitcoin as a long-term investment, Coinbase makes it very simple. Buy your currencies, keep them on Coinbase, and track their long-term value. It is, however, a valuable option for you as you grow as a crypto trader.

The online trading platform of eToro is an enticing concept for crypto investors who want to emulate the conduct of experts who trade crypto. eToro offers a broader selection of cryptocurrencies for purchase and trading than certain U.S. brokers.

You may also enjoy social trading on eToro, but everyone, even non-experts, can share their thoughts because it is an open social network.

The conclusion is that Coinbase is better suited to novices, while eToro is better suited to more knowledgeable traders looking for a more robust trading experience.

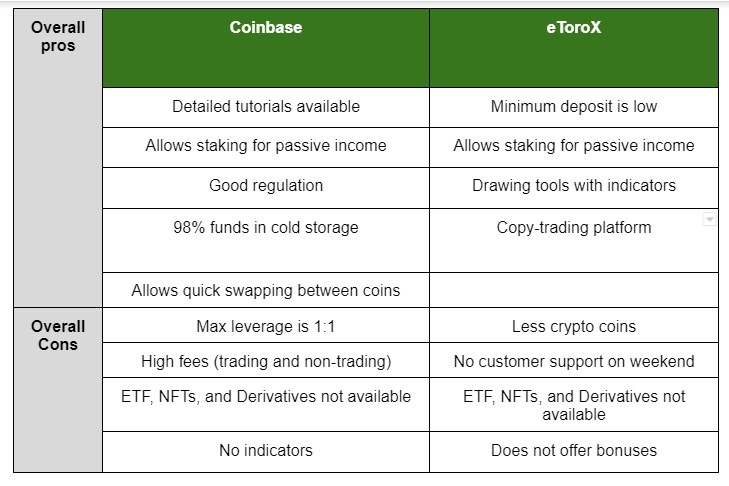

Conclusion

When comparing eToroX vs Coinbase, both of these are reliable cryptocurrency exchanges. They will, however, look best in various ways and appeal to every kind of investor.

Coinbase might take the lead due to its efficient user-interface and in-depth guides. Coinbase focuses heavily on beginner traders and allows them to get started very easily. However, it does not offer detailed indicators and drawing tools unlike eToro.

Nevertheless, it is a large crypto exchange with a lot of liquidity and features more than 170 crypto tokens. This simply gives you a larger number of options.

On top of that, Coinbase also has a lower minimum deposit fee set at $25, while eToroX requires at least $50 worth of deposits.

However, despite the pros of Coinbase, eToroX also takes the lead in some aspects such as offering indicators and drawing tools. This helps you develop a strategy and assess the market risk before trading

They have platforms with more sophisticated capabilities (Coinbase Pro and eToroX). Additionally, they enable users to stake a limited number of coins. Staking is the process of earning benefits by tying up coins for a certain amount of time.

eToro social trading platform is most likely probably more suited for more educated traders who will benefit from its cheaper costs. It also has intriguing social trading capabilities such as copy trading, which allows customers to mimic the trades of top-performing traders. It offers a demo account where users may test trading methods without risking any money. Furthermore, non-US consumers may utilize the site to trade equities, compensating for the limited amount of cryptocurrencies available.

Although its costs are somewhat higher, Coinbase is an excellent choice for first-time crypto traders. It includes superior instructional materials and a highly user-friendly U.I. It will also provide a Coinbase Visa debit card in the United States to pay out cryptocurrency incentives. It supports broader virtual cryptocurrency, and the exchange’s interaction with the crypto wallet is more adaptable.