Cosmos Network developers have made significant moves with their crypto holdings, transferring 295.3 Bitcoin (BTC), valued at approximately $27.7 million, from funds raised during their 2017 Initial Coin Offering (ICO). This marks the first transfer of Bitcoin by the team in nearly two years, according to blockchain analyst Yu Jin.

Cosmos Network conducted its ICO in April 2017, raising about $17 million in contributions comprising 4,882.7 BTC and 246,891 Ethereum (ETH). Over the years, the value of these assets has surged exponentially.

Yu Jin noted that these recent sales and transfers likely stem from the funds raised during the ICO, where significant contributions in Bitcoin and Ethereum were received. Owing to the recent market bull run that saw BTC reach new highs, its holdings significantly increased in value.

According to Yu Jin’s analysis, the unsold portion of these holdings, combined with previously liquidated amounts, transformed the initial $17 million into a staggering $213.1 million.

Cosmos Bitcoin and Ethereum transactions in 2024

Since the 2017 ICO, Cosmos developers have transferred a total of 4,786 BTC and 229,703 ETH. Despite these recent transfers, they still retain 96.4 BTC and 17,188 ETH, currently valued at $67 million. The steep appreciation of BTC and ETH over the years has significantly amplified the value of the unsold assets.

The latest Bitcoin transfer adds to a series of high-value sales made by Cosmos developers this year. In October 2024, Interchain Foundation, the team behind Cosmos, sold 4,000 ETH for $9.5 million.

Between April and October 2024, the foundation sold a total of 15,100 ETH, valued at $37.09 million. These transactions have brought this year’s total sales to 21,600 ETH and 295.3 BTC, amounting to $78.67 million.

Like the broader crypto market, Cosmos’ native token (ATOM) is having a tough December, dropping 24% in the last 30 days. At press time, per CoinGecko data, ATOM is changing hands at $6.79, a 6.6% uptick from its values 24 hours ago.

Bitcoin price short-term struggle prompts investors to cash out on gains

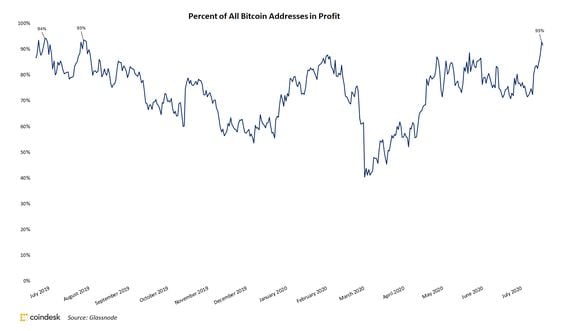

Bitcoin’s price is currently facing some struggles, decelerating downwards from a 6-day high of $99,000 to trading just above $93,000, according to recent updates from CoinGecko. The recent price consolidation phase could have prompted whales like Cosmos to sell, which may increase the selling pressure even further.

Bitcoin remained above the $92,000 mark last Friday, offering some relief to the market over the weekend. However, the $100,000 level continues to present a significant challenge for buyers.

The crypto remapped its support near $93,000 today, climbing briefly to $96,000 before facing rejection. It has since retreated to the $93,500 level, shedding at least $1,000 in value.

While bullish interest persists, momentum remains limited. If bulls regain control, Bitcoin could attempt another rally past $100,000. Sustained gains above this level may bolster the ongoing bullish trend within its ascending channel, though it risks entering overbought territory.

Conversely, a breakdown from this channel could lead to a sharper decline in the coming days, potentially testing six-week lows before any meaningful recovery.

Land a High-Paying Web3 Job in 90 Days: The Ultimate Roadmap