Ethereum price analysis shows rising signs as the market shows massive upside potential. The bulls have regained their control of the Ethereum market, which will change the course of the market for the better, and ETH now expects the bullish period to take over in the next few days. However, the bears will do everything they can to regain control. As a result, the ETH price has experienced extremely increasing dynamics in the last few hours.

The market shows the price of Ethereum crashed yesterday to the $1,207 mark but spiked soon after to the $12.70 level. Ethereum continues a positive movement as the prices spiked and reached $1,272. ; ETH has been up 5.08% in the last 24 hours with a trading volume of $155.55 Billion and a live market cap of $8.059 million.

Ethereum price action on a 1-day price chart: Bulls continue to push prices higher

The 1-day price chart for Ethereum price analysis shows the coin price has increased significantly today as it is trading at $1,272 at the time of writing. Ethereum has formed a short-term upwards trendline, which is currently providing strong support near the $1,206 level. The price may bounce back from this support level in case of any bearish pressure. The bulls are currently aiming for a breakout above the $1,272 resistance level. The 24-hour market for Ethereum suggests that the buying sentiment is quite strong in the market as the buyer’s volume is currently above the seller’s volume.

The ETH/USD price appears to be crossing over the Moving Average curve, displaying bullish momentum. However, the support and resistance are opening up, indicating increasing volatility with massive chances of maintaining a positive trend. Hence, the price moves upwards towards increasing characteristics.

The MACD indicator is currently in the bullish zone, and the signal line is also gaining ground above the MACD line. This suggests that the buying sentiment is likely to continue in the market in the near term. The RSI indicator for Ethereum is currently trading at 41.27, which suggests that the prices are neither overbought nor oversold in the market at the moment. The ETH/USD price appears to be crossing over the Moving Average curve as the prices are trading well above the MA50 and MA200 curves.

Ethereum price analysis: Bulls regain stability as price levels up to $1,272

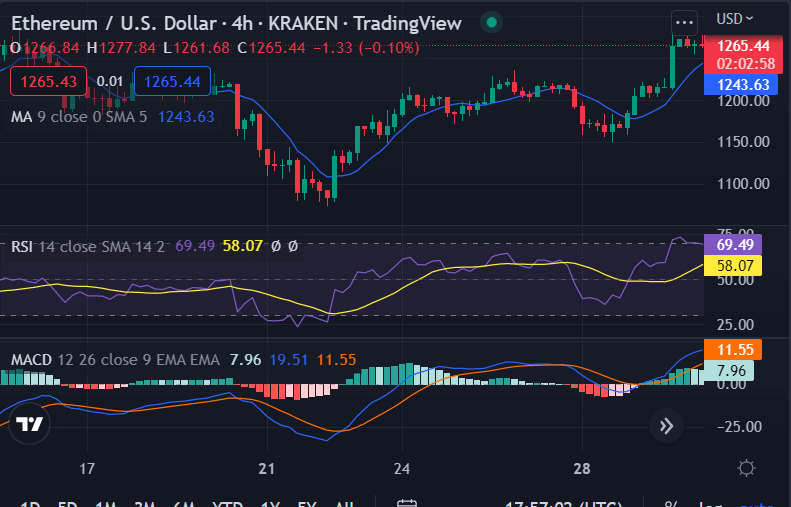

The 4-hour Ethereum price analysis favors cryptocurrency buyers as a strong rise in ETH/USD value was detected in the past few hours. The bulls have been dedicated to rewin their leading position in the market, and so far, their progress has been fascinating. The price experienced a rise to $1,272 in the last four hours because of the upturn. At the same time, the price crossed its moving average value, i.e., $1,243, due to the upside.

The Relative Strength Index (RSI) score appears to be 58.07, showing the cryptocurrency’s stability. However, the RSI score follows an upward movement signifying an expanding market and gestures toward increasing dynamics. The increasing RSI score indicates buying activity exceeds the selling activity. The MACD indicator shows a positive sign with its blue curve crossing above the red curve, indicating growing buying power for Ethereum.

Ethereum price analysis conclusion

To sum up, the Ethereum price analysis shows bullish momentum and further bullish opportunities. Moreover, the bulls have shown their deterrence and might take control of the market soon for the long term as the market shows massive signs of any change. Therefore, according to this analysis, Ethereum is expected to have a promising future, with the bulls taking the bears completely out of the picture.

While waiting for Ethereum to move further, see our Price Predictions on XDC, Cardano, and Curve.

Disclaimer. The information provided is not trading advice. Cryptopolitan.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.