Published: January 9, 2025

Welcome to BitlyFool.com’s weekly update on the cryptocurrency mining industry. This week, we delve into the latest statistics, profitability metrics, and the top-performing mining hardware in the market.

Current Mining Landscape

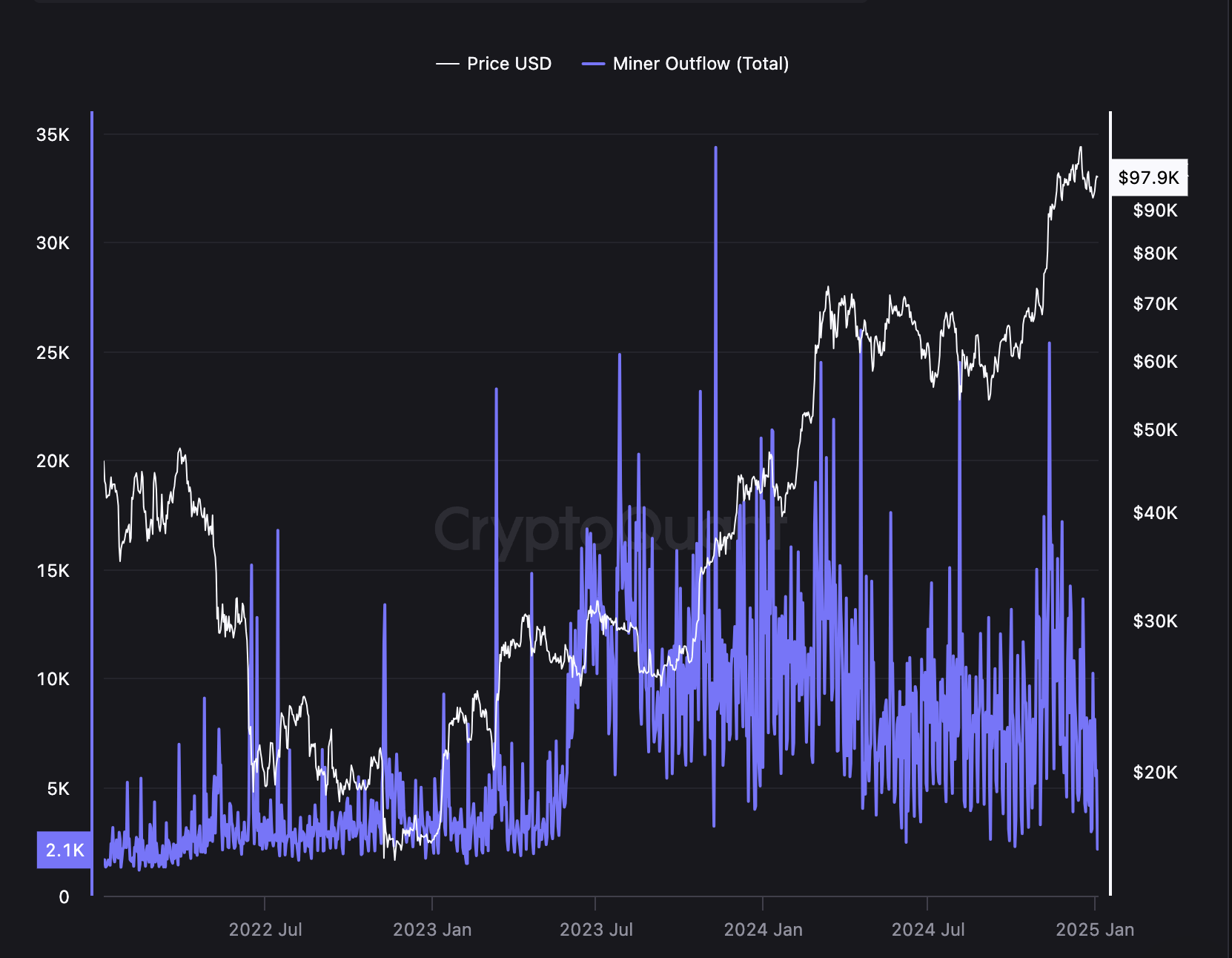

- Bitcoin Mining Revenue: As of January 8, 2025, Bitcoin miners’ daily revenue stands at approximately $38.73 million, reflecting a 10.76% decrease from the previous day and a 21.81% decline compared to the same period last year.

- Average Mining Costs: The average cost to mine one Bitcoin is estimated at $89,973, with Bitcoin’s market price around $92,959, indicating a narrow profit margin for miners.

- Global Hashrate Distribution: The United States continues to lead in Bitcoin mining, contributing a significant portion of the global hashrate.

Top 5 Mining Hardware Units and Their Daily Profits

Here are the top five mining machines currently leading the market in terms of profitability:

Bitmain Antminer S19 XP Hydro

Hashrate: 255 TH/s

Power Consumption: 5304W

Estimated Daily Profit: Approximately $50–$70, depending on electricity costs and network difficulty.

Whatsminer M63 Hydro

Hashrate: 366 TH/s

Power Consumption: 7283W

Estimated Daily Profit: Approximately $60–$80, influenced by operational expenses and market conditions.

Bitmain Antminer S19k Pro

Hashrate: 120 TH/s

Power Consumption: 2760W

Estimated Daily Profit: Approximately $25–$35, subject to fluctuations in Bitcoin’s price and mining difficulty.

WhatsMiner M60S

Hashrate: 180 TH/s

Power Consumption: 3441W

Estimated Daily Profit: Approximately $35–$45, varying with energy costs and network parameters.

Canaan Avalon Made A1366

Hashrate: 130 TH/s

Power Consumption: 3250W

Estimated Daily Profit: Approximately $30–$40, depending on current market dynamics and operational expenses.

Note: Profit estimates are based on current market conditions, including Bitcoin’s price, network difficulty, and average electricity costs. Actual profits may vary.

Altcoin Mining Insights

Altcoin mining remains a viable option for diversifying mining operations. Here are some of the top altcoins to consider:

- Litecoin (LTC): With the recent halving event, Litecoin’s mining rewards have decreased, but its strong market presence continues to offer opportunities for miners.

- Monero (XMR): Known for its privacy features, Monero remains a popular choice for CPU and GPU miners.

- Ravencoin (RVN): Designed for asset transfers, Ravencoin offers mining opportunities with relatively lower difficulty levels.

HashDeploy.net: Your Partner in Mining Success

To maximize your mining potential, consider partnering with HashDeploy.net. They offer:

- Comprehensive Hardware Selection: Access to the latest and most efficient mining rigs.

- Expert Support: Guidance on setup, optimization, and scaling of your mining operations.

- Competitive Pricing: Affordable solutions tailored to both novice and experienced miners.

Visit https://hashdeploy.net today to enhance your mining endeavors.

Stay Informed

The cryptocurrency mining landscape is dynamic, with profitability influenced by various factors, including hardware efficiency, energy costs, and market volatility. Staying informed and adapting to changes is crucial for sustained success in this industry.

For more detailed analyses and updates, continue following BitlyFool.com.