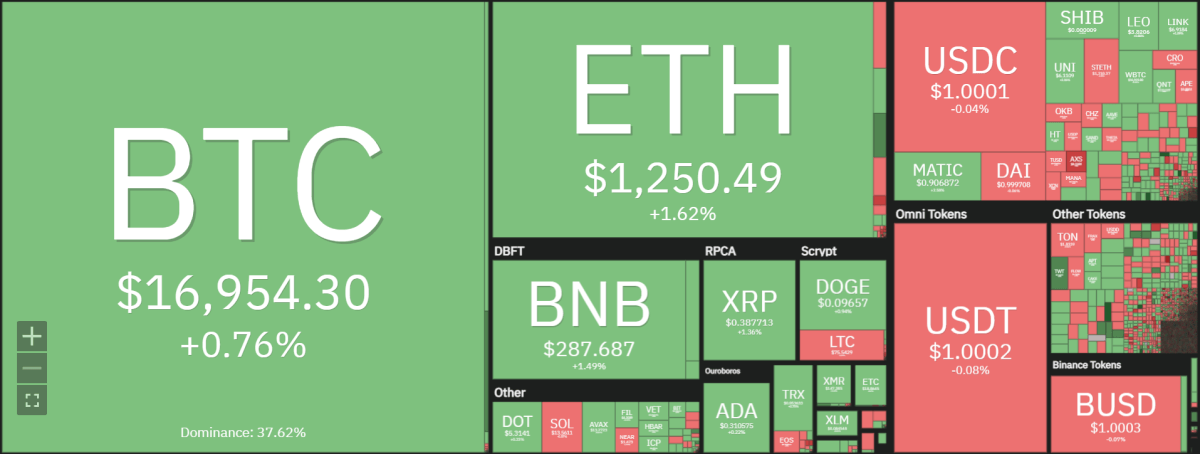

Recent Bitcoin price analysis indicates the top coin continues to trade in a narrow range between $16,788.78 and $16,935.37, with potential upside resistance at $17,618.72, and potential downside support at $14,893.55.There was a short-lived bull run during November’s closure whereby Bitcoin actually reached a high of $17,364.28 and it was subsequently followed by a selloff that saw the coin drop to lower levels.

With BTC currently hovering around $17,000, many analysts believe that the coin might have reached the bottom and a potential break-out upside could be around the corner. Some of Bitcoin’s market analysts have looked at past price patterns and believe that Bitcoin will do well in the next halving event. They are saying that the value could go up over 100 times, with a possibility of it reaching $100,000 or more by 2024 springtime.

The next time the block reward is halved is set for block 840K. This should take place sometime in spring 2024 and will see the current per-block prize of 6.25 BTC fall to 3.125 BTC. This event could have a large effect on Bitcoin’s value.

As we can observe from historical data, Bitcoin’s spot price has increased more than 1263% between 2016 and 2020 halvings. With this rate of growth, many market analysts are predicting that Bitcoin could reach levels well above $100k by the spring of 2024.

Bitcoin price analysis: Bitcoin stagnates again, but a bullish breakout could be near

Although Bitcoin remains dormant for the most part, many believe that this is just a temporary phase and that BTC will soon begin to show some signs of life. There are several support levels in the range between $16,000-15,500 that could act as potential triggers for an upcoming uptrend.

The Fibonacci retracement line is another indicator that suggests a possible bullish breakout. According to this line, BTC could reach levels of $17,500 or even higher in the coming weeks. This confluence of technical indicators could be enough to convince more investors to enter the market and enable Bitcoin to reach new highs.

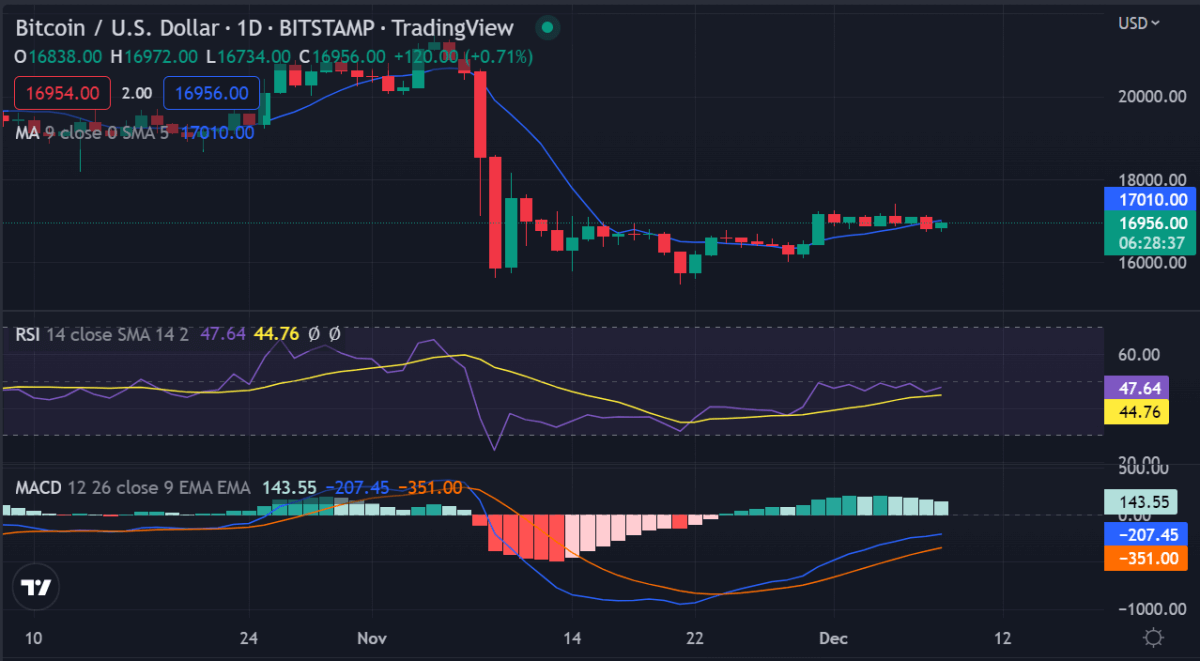

Looking at the moving averages, we can see that the 100-day MA is starting to turn bullish, which could indicate that a large price rally might be on the cards. The 200-day MA is also on a bullish trajectory, which means that momentum could be shifting from the bears to the bulls. The immediate support level for BTC is set at $16,500 and the immediate resistance level is set at $17,500.

Bitcoin price analysis on a 4-hour chart: Bulls hold the edge

Bitcoin price analysis on a 4-hour timeframe shows Bitcoin has traded at around $16,900 and the bulls have been able to push the prices up to $16,943.91 where it is trading at. It has been unable to break above the key resistance at $17,600 as it trades in this volatile range of $16,700-17,500.

The 4-hour MACD is slightly bullish with a positive crossover between the signal line and the MACD line. The Bollinger bands are narrow which indicates that volatility could be expected soon. The RSI is pointing downwards indicating a possible bearish breakout. Given the current level of bull momentum, there are strong chances for Bitcoin to break out upwards and reach levels near $17,000 or even higher in the next few hours.

Bitcoin price analysis conclusion

Bitcoin price analysis shows that Bitcoin has remained dormant in recent days, hovering around $17,000. However, analysts believe that a bullish breakout could be near, fueled by technical indicators like the Fibonacci retracement line and moving averages. If Bitcoin manages to break out of its current range, it could rally to highs of $17,500 or even higher in the coming weeks. However, if the bears regain control of the market and push prices below $16,000, we could see another dip in value.

While waiting for Bitcoin to move further, see our Price Predictions on XDC, Cardano, and Curve.