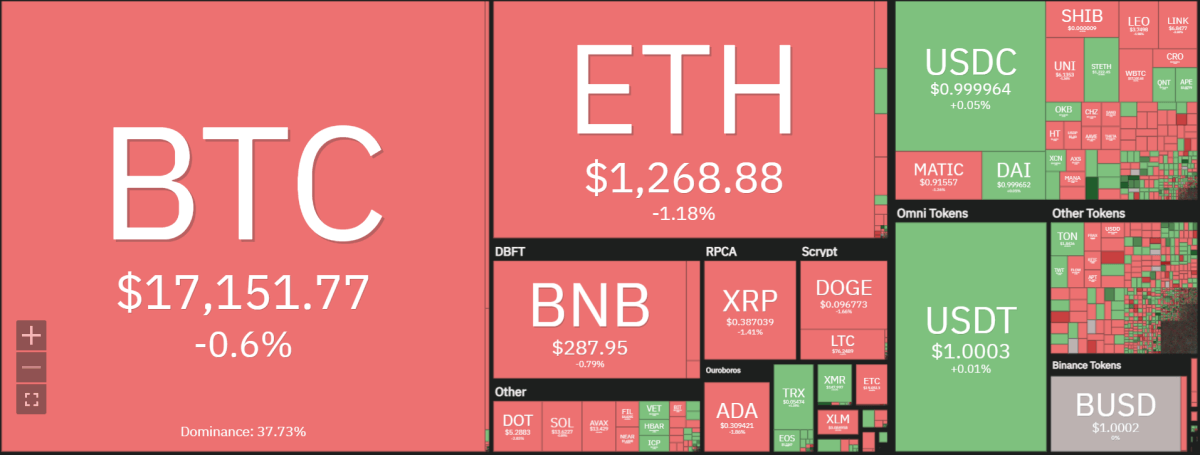

Bitcoin price analysis reveals BTC has moved past the $17,000 level after a period of consolidation below the previous key resistance level. The BTC/USD pair is struggling to maintain the $17,000 level and is oscillating near the $17,100 region with a downward bias. The upward movement from the $16,800 level is not confident and it seems the bulls are faltering.

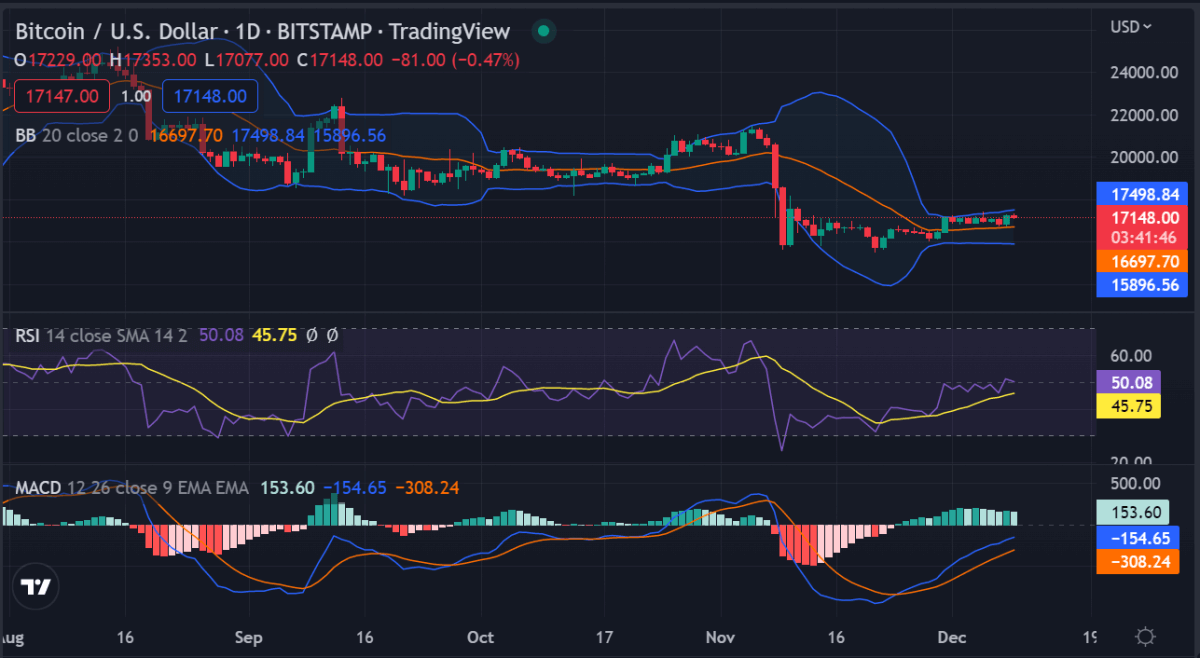

The Bollinger bands on the daily timeframe chart are not showing any major upward movement. On the contrary, the region near $18,000 is raising concern regarding the contraction in the Bollinger Bands. In such a scenario, the Bollinger Bands will likely cause the price to trade in a thin range. Bitcoin is trading at $17,154.38 after a period of sideways trading in the last 24 hours.

Bitcoin price analysis on a daily chart: Volumes required for a directional move

Bitcoin price analysis on a daily chart reveals a sustainable trend is yet to form on the hourly charts. The daily charts are showing a slight bias upwards but the same needs to be established as the day comes to a close. The high trading volumes along with a decent upshot can turn the tables for the bulls. The recent sideways phase must end on the daily charts for the BTC/USD to move beyond $20,000.

The next bullish targets are $21,000 and then $25,000 where the pair is bound to meet stiff resistance. The journey, however, is not going to be smooth as the pair is moving towards the middle of the Bollinger Bands near the $19,800 range on the hourly timeframe as per Bitcoin price analysis. The pair has successfully made it beyond the 50-day moving average and seeks to cross the 200-day moving average which is showing a slight bent downward.

BTC/USD 4-hour price chart: Technical indicators forecast a range-bound movement

Bitcoin price analysis shows the technical indicators such as the Ichimoku cloud shows a slight retracement before the pair can chart its further course higher. The last attempt to move above the Ichimoku cloud only led to the pair falling near $19,000. So, the bulls must maintain both momentum and the volumes required to cross the resistance at $18,000.

The technical indicators are reflecting the current choppy price action, with both the RSI and MACD indicators still hovering near neutral territory. Nevertheless, given that Bitcoin has been trading sideways for three consecutive days, we could be facing a period of consolidation before either bull or bear takes control.

So far, it looks like bulls are likely to regain control in the short term, as the relative strength index (RSI) is still trending higher and may indicate a further rally in Bitcoin prices. However, if the bears manage to break below the $16,000 support level, we could see a pullback toward $15,000 or lower.

Bitcoin price analysis conclusion

Bitcoin price analysis on the daily timeframe shows that despite facing a slight pullback, the bulls seem to be gaining the upper hand in the short term. However, given that Bitcoin is currently trading at a key resistance level, we are likely to see a continuation of the current choppy price action.

While waiting for Bitcoin to move further, see our Price Predictions on XDC, Cardano, and Curve.