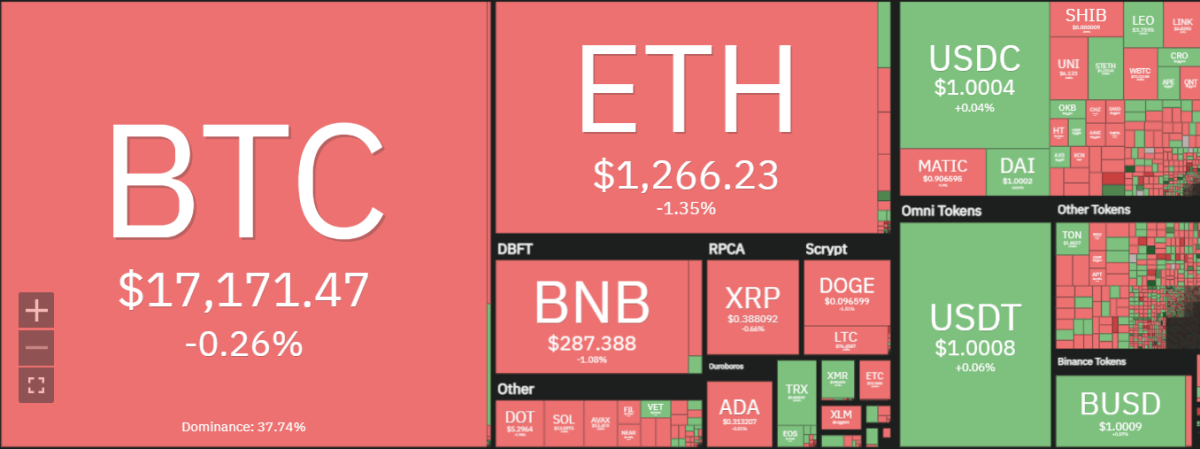

Polkadot price analysis reveals DOT is stuck in a bearish trendline and has been unable to break above $6.0 for the previous three weeks. Polkadot is trading at $5.29, down by $5.29, down by 1.92 percent in the last 24 hours. The price of Polkadot has remained negative over the past few hours. The previous day’s market was on a bullish trend and the price was looking like moving above the long-term level of $5.74, but due to some bearish pressure on the market, it dropped down from the $5.74 handle and is currently trading in a tight range of $5.27 to $5.41.

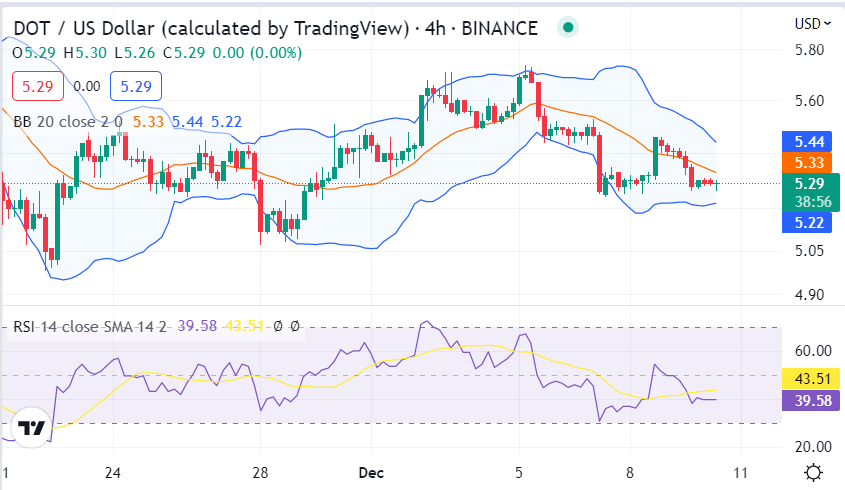

Polkadot price analysis on a 4-hour chart: DOT trades in a narrow range of $5.27 and $5.41

Polkadot price analysis on a 4-hour chart reveals DOT’s market volatility has been relatively low as the digital asset is trading in a narrow range. The prices seem to have stabilized around the $5.0 level after a period of trading sideways. Polkadot price analysis reveals the market’s volatility following a dormant movement. This means that the price of Polkadot is becoming resistant to undergoing variable change on either extreme. The upper limit of Bollinger’s band is present at $5.84, while the lower limit of Bollinger’s band is present at $5.51.

The DOT/USD price appears to be moving under the price of the Moving Average, signifying a bearish movement. The DOT/USD price appears to be moving toward the support, potentially reversing the movement soon if the price breaks the support.

The Relative Strength Index (RSI) is 42.49, showing a relatively stable cryptocurrency. This means that the cryptocurrency falls in the lower neutral region. Furthermore, the RSI appears to move downward, indicating a decreasing market. The dominance of selling activity causes a declining RSI score. The RSI indicates depreciating features that could potentially reverse the market dynamic if it falls too much. This can be considered an opening for the bulls if they capture this opportunity.

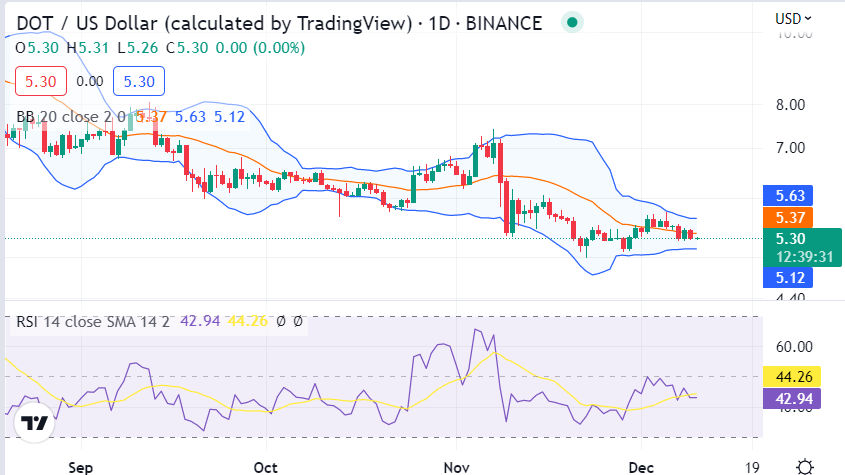

Polkadot price analysis on a daily chart:DOT prices remain dormant, Further declines to follow?

Polkadot price analysis on a daily chart reveals the bulls have been stumbling to neutralize the bearish market sentiment and have successfully held the $5.0 immediate support level for the last few days. Bears on the other side seem to be adamant about pushing the prices further downwards as there has not been intense selling pressure that could break the $5.0 key support level.

The market’s volatility follows a declining movement, which means that the price of Polkadot is becoming less prone to experience variable change on either extreme. The upper limit of Bollinger’s band is present at $7.21, while the lower limit of Bollinger’s band is present at $5.08.In addition, the Relative Strength Index (RSI) is currently at a score of less than 44.72, which indicates that the market is oversold and might see a reversal in price. The RSI seems to be moving downward, indicating a continuing negative movement.

Polkadot price analysis conclusion

To conclude, Polkadot price analysis indicates that the daily and hourly price predictions favor bears today, as the price has experienced a slight downfall in the last 24 hours. The long-term trending line is also moving in the descending direction now as the bears have been leading the price charts for a while now.