Core Scientific reportedly filed for Chapter 11 bankruptcy protection in Texas owing to falling revenue and BTC prices.

Just days after creditors offered to help Core Scientific — a Bitcoin (BTC) mining company — avoid possible bankruptcy, reports emerged confirming the business’ inevitable fate. Core Scientific reportedly filed for Chapter 11 bankruptcy protection in Texas owing to falling revenue and BTC prices.

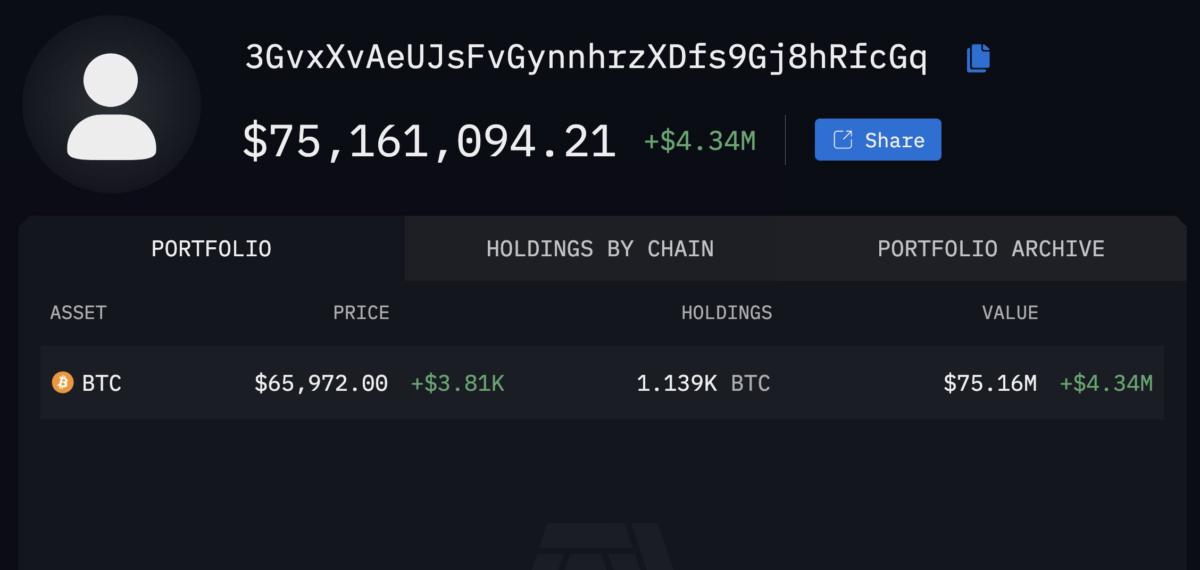

On Dec. 14, Financial services platform B. Riley offered to finance Core Scientific with $72 million — $42 million with zero contingencies and $32 million with conditions — to retain the value for stakeholders. The decision was made after Core’s valuation fell from $4.3 billion in July 2021 to $78 million at the time of reporting.

As a direct result of an extended bear market, Core Scientific had to sell 9,618 BTC in April to stay operational. A CNBC report citing a person familiar with the company’s finances said that the Bitcoin mining company would file for Chapter 11 bankruptcy on Dec. 21, 2022.

While the company continues to generate positive cashflows, the income does not suffice the operational costs, which involve repaying the lease for its Bitcoin mining equipment.

The report also suggests that Core Scientific will continue its mining operations and has no plans to liquidate. While creditors offered a lending hand, the company’s stocks momentarily surged nearly 200%, which has since seen a steady decline.

On Oct. 26, a Core Scientific filing with the United States Securities and Exchange Commission indicated financial distress. According to the company, the primary reasons for this situation were low Bitcoin prices, increased electricity costs, an increase in the global Bitcoin hash rate and a bankruptcy filed by crypto lender Celsius which wiped out the debts owed to Core Scientific.

Core Scientific has not yet responded to Cointelegraph's request for comment.

Related: Bitcoin miner Greenidge signs $74M debt restructuring agreement with NYDIG

Tech giant Microsoft recently restricted its cloud users from mining cryptocurrencies as a measure to increase the stability of its cloud services.

As Cointelegraph reported, Microsoft had updated its acceptable use policy on Dec. 1 to clarify that “mining cryptocurrency is prohibited without prior Microsoft approval.”

The company sufficed the move by stating its intent to protect customers by reducing risks of disrupting or impairing services in the Microsoft Cloud.