TL;DR Breakdown

- Chainlink price analysis suggests sideways movement below $6.00

- The closest support level lies at $5.89

- LINK faces resistance at the $6.00 mark

The Chainlink price analysis shows that the LINK price action has started to consolidate below the $6.00 mark as the markets observe low activity across the broader spectrum.

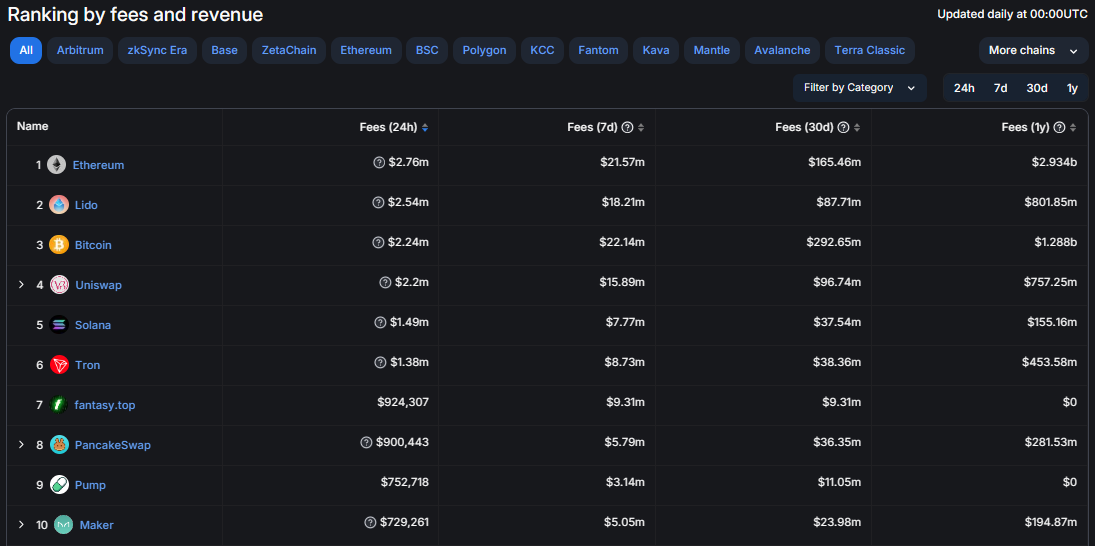

The broader cryptocurrency market observed a mixed market sentiment over the last 24 hours as most major cryptocurrencies recorded mixed price movements with low volatility. Major players include OKB and XCN, recording a 5.30 percent incline and a 5.89 percent decline, respectively.

Chainlink price analysis: LINK continues consolidation

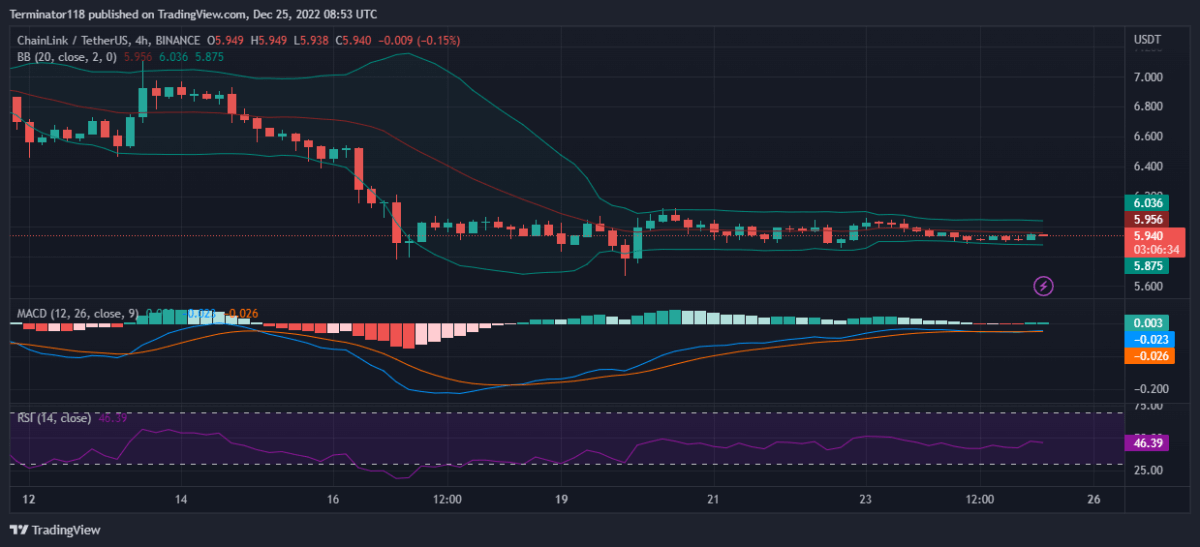

The MACD is currently bullish, as expressed in the green colour of the histogram. However, the indicator shows low bullish momentum as observed in the low height of the histogram. Moreover, the indicator’s lighter shade suggests that the bullish momentum is dwindling as the indicator points towards a bearish crossover. Overall, the indicator shows a lack of activity from either side of the market.

The EMAs are currently trading below the mean position as net price movement over the last ten days remains negative. However, the two EMAs are moving upwards suggesting a bullish activity in the markets. On the other hand, the two EMAs move close together showing little to no momentum towards either side across the short-term charts.

The RSI dipped briefly into the oversold region a few days ago but quickly resurfaced and continued to trade in the neutral zone till press time. Now, the index is trading at the 46.39 unit level with a slight downwards slope. The indicator does not issue a signal at the moment while the low slope suggests low bearish pressure across the markets.

The Bollinger Bands are currently very narrow as the price action observes little to no volatility. At press time, the indicator’s bottom line provides support at $5.875 while the upper limit presents a resistance level at the $6.036 mark.

Technical analyses for LINK/USDT

Overall, the 4-hour Chainlink price analysis issues a strong sell signal, with 12 of the 26 major technical indicators supporting the bears. On the other hand, only five of the indicators supports the bulls showing significant presence in recent hours. At the same time, nine indicators sit on the fence and support neither side of the market.

The 24-hour Chainlink price analysis shares this sentiment and also issues a sell signal with 16 indicators suggesting a downward movement against only two of the indicators suggesting an upwards movement. The analysis shows bearish dominance across the mid-term charts while little buying pressure exists for the asset across the same timeframe. Meanwhile, eight indicators remain neutral and do not issue any signals at press time

What to expect from Chainlink price analysis?

The Chainlink price analysis shows that strong bearish momentum enabled the bears to cause a price drop to the $6.00 mark. However, the bulls found support at the level that enabled them to stabilize the price action. Since then, the price action has not recorded much movement as either side of the market lacks momentum.

Traders should expect LINK to observe sideways movement between the $6.00 and the $5.80 mark as either side struggles to gain market control. While the mid-term analyses appear bearish, there is a shift across the short-term charts that favours the bulls. This suggests that the consolidation will likely end with a bearish breakdown toward the $5.50 mark.