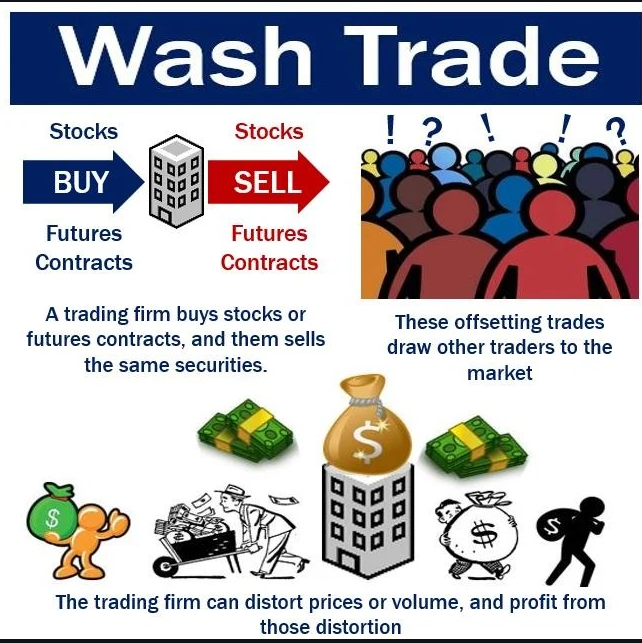

Wash trading is a form of market manipulation that has the potential to negatively affect the cryptocurrency markets. It is a form of market abuse whereby a trader simultaneously buys and sells a security to create misleading, artificial activity that can influence the market. Wash trading has become a growing concern in the cryptocurrency markets, as it can lead to market instability, price manipulation and liquidity issues. This article will discuss the effects of wash trading on the crypto markets, and the steps that can be taken to help prevent it.

The effects of wash trading on crypto markets are far-reaching and can have a significant impact on the market. Wash trading can create an artificial market, drive up asset prices and create false signals for traders. Wash trading can also create an unfair playing field for individual traders, as well as for legitimate cryptocurrency exchanges. It is important for traders to be aware of the potential impact of wash trading and to take steps to protect themselves from any ill-effects. Regulators should keep a close eye on the crypto markets and take action whenever wash trading is discovered.

What Have We Learned About Wash Trading From Recent Crypto Market Events?

Recent events in the crypto market have illuminated the prevalence of wash trading, a practice in which traders buy and sell a security to create the illusion of increased trading volume. This type of trading is illegal and can be used to manipulate the market by artificially inflating prices or providing false signals. Through investigations of crypto exchanges, it has been revealed that wash trading is common in the crypto market. In fact, research has suggested that more than 80% of all crypto trading volume is artificially inflated by wash trading. This has implications for investors, as well as for regulators who are attempting to crack down on market manipulation. Wash trading is difficult to detect, as it can be done in a variety of ways. Traders may use multiple accounts to buy and sell the same assets, or they may use algorithms to rapidly buy and sell the same assets in order to create the illusion of increased activity. Furthermore, it has become apparent that some exchanges have allowed wash trading to occur on their platforms. In some cases, exchanges have provided incentives for traders to engage in wash trading. In other cases, exchanges have been found to be complicit in the practice, actively participating in wash trading in order to increase trading volume and attract more investors. These events demonstrate the need for better regulation in the crypto market. Regulators must take steps to ensure that exchanges are held accountable for any wash trading that takes place on their platforms. Furthermore, exchanges must implement measures to detect and prevent wash trading. Only then will investors be able to trust that the crypto market is a fair and transparent marketplace.

Understanding the Legal Implications of Wash Trading in Crypto Markets

Wash trading is a form of market manipulation that involves a trader placing both buy and sell orders for the same asset, with the intention of creating a false impression of market activity. In the cryptocurrency market, wash trading is an illegal activity, as it is a deceptive practice. When wash trading takes place, the false impression of market activity can influence the price of an asset. For example, if a trader places a large buy order at a certain price, it could lead to an increase in the asset’s price. This increase in price could then be attractive to other traders, who may then buy the asset at a higher price. The same phenomenon can occur in reverse when the wash trader places a large sell order. The implications of wash trading in crypto markets can be serious. A trader who engages in this illegal practice could face legal action and possibly financial penalties, depending on the jurisdiction. Furthermore, wash trading can lead to market distortion, which can lead to losses for other traders. In addition, wash trading can lead to market mistrust and a lack of confidence in the crypto markets. If traders become aware of wash trading taking place, they may become hesitant to engage in the market, which can lead to decreased liquidity and an inefficient market. It is important to note that wash trading is not the same as arbitrage. Arbitrage involves taking advantage of price differences in different markets, while wash trading involves deceiving the market by placing both buy and sell orders for the same asset. In conclusion, wash trading is a form of market manipulation that is illegal in most jurisdictions. It can lead to market distortion and losses for other traders, and can also lead to a lack of confidence in the crypto markets. Therefore, it is important to be aware of the legal implications of wash trading in crypto markets.

How Wash Trading Impacts Crypto Market Volatility

Wash trading is a form of market manipulation that is common in the cryptocurrency markets. It involves the illicit trading of a security or commodity in order to create false and misleading appearances of market activity or price movement. By doing so, traders are able to artificially inflate the trading volume and market capitalization of a particular asset, creating an illusion of liquidity and market demand. This can then lead to increased volatility in the price of the asset as traders attempt to capitalize on the false market signals. The effects of wash trading on the crypto market are significant. By creating false appearances of liquidity, it artificially inflates the market capitalization of a given asset, which can lead to greater volatility in its price. This means that a single trader can have a large impact on the price of an asset, as they can manipulate its market capitalization and volume to create the illusion of demand. This increased volatility can have a negative effect on the market as a whole. By artificially inflating the prices of a given asset, it can create a false sense of security in the market, leading to increased speculation and investment in the asset, even though it may not be fully supported by underlying fundamentals. This can lead to a bubble-like situation, where prices rise beyond the assets true value and suddenly collapse when the market realizes its manipulated nature. Additionally, wash trading can lead to a lack of investor confidence in the market. By creating false market signals and artificially inflating prices, it can lead investors to believe that the market is not operating in a fair and transparent manner. This can lead to hesitation and reduced investment in the crypto markets as investors become wary of investing in an area that has been subject to manipulation. Overall, wash trading has a significant impact on the crypto market, leading to increased volatility, speculative bubbles, and reduced investor confidence. It is important that all market participants are aware of this form of manipulation so they can make informed decisions when investing in the crypto markets.

The Impact of Wash Trading on Market Liquidity in Crypto Markets

The cryptocurrency market is a relatively new and rapidly evolving financial asset, with many investors and traders looking to capitalize on its potential. As a result of this activity, the market has been subject to a number of fraudulent practices, including wash trading. Wash trading is a process where a trader simultaneously buys and sells the same asset. This is done to create the false impression of market activity and liquidity in order to manipulate the asset’s price. While this practice is illegal in many traditional markets, it is still common in the crypto markets. This has a negative effect on market liquidity, as the fake trading volume artificially inflates the total trading volume in the market. This can lead to inaccuracies in pricing and misallocation of capital, as traders may be trading based on false information. In addition to the negative effects on market liquidity, wash trading can also lead to unfair competition among market participants. By artificially inflating the trading volume, some traders can gain an advantage over others, as they can manipulate the price of an asset to their benefit. This can create an uneven playing field in the market, as some traders are able to benefit from unfair practices while others are not. Finally, wash trading can lead to an overall decline in market confidence. Once traders become aware of this practice, they may become less likely to participate in the market, as they may not trust the accuracy or fairness of the market prices. This can lead to a decrease in liquidity, as traders may be less willing to enter or exit positions. Overall, wash trading has a significant negative impact on market liquidity in the crypto markets. By creating false trading volume and an uneven playing field, wash trading can lead to inaccuracies in pricing and misallocation of capital. Additionally, it can lead to a decline in market confidence, making traders less likely to participate in the market. Therefore, it is important for regulators to take steps to prevent wash trading in order to ensure the fair and efficient functioning of the crypto markets.

How to Identify and Detect Wash Trading in Crypto Markets

Wash trading is a form of market manipulation in which traders buy and sell the same security at the same time and at the same price. This illegal activity artificially inflates trading volumes and can lead to distortions in pricing. In the cryptocurrency markets, wash trading is particularly problematic as the markets are still relatively immature and largely unregulated. To identify and detect wash trading in the crypto markets, it is important to understand the different indicators that can be used to identify potential signs of manipulation. One of the most common indicators is an unusually high trading volume relative to other exchanges. This could indicate that traders are attempting to inflate the price of a specific asset by engaging in wash trading. Another indicator to look for is a large number of trades occurring between two addresses or accounts with a similar trading pattern. If the trading pattern is overly consistent and there is a lack of diversity in the trading activity, it could indicate wash trading. It is also important to look for unusually large orders that could indicate wash trading. If a single order is larger than the average order size, this could be a sign of manipulation. Furthermore, if a large amount of orders occur within a short amount of time, this could also be a sign that a trader is attempting to artificially inflate the price of a particular asset. Finally, it is important to look for discrepancies in the market depth. A market depth discrepancy can occur when the total buy orders are far greater than the total sell orders, or vice versa. This could indicate that traders are attempting to push the price of a particular asset either up or down. By monitoring for these indicators, traders can more easily identify and detect potential wash trading in the crypto markets. It is also important to remember that wash trading is illegal and that any suspicious activity should be reported to the relevant authorities.