Avalanche price analysis continues to show a dominating bullish run in place, as price strengthened up to a high of $12.96 during the day’s trade. AVAX recorded a 4 percent rise from yesterday’s high of $12.56, with price settling at $12.68 at the time of writing. Bulls will be hoping to target the immediate resistance point at $12.85 and increase up to the December 2022 high of $13 in the current run. AVAX price has risen over 15 percent since the turn of the year, providing a timely uptrend as the cryptocurrency keeps the 18th rank in the crypto market with a market capitalisation of $3,954,552,538.

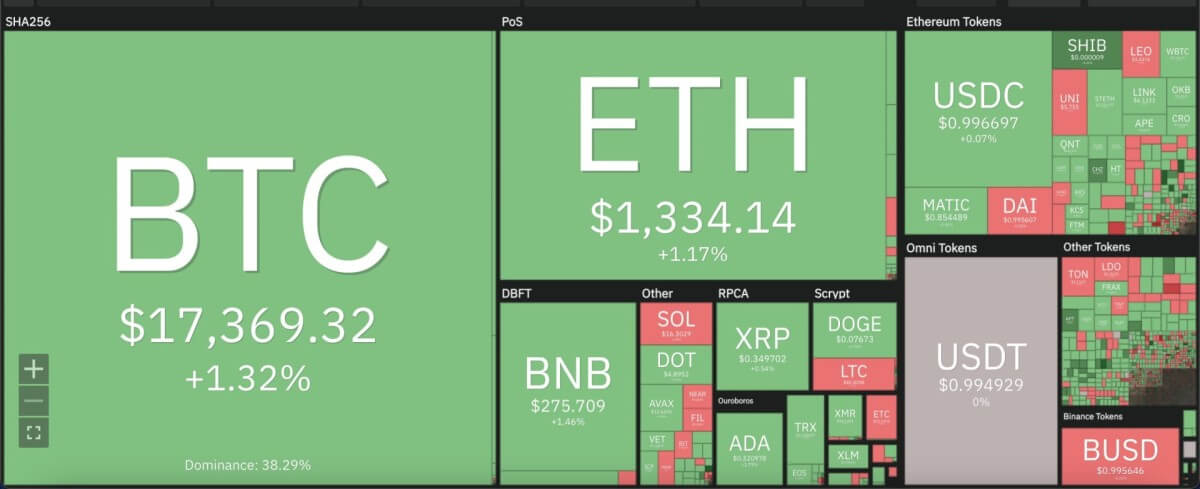

The larger cryptocurrency market continued to show greens initiated yesterday, as Bitcoin consolidated past the $17,000 mark while Ethereum extended up to $1,300. Meanwhile, among leading Altcoins, Ripple scored a minor increment to move up to $0.35, whereas Dogecoin rose 2 percent to stay put at $0.07. Cardano also rose 2 percent, moving up to $0.32, while Polkadot stayed at yesterday’s price level of $4.89.

Avalanche price analysis: Price clears moving averages on daily chart

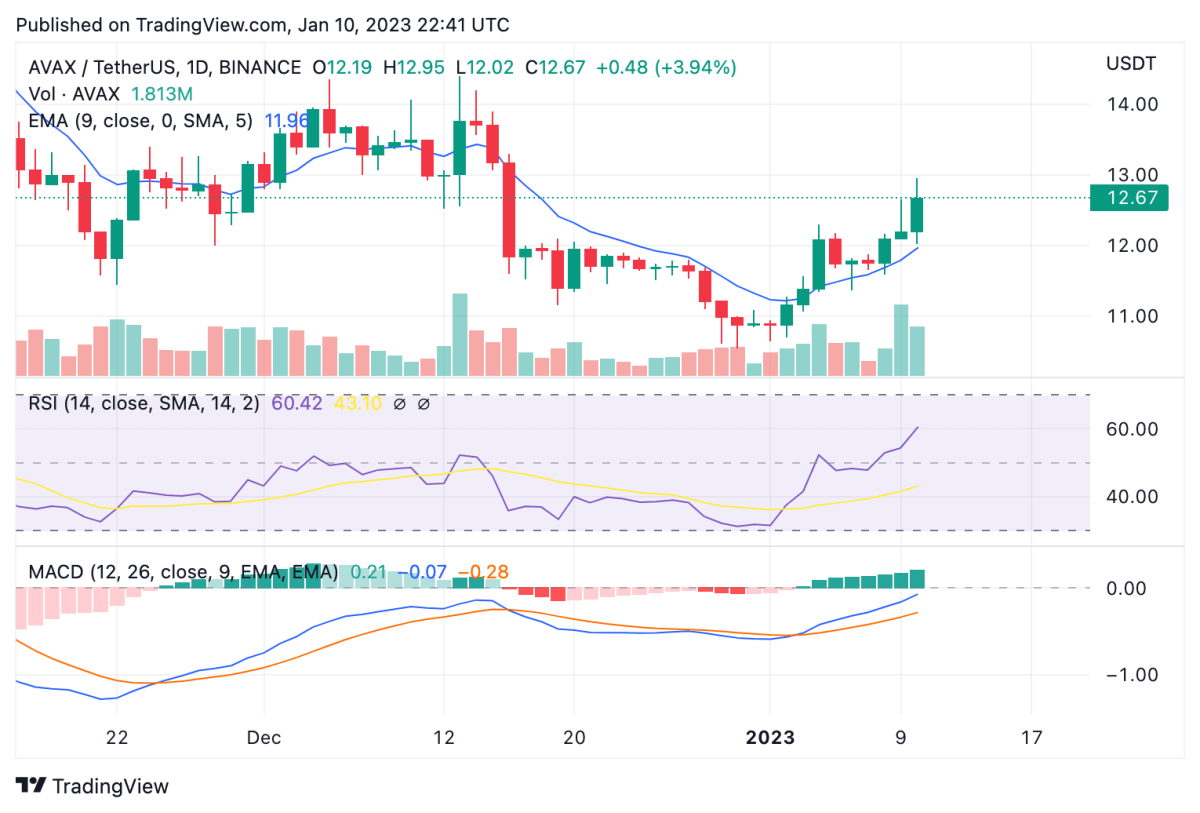

On the 24-hour candlestick chart for Avalanche price analysis, price can be seen trending on an incremental uptrend that has been in place since January 2. In the process, AVAX price has jumped more than 15 percent to reach the highest point since December 16. With the current bull run in place, price has also cleared well above the 9 and 21-day moving averages, along with the crucial 50-day exponential moving average (EMA) at $11.96.

The 24-hour relative strength index (RSI) can be seen extending upwards along with the price uptrend. The daily RSI has moved into the 60’s, which could be considered a risky zone for new investors as price could soon be headed for a correction with the RSI in an overbought zone. Meanwhile, the moving average convergence divergence (MACD) curve continues to show a bullish divergence above the trend line and the 24-hour trading volume for AVAX shows a 28 percent decline.

Disclaimer. The information provided is not trading advice. Cryptopolitan.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.