India’s central bank has reiterated its stance on banning cryptocurrencies like bitcoin and ether. The governor of the Reserve Bank of India (RBI) likened cryptocurrency trading to gambling. He warned that crypto “will undermine the authority of the RBI and lead to the dollarization of the economy.”

RBI’s Governor Wants Crypto Banned

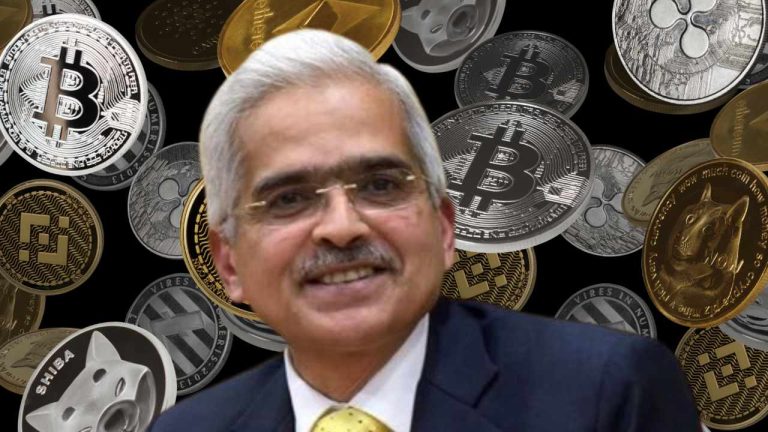

The governor of India’s central bank, the Reserve Bank of India (RBI), Shaktikanta Das, emphasized the bank’s stance on crypto at the Business Today Banking and Economy Summit Friday.

Das stressed that the central bank’s view is to completely ban cryptocurrencies like bitcoin and ether, India Today reported, quoting him as saying: “RBI’s position on crypto is very clear — it should be banned.”

Emphasizing that cryptocurrencies have no underlying value, the Indian central bank governor described:

Some people call cryptocurrency an asset, some call it a financial product, but every asset or financial product needs to have an underlying value. But cryptocurrency does not have any underlying value.

Das proceeded to express his opinion on the market prices of cryptocurrencies, stating that they are based on speculation alone. He likened cryptocurrency trading to gambling.

“Anything whose valuation is dependent entirely on make-believe is nothing but 100% speculation, or to put it bluntly, it is gambling,” the RBI chief stressed. “In our country, we don’t allow gambling. If you want to allow gambling, treat it as gambling and lay down the rules.”

Reiterating that he does not see crypto as a financial product, the central banker said:

Cryptocurrency masquerading as a financial product or a financial asset is a completely misplaced argument.

Das also warned about the risks crypto poses to the Indian economy. He cautioned:

The Reserve Bank, being the monetary authority of the country as the central bank, will lose control over the money supply in the economy … It will undermine the authority of the RBI and lead to the dollarisation of the economy.

RBI officials similarly warned in May last year that crypto could lead to the dollarization of a part of India’s economy “which will be against the country’s sovereign interest.”

India currently does not have a regulatory framework for cryptocurrencies. The government has been working on a crypto bill for several years. Indian Finance Minister Nirmala Sitharaman said in October last year that the government hopes to discuss crypto regulation with the G20 countries to establish a technology-driven regulatory framework for crypto assets.

What do you think about RBI Governor Shaktikanta Das’ statements? Let us know in the comments section below.