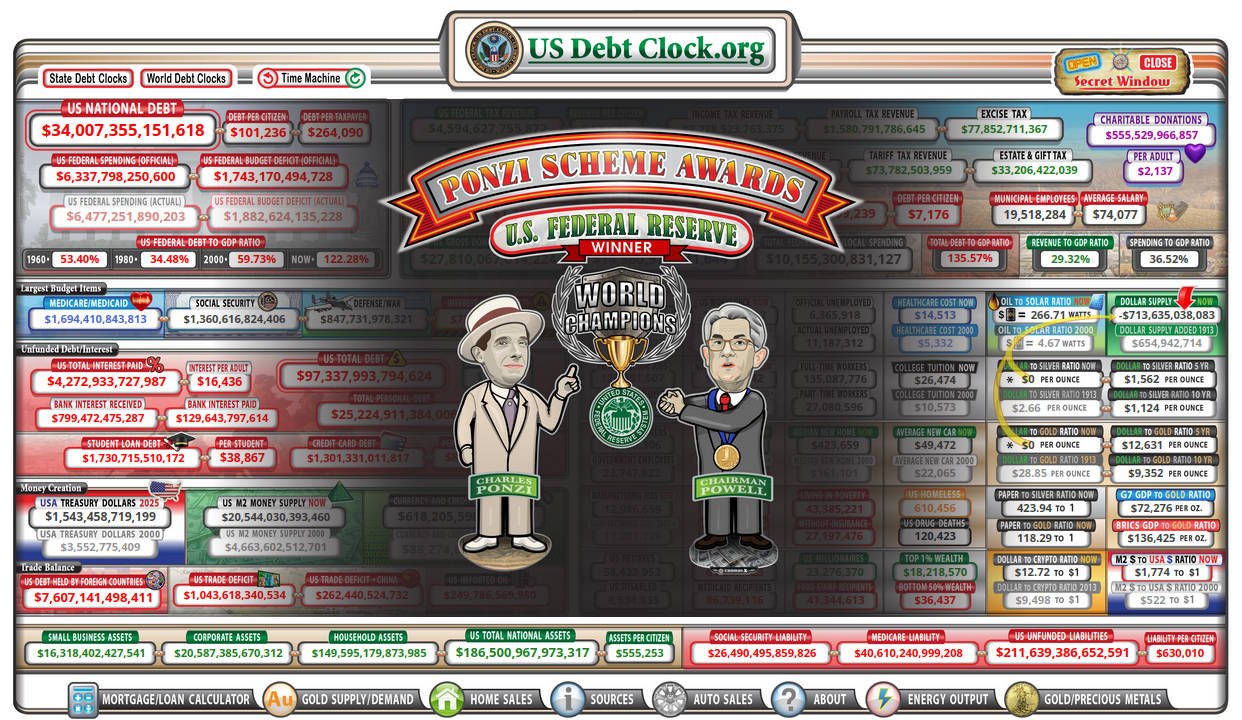

Will The Real Ponzi Scam Please Stand Up? Bitcoin Vs Central Banks. This article takes a look at the similarities between Bitcoin and Central Banks, and how each one could be perceived as a Ponzi scheme. We will explore how each system works, and how their similarities can provide insight into the world of cryptocurrencies. We will also discuss how these two monetary systems interact, and how their differences can be beneficial or detrimental to the global economy. Finally, we will explore the implications of the comparison between these two systems and what the future holds for both.

The History of Ponzi Schemes: From Charles Ponzi to Bitcoin

The concept of a “Ponzi scheme” is named after Charles Ponzi, an Italian immigrant who moved to the United States in

1. In 1920, Ponzi launched his infamous scheme, which promised investors a 50% return on their investment in just 90 days. In reality, Ponzi was using money from new investors to pay out dividends to earlier investors, and was not actually earning any returns.

The term “Ponzi scheme” is now used to describe any fraudulent investment scheme that promises investors high returns but is actually paying out returns to investors with funds from other investors. Ponzi schemes are illegal in the United States and they are seen as unethical and financially irresponsible.

Since Ponzi’s scheme, there have been many other high-profile Ponzi schemes and frauds. In the 1980s, the “Equity Funding Corporation” was exposed in the United States, which had been operating a multi-billion dollar Ponzi scheme that had fooled thousands of investors. In the 2000s, the “Bernie Madoff” scheme was revealed, which had attracted billions of dollars from investors before it was exposed.

In recent years, Ponzi schemes have become increasingly prevalent in the digital currency market. Bitcoin, the world’s most popular digital currency, has been used to facilitate a number of fraudulent Ponzi schemes. These schemes promise investors high returns but are ultimately designed to steal funds from unsuspecting victims.

Ponzi schemes have been around for almost a century and they remain a source of financial fraud. Investors should be aware of the potential risks associated with these schemes and should always do their due diligence when considering an investment. By being mindful of these schemes, investors can help to protect themselves from financial losses.

How to Spot a Ponzi Scheme and Avoid Being Scammed

Ponzi schemes are fraudulent investment operations that promise high rates of return with little risk to investors. Named after Charles Ponzi, who ran a famous scam in the 1920s, these schemes involve the use of funds from new investors to pay returns to existing investors. Unfortunately, many people fall victim to these types of scams, which can lead to devastating financial losses. There are several warning signs to look out for if you believe you may be dealing with a Ponzi scheme. First, be wary of any investment that promises unusually high returns with no risk. While it is possible to make a good return on an investment, it is highly unlikely that you will earn an abnormally large profit without taking on any risk. Second, be wary of investments that offer guaranteed returns. In a legitimate investment, you assume some risk and there is no guarantee that you will make money. Third, be wary of investments that require you to recruit other investors in order to receive a commission. This type of structure is common in Ponzi schemes and should be avoided. Fourth, be sure to research any investment you are considering and verify the credentials of the person offering it. Before investing, make sure that you understand the terms and conditions of the investment and that you are comfortable taking on any associated risks. Finally, be sure to seek advice from a trusted financial advisor before making any investment decisions. By following these steps and being aware of the warning signs, you can avoid becoming a victim of a Ponzi scheme and protect your money.

The Impact of Bitcoin on Central Banks: Is it a Threat or an Opportunity?

Central banks must contend with the emergence of Bitcoin, a decentralized digital currency, and its potential to disrupt the financial system. Bitcoin has the potential to challenge traditional banking practices and the authority of central banks. While there is a risk that Bitcoin could destabilize the economy, it also has the potential to bring new opportunities and efficiencies to the financial system. The decentralized nature of Bitcoin is one of its main advantages. Transactions are secured through a blockchain ledger, which is open and transparent. This eliminates the need for a central authority to oversee and manage transactions, making it much less vulnerable to fraud and manipulation. Furthermore, Bitcoin is not subject to the same regulations and restrictions as traditional currencies, allowing it to move freely across borders. The decentralized nature of Bitcoin presents a challenge to central banks. Central banks are responsible for regulating and managing the supply of money in an economy, and Bitcoin is outside of their control. This could create uncertainty and volatility in the markets. Additionally, the decentralization of money could weaken the power of central banks and challenge their role in the economy. At the same time, the emergence of Bitcoin presents an opportunity for central banks. The blockchain technology behind Bitcoin has the potential to revolutionize the way financial transactions are processed, allowing for more efficient and secure payment systems. Central banks can use this technology to create their own digital currencies, and explore ways to use them to improve the speed and efficiency of transactions. In conclusion, it is clear that the emergence of Bitcoin presents both a threat and an opportunity for central banks. While central banks must be cautious of the potential for disruption, they can also use the technology to create their own digital currencies and explore ways to use them to improve the efficiency and security of their financial systems.

A Guide to Understanding and Avoiding Bitcoin-Related Ponzi Schemes

Ponzi schemes have become one of the most dangerous scams in the modern world. In the cryptocurrency world, they are a particularly nasty form of fraud, often taking advantage of unsuspecting investors who are looking to make a quick buck. In this guide, we will take a look at Bitcoin-related Ponzi schemes, how they work, and how to avoid becoming a victim. A Bitcoin-related Ponzi scheme is a fraudulent investment program that promises high returns with little to no risk. The scheme typically works by luring investors in with promises of high returns, but in reality, these returns are generated through money from new investors, rather than from any legitimate business or investment activities. The most common way that a Bitcoin-related Ponzi scheme works is by offering an investment opportunity in which paying investors are promised high returns for their investment. This high return is usually offered on a short-term basis, and is often significantly higher than returns available from legitimate investment activities. Unfortunately, these scams are often difficult to spot. Many offer attractive websites and convincing stories, and some even offer legitimate-looking documentation. It is important to remember that if something looks too good to be true, it probably is. In addition to being wary of suspiciously high returns, it is important to do your research before investing in any cryptocurrency-related scheme. Check out the company’s website and social media accounts, as well as any articles written about them. Look for any red flags, such as lack of transparency or unverifiable claims. Finally, it is important to remember that there is no such thing as a guaranteed return on investment. All investments carry risk, and it is important to be aware of the risks associated with any investment opportunity. Bitcoin-related Ponzi schemes remain a serious threat to investors, but with a bit of caution and research, it is possible to avoid becoming a victim. By researching any potential investment opportunity thoroughly, being aware of the risks associated with any investment, and avoiding any promises of guaranteed returns, you can help protect yourself from falling victim to a Ponzi scheme.

How Central Banks Reacted to the Emergence of Bitcoin — A Comparative Analysis

The emergence of Bitcoin in 2009 has prompted a wide range of reactions from central banks around the world. While some central banks have taken a cautiously optimistic stance towards this new form of digital currency, others have been far more critical in their assessments. This paper will compare and contrast the reactions of different central banks to the emergence of Bitcoin. The Bank of England has taken a cautiously optimistic stance on the emergence of Bitcoin. The bank has noted that the technology underlying Bitcoin, known as blockchain, could have potential applications in the financial sector. However, it has also noted that the lack of regulation and oversight of the cryptocurrency could pose significant risks to the financial system. The Bank of England has also highlighted the need for further research and development in order to mitigate the risks associated with Bitcoin. The European Central Bank has adopted a more critical stance towards the emergence of Bitcoin. The bank has warned that the use of Bitcoin could lead to increased financial instability due to its lack of regulation and oversight. The ECB has also noted that Bitcoin transactions are not protected by the same consumer protection laws as traditional financial services and thus could leave users vulnerable to fraud and theft. Furthermore, the ECB has highlighted the potential for money laundering and terrorist financing through the use of Bitcoin. The Bank of Japan has taken a more neutral approach to the emergence of Bitcoin. The bank has noted that the cryptocurrency has the potential to offer users new forms of payment and financial services, but has also warned that the lack of regulation and oversight of the cryptocurrency could lead to increased financial instability. The Bank of Japan has also highlighted the need for further research and development in order to ensure that Bitcoin is used in a safe and responsible manner. In conclusion, the reactions of central banks to the emergence of Bitcoin have varied widely. While some banks have taken a cautiously optimistic stance towards the digital currency, others have been far more critical in their assessments. It is clear that further research and development is needed in order to ensure that Bitcoin is used in a safe and responsible manner.

The Will The Real Ponzi Scam Please Stand Up? Bitcoin Vs Central Banks comparison demonstrates that although Bitcoin and Central Banks have some similarities, the differences are more pronounced. Bitcoin is not a Ponzi scheme and is a decentralized and secure digital currency that eliminates the need for third-party intermediaries and provides users with a greater degree of privacy. Central Banks, on the other hand, are centralized institutions that have the ability to manipulate the economy through monetary policy and the issuance of currency. Ultimately, the comparison between Bitcoin and Central Banks reveals that Bitcoin is a unique and innovative technology that has the potential to revolutionize how we exchange and store value.