Dollar cost averaging with Bitcoin miner rigs is a great way for those interested in crypto-currency to obtain a steady stream of Bitcoin income without having to worry about the volatility of the crypto-currency market. By using a dollar cost average approach, you can purchase a miner rig at a set price and continue to buy more rigs over time as the price of Bitcoin fluctuates. By doing this, you will be able to take advantage of the upside potential of Bitcoin without being exposed to the large swings in the market. This strategy is especially useful for those who want to invest in Bitcoin mining but do not have the large capital investments required to purchase a large mining rig.

How Dollar Cost Averaging With Bitcoin Miner Rigs Can Reduce Risk and Maximize Returns

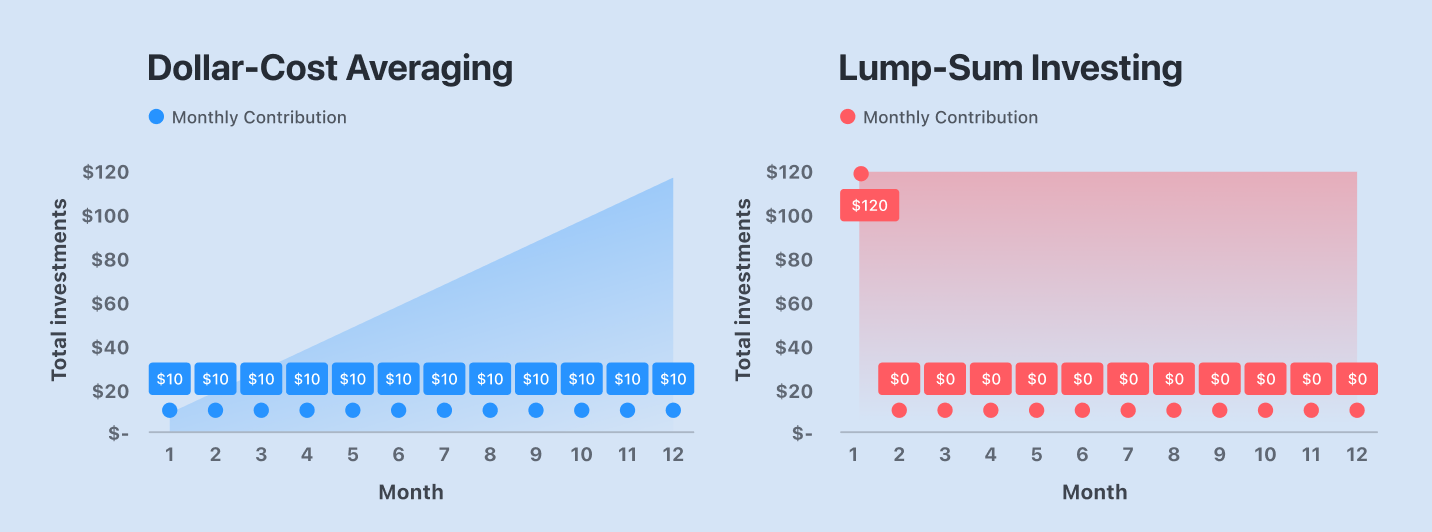

Using a dollar cost averaging approach with Bitcoin mining rigs is an effective way to reduce risk and maximize returns. Dollar cost averaging is an investment strategy which involves investing a fixed amount of money regularly over a period of time, regardless of the price of the asset. This strategy can help to reduce risk because it eliminates the need to predict the market and allows investors to gain exposure to the asset at multiple price points. The Bitcoin mining rigs are specialized computers that are designed to mine the cryptocurrency. By investing in a mining rig, investors can take part in the mining process and receive rewards in the form of newly mined Bitcoin. This eliminates the need to purchase Bitcoin on an exchange, which can be risky due to the volatility of the market. The dollar cost averaging approach can be applied to Bitcoin mining rigs as well. By investing a fixed amount of money into a mining rig over a period of time, investors can gain exposure to the asset at multiple price points, which can help to reduce risk. This approach can also help to maximize returns because it allows investors to take advantage of any dips in the market, which can result in increased rewards. In conclusion, using a dollar cost averaging approach with Bitcoin mining rigs can be an effective way to reduce risk and maximize returns. By investing a fixed amount of money regularly, investors can gain exposure to the asset at multiple price points and take advantage of any dips in the market. This strategy can help to reduce risk and maximize returns when investing in Bitcoin mining rigs. Please consider helping small business, hardware available at https://hashdeploy.net

Exploring the Pros and Cons of Dollar Cost Averaging With Bitcoin Miner Rigs

Dollar cost averaging (DCA) is a popular investment strategy that involves investing a fixed amount of money in an asset such as Bitcoin miner rigs on a regular basis over a period of time. This strategy can be beneficial for investors who are looking to limit the risk associated with sudden price changes, as well as those who want to avoid making large, one-time investments. While there are clear benefits to using this approach, it is important to understand the potential drawbacks before committing to it. The primary benefit of dollar cost averaging with Bitcoin miner rigs is that it enables investors to spread their investment across multiple periods, rather than investing a large sum of money at once. This means that the risk of a sudden price drop is lessened, as the investor is not exposed to a single large investment. Additionally, dollar cost averaging allows investors to time their investments in a way that can help them take advantage of any price fluctuations that may occur. However, there are some potential drawbacks to this strategy. For example, it can be difficult to determine an effective time frame for dollar cost averaging with Bitcoin miner rigs. This is because the price of Bitcoin is highly volatile and can change quickly. As a result, it can be difficult for an investor to accurately predict when the best time to purchase these rigs would be. Additionally, dollar cost averaging does not take into account any external factors that may affect the price of Bitcoin, such as political or economic events. Overall, dollar cost averaging with Bitcoin miner rigs can be a useful strategy for investors who want to limit their risk while taking advantage of potential price gains. However, it is important to understand the potential drawbacks before committing to this approach. By understanding the potential risks and rewards associated with this strategy, investors can make more informed decisions when investing in Bitcoin miner rigs.

Analyzing the Impact of Bitcoin Mining on Dollar Cost Averaging Strategies

As the cryptocurrency market continues to evolve, so does the process of mining for Bitcoin and other digital tokens. With the emergence of new technologies, miners have become increasingly efficient in their efforts to generate Bitcoin, thus giving rise to the concept of dollar cost averaging. This technique, which involves investing a fixed amount at regular intervals, is becoming popular among Bitcoin miners seeking to maximize their profits by equalizing their risk exposure over time. In order to understand the impact of Bitcoin mining on dollar cost averaging strategies, it is important to first distinguish between the two processes. Bitcoin mining is the process by which new Bitcoin is generated and released into circulation, whereas dollar cost averaging is a method of investing in which a fixed amount of money is allocated to various investments at regular intervals. Bitcoin mining can have a significant impact on dollar cost averaging strategies. For example, as miners become more efficient, they can purchase larger amounts of Bitcoin, which can cause prices to fluctuate. This can create a situation in which an investor’s dollar cost averaging strategy may become unbalanced due to the changing prices of Bitcoin. In addition, as miners become more efficient, they can generate more Bitcoin than is released into circulation, which can lead to an overall decrease in the price of Bitcoin. This may make dollar cost averaging strategies less profitable or even unprofitable depending on the circumstances. Furthermore, it is important to consider the impact of mining difficulty on dollar cost averaging strategies. The difficulty of mining Bitcoin is determined by the total number of miners competing for a given block reward. As the number of miners increases, the difficulty of mining Bitcoin also increases, making it more difficult for miners to generate a profit. This can lead to an overall decrease in the profitability of dollar cost averaging strategies. In conclusion, while dollar cost averaging strategies can be a great way to maximize profits and equalize risk exposure, it is important to consider the impact of Bitcoin mining on such strategies. As miners become more efficient, they can cause prices to fluctuate and difficulty levels to increase, which can make dollar cost averaging strategies less profitable or unprofitable. Therefore, it is important to understand the implications of Bitcoin mining before investing in order to ensure that one’s strategy is effective and profitable.

What You Need to Know Before Investing in Bitcoin Miner Rigs Through Dollar Cost Averaging

Investing in Bitcoin miner rigs through dollar cost averaging (DCA) is a popular strategy for investors looking to maximize their returns from Bitcoin mining. DCA is a strategy that involves buying a fixed amount of a particular asset at regular intervals over a period of time, regardless of its price. This approach is often used to reduce the risk associated with investing in volatile markets and to increase the likelihood of long-term success. Before investing in Bitcoin miner rigs through DCA, it is important to understand the risks and rewards associated with this strategy. First and foremost, risks include the possibility of the price of Bitcoin dropping and the difficulty of mining increasing. This could mean that the cost of mining could exceed the amount of Bitcoin that was mined, leading to a loss. Additionally, there are also the risks of malicious actors stealing miners, as well as the potential for hardware or software failure. On the other hand, there are also potential rewards associated with DCA for Bitcoin mining. First and foremost, long-term investors may be able to benefit from the appreciation of Bitcoin over time, as well as from the rewards associated with mining it. Additionally, with DCA, investors can benefit from the greater diversification of their portfolio, as well as from the reduced risk associated with investing in volatile markets. In conclusion, investing in Bitcoin miner rigs through DCA is a popular strategy for investors looking to maximize their returns from Bitcoin mining. Before investing, it is important to understand the risks and rewards associated with this strategy, as well as to ensure that the miner rigs are purchased from a reputable source. With proper research and due diligence, DCA may prove to be an effective strategy for Bitcoin mining investors.

Evaluating the Long-Term Benefits of Dollar Cost Averaging With Bitcoin Miner Rigs

Dollar cost averaging (DCA) is a strategy that involves investing a fixed sum of money at regular intervals over a period of time. This strategy is especially popular among long-term investors who are looking to reduce risk and diversify their portfolios. While DCA has traditionally been used to purchase stocks, bonds, and other traditional investments, it can also be applied to the purchase of Bitcoin miner rigs. When applied to Bitcoin miner rigs, DCA can provide a number of long-term benefits. First and foremost, it can help reduce risk by allowing investors to spread their investment over time, rather than investing all their money at once. By investing smaller amounts at regular intervals, investors can avoid the risk of buying at a high price and then seeing the value of the miner rigs drop significantly. Additionally, DCA can help investors take advantage of dips in the market. By investing small amounts over time, investors can take advantage of lower prices when they occur. This allows investors to purchase more miner rigs when prices are low, and less when prices are high. Over time, this can potentially lead to a higher return on investment. Finally, DCA can be beneficial for those who are looking to invest in a large number of miner rigs. By investing a fixed sum of money at regular intervals, investors can gradually accumulate a large number of miner rigs without having to make a large upfront investment. This can help reduce risk and make it easier for investors to enter the market. In summary, DCA can be a powerful tool for investors looking to purchase Bitcoin miner rigs. By investing a fixed sum of money at regular intervals, investors can reduce risk, take advantage of dips in the market, and accumulate a large number of miner rigs over time. All of these factors can help investors maximize their returns and benefit from the long-term advantages of owning Bitcoin miner rigs.

Dollar Cost Averaging with Bitcoin Miner Rigs is an effective way to increase your Bitcoin mining profits. By consistently investing a set amount of money into Bitcoin miner rigs over time, you can benefit from the long-term growth of the Bitcoin market. This strategy can reduce the risk of volatility and ensure that you’re always investing in the most profitable rigs. However, it’s important to remember that there is always risk involved in any form of investing, and you should always be aware of potential market fluctuations. Please consider helping small business, hardware available at https://hashdeploy.net