Uniswap price analysis reveals the coin is getting weaker against the US dollar as it trends downward. The coin broke below its important support level of $6.14 and is now trading at $6.34, down by 6.08% in the last 24 hours. The coin has been trading in a tight range of $6.14 – $6.78 for the last 24 hours, but the bears have taken charge and pushed it below the support level. The selling pressure is increasing which could push the coin further down.

The previous day’s closing price of UNI was $6.45 which was high compared to the current levels. The coin is likely to remain bearish in the coming days if it fails to break out of its tight range. The bullish momentum could pick up if it manages to break above the $6.78 resistance level, and a further push beyond the $7.00 mark is also possible if some positive news surfaces.

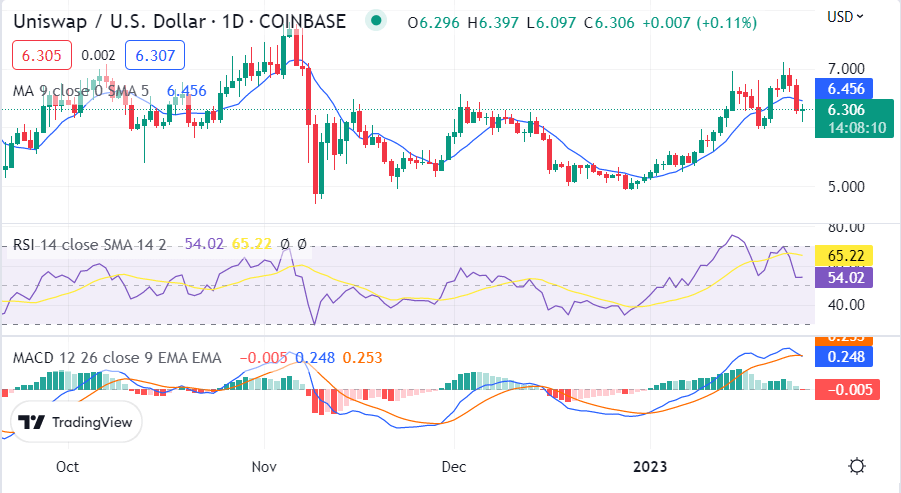

UNI/USD 1-day price chart: Bears are struggling to sideline bulls completely

The 1-day price chart for Uniswap price analysis shows the bears have hindered the upwards price movement and decreased the price up to $6.34. As the bearish pressure is comparatively high, bulls are unable to move any further in their endeavor. Currently, the coin is trading at $6.34 at the time of writing, still reporting a loss of around one percent during the last 24 hours and a two percent loss over the past 24 hours, which proves bearish supremacy in price trends. Along with the price, the trading volume has also slightly decreased today by 24.43 percent.

The technical indicator RSI is at 65.22, showing that the coin is neither oversold nor overbought which indicates it could move either way. The 50-day moving average is also situated at $6.45, further below the current price level, which suggests that the coin may remain bearish in the near future while the 200-day moving average is situated at $7.13 which could be a strong resistance level for bulls if they manage to break above the current levels. The MACD shows a bearish crossover as it is trending downwards, indicating that the current bearish momentum could continue in the coming days.

Uniswap price analysis: Recent developments and further technical indications

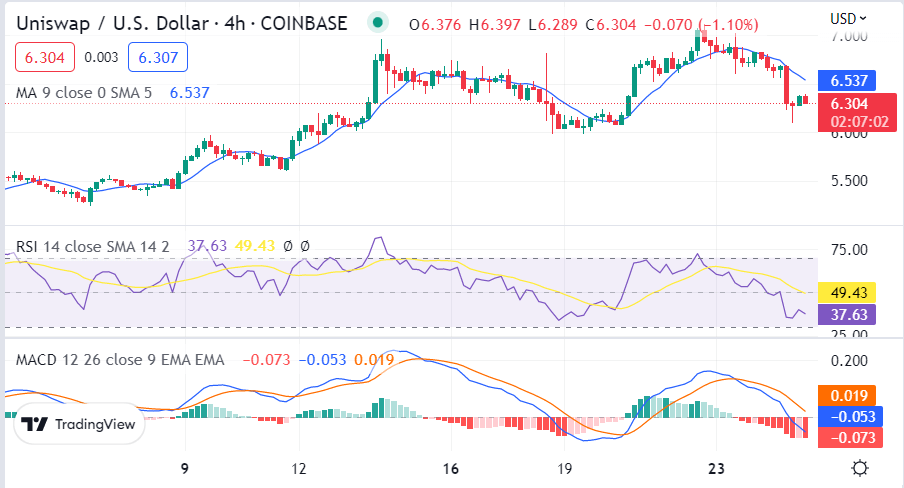

The 4-hour price chart for Uniswap price analysis shows the price breakup was upwards today, and the bulls uplifted the price slowly during the first four hours. But the price function came under bearish pressure after that bears have almost sidelined the bulls and may completely outplay them if no support arises for the bulls. The price may also step below the psychological mark of $6.14 if the selling pressure persists.

The moving average is situated at $6.53 which is above the current price level, indicating a bearish sign in near-term price trends. The MACD has formed a bearish crossover as the price is trending downwards. The RSI is also at 49.43, showing that the coin is neither oversold nor overbought which could mean that the current bearish momentum could continue in the coming days.

Uniswap price analysis conclusion

Overall, a bearish pressure is dominating the Uniswap price analysis trends and it remains to be seen if the bulls will be able to break the current resistance or not. However, the technical indicators suggest that the coin could remain bearish in the near term, but there is still a chance for bulls to make up some ground if they manage to break above the current resistance.