The AI boom looks like the dot-com boom, according to an expert, but he says there is one major difference that makes this frenzy far more dangerous.

AI boom vs. dot-com boom

Investors’ interest in AI reached its peak last year as equity markets were dominated by large-cap stocks that started to pay off handsome profits due to their investments in AI. The leading player in this trend is the computing chip maker Nvidia, whose stock went up by 239% last year and continues to grow today.

The excitement of investors about artificial intelligence (AI) is also visible in the high valuations of corporations like Intel and Nvidia, as the latter’s stock trades nearly 32 folds of its next 12-month (NTM) price to earnings multiple.

The reason for their higher bets is their hope that AI will dramatically transform the global economy, increase productivity across all sectors, and also be the backbone of revolutionary products.

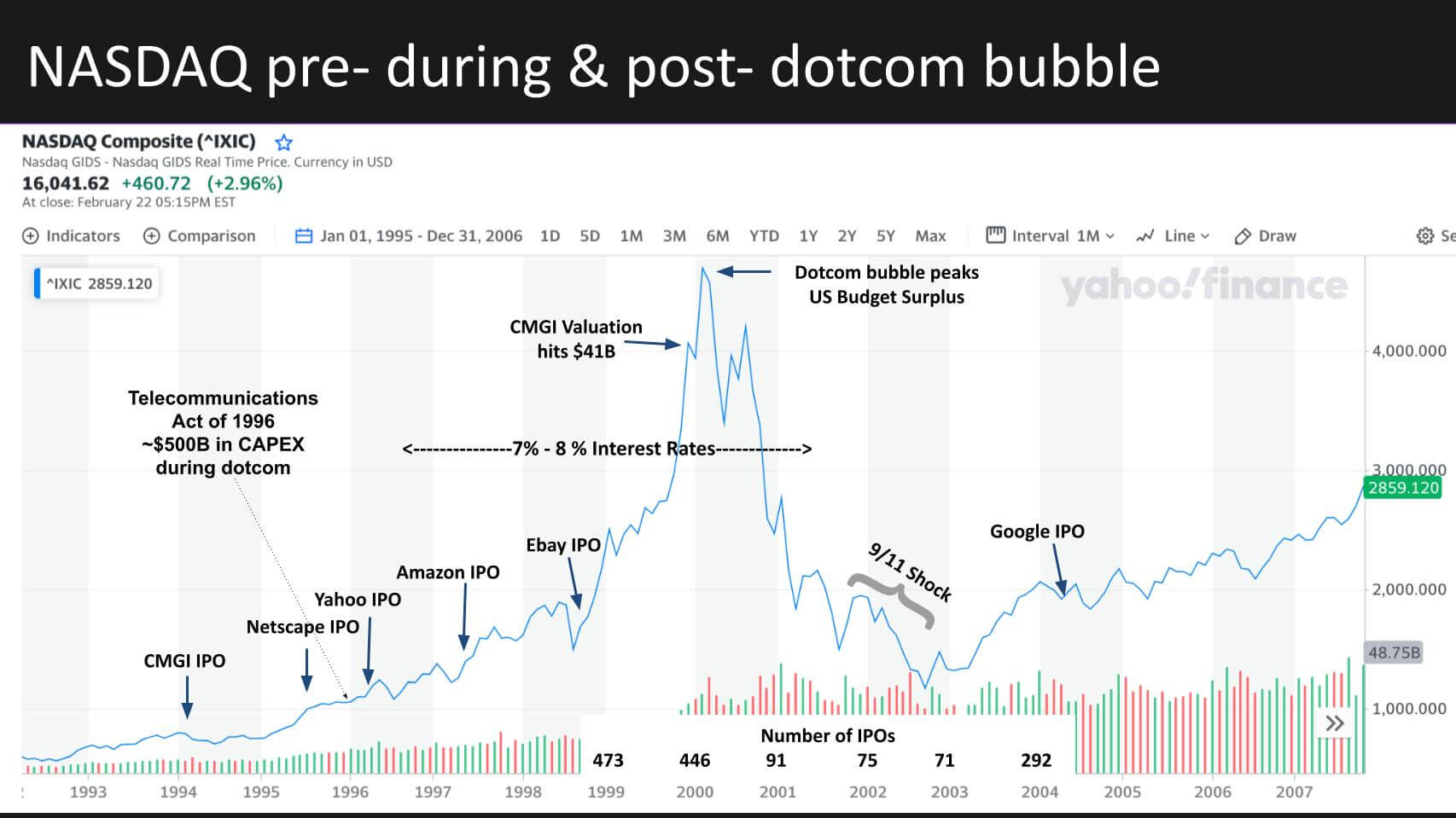

When the internet came back in the late 1990s, people were amazed and saw ample potential in it to change the world we live in, which sounds like the same story. The Internet definitely changed things, but our lives remain by and large the same in many aspects of our daily routines.

According to a Business Insider report, professor of business studies at the University of Michigan’s Ross School for Business, Erik Gordon, said that the internet was revolutionary and artificial intelligence will also be.

AI has a bigger player involved

He noted that it’s not necessary that companies that are valued based on these scenarios are a good investment option, despite the fact that both scenarios are right. He said,

“Many dot-com companies that drove the internet change went broke doing it. Many AI companies driving as big a change will go broke or lose half their value.”

Source: Business Insider.

In simpler terms, the value of AI companies might be too high compared to what they’re actually worth. And some of the first companies that are trying to do big things with AI might fail, despite considering the fact that AI is expected to be very important in the future.

The semiconductor maker’s revenue surged to $61 billion during the last year, which was a 126% increase on a year-over-year basis, and its net income increased by $30 billion, which amounts to a 600% surge. This makes Nvidia the highest gainer in the AI race.

Investors flocking to Nvidia have drawn its stock price up by 600% since the start of 2023, which has brought the company’s market cap to $2.2 trillion, which was $400 billion before that.

Looking at the market statistics, the same investors are now flocking to nuclear energy and uranium-related stocks and ETFs, as they are also in high demand due to the power-hungry nature of AI, and the uranium price has increased by 70% over the past year.

Gordon has identified one key difference between the internet and AI frenzies. He says that the internet’s pioneers were small companies, while AI is a different case, and tech giants like Alphabet and Microsoft are some of the big players. We can add more to Gordon’s list as nearly all tech titans are onboard and involved in heavier investments, with a web of 90 partnerships identified by British Market watchdog that involve the same companies.

But the point that Gordon highlights is the fact that these giants can afford to lose billions of dollars and will still be in business. While dot-com firms had small shareholders, when they failed, the most daring shareholders got hurt.

While the big tech brands in AI hold a big portion of the entire US stock markets, and if they fail, they might still survive but their losses will decrease their stock price which in turn will make many small shareholders suffer losses. So according to him, it’s a bubble of overvaluation of a bigger magnitude.