Bitcoin ETF shares were 3 times bigger than in previous months at the end of March. The running trading volumes had propelled to the numbers that the previous January and February could not match. This surge is primarily credited to IBIT, the BlackRock Bitcoin ETF that has been viewed as an early frontrunner in the market.

BlackRock’s IBIT ETF surges with $16 Billion in Bitcoin holdings

With BlackRock’s IBIT Ito as the center of attention and attracting the most investor interest, they have won the race for the highest ETF volume in Bitcoin. Analyzing the gold ETF as a dominant GLD market choice, IBIT shows a rising appetite of crypto investors for these assets via common ways.

The close of trade on the last Tuesday of March was still at hand when BlackRock held massive sums of money, which amounted to $16bn, from the Bitcoin ETF by mid-March. That indicates that the ETF needs minimal time to attract the huge inflow. The flow numbers carried by the FarSide Investors paint the picture that this is the main factor. This means that the stocks are well-trusted and have value among investors.

Retail investors have indeed emerged as a pivotal agency behind the rise in ETF’s perpetual trade volumes, with the average trade size being $13,000. With an ETF, investors could indirectly buy a Bitcoin via the ETF exchange; the massive retail exposure to the ETF will result in more people joining the Bitcoin market, making its access easy and convenient.

Bitcoin ETF approval market transformation

The US Securities and Exchange Commission’s approval of Bitcoin ETFs on January 7 marked a great step, turning the trading ETFs possessions on the 12th of the month. However, after scope of their introduction, the price of Bitcoin soared to the record value of $73,000 as an implication of the new state of the market in which fundamental analysis matters less and the performance of ETF influences investments more.

March’s Bitcoin ETF Boom Signals Sustained Investor Interest and Market Evolution

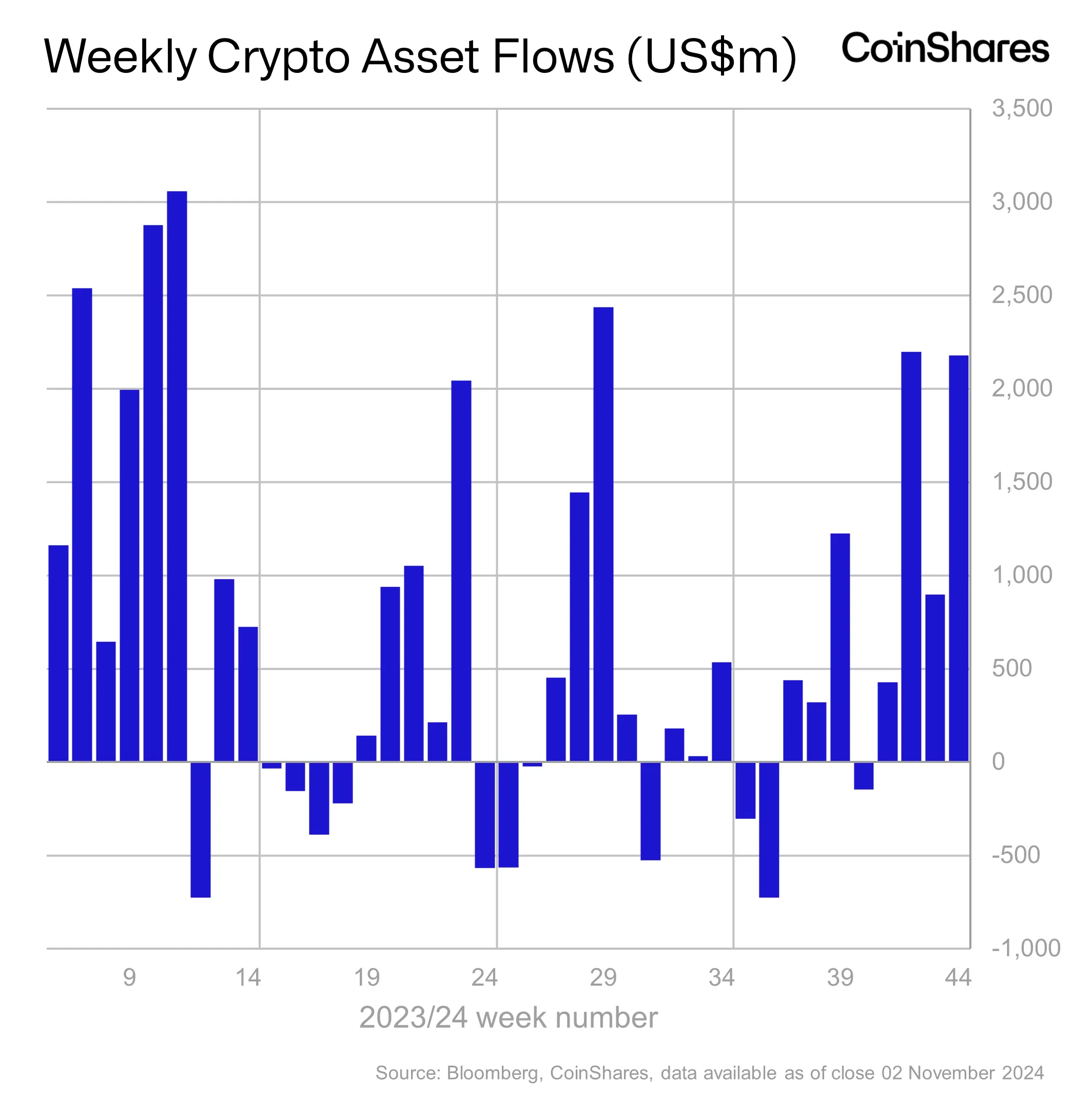

Although the factors concerning future trends are all uncertain, the truly expansive trading volume data of Bitcoin ETF in March brings forth the terrific demand for digital currencies among the market players.

Even though it is premature to measure the extent to which the decline in the interest has been sustained or surpassed, it is apparent that the trend signals a continuation of the interest in bitcoin ETFs as a key element in investment portfolios.

Bitcoin ETF trading volumes in March expressed the expanding appetite for crypto assets and suggested a change in methodology, which is now utilized to invest in the cryptocurrency market.

Alongside ETFs like IBIT, the topography of crypto investment continues to be a remodeling process. New opportunities for retail and institutional investors are creating more room for the EU members. Long-term acknowledgment and cash inflow into Bitcoin ETFs are evidence of cryptocurrency prospects’ reliability and a powerful factor in forming crypto funds.