Aave price analysis shows sideways price movement for the day as the price is recovering slowly. The price has been under the bearish shadow for the past two days, yet today a recovery in bullish momentum is being observed. Prices are facing resistance at the $80.02 level, And a break above this resistance level could see prices test the $80.30 resistance level. The critical support is seen at the $76.88 level. And a break below this support could see prices retrace back to the $76.50 support level.

The price has increased by1.91 percent in the last 24 hours and is currently trading at $78.96, the price opened today, trading at $78.43, but the bull run was short-lived as the price corrected higher to reach the current level. The 24-hour volume traded is $115,928,198 and the total market cap of Aave is now $6,825,394,382.

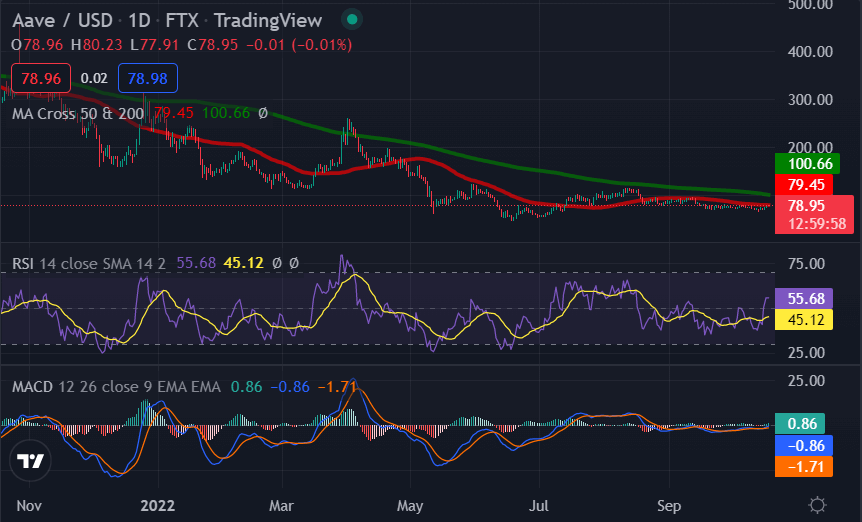

AAVE/USD 1-day price chart: Bulls continue to push prices higher as altcoin hits $78.96

The 1-day Aave price analysis shows that the market has been in a strong uptrend since early today as it climbed to the current high at $78.96. Aave prices have been stuck in a tight range between $76.00 and $80.00 for the past few days as bulls and bear battle for control of the market. Further recovery is possible in the coming days if the bullish momentum extends.

The 50 -day moving average is currently flat, and the 200-day moving average is still rising, which indicates that the long-term trend is still bullish. The RSI is currently below 50, which indicates that the market has some room to move higher before becoming overbought. The MACD line is currently above the signal line, which indicates that the market is in a strong uptrend.

Aave price analysis on a 4-hour price Chart: AAVE/USD trades above $76.00

On the 4-hour chart, Aave price analysis, we can see that the market has formed an ascending parallel channel and is currently trading at the upper boundary of the channel. Prices have recently broken out of a symmetrical triangle pattern which is a bullish sign. The market is expected to retrace back to the $78.96 level before resuming its upward move. The bears will be looking to take control of the market if prices break below the $76.88 level.

The RSI on 4-hour is currently at 67.98, which is in the overbought region and indicates that the market might be due for a correction. The MACD line indicator is currently above the signal line, indicating that the market is in a strong uptrend but is losing momentum. The 50-Moving average and 200-moving averages are both still rising, which indicates that the long-term trend is still bullish. The 50 MA is currently at $79.07, while the 200 MA is at $73.55.

Aave price analysis conclusion

To conclude, the Aave price analysis shows that the market is in a bullish trend as the price is expected to surge higher in the coming days. The market will find it difficult to sustain these levels. However, the overall market sentiment is bullish. The technical indicators are in favor of the bulls, which indicates that further upside is possible in the short term.