The Association of British Insurers (ABI) has introduced a pioneering guide aimed at fostering responsible artificial intelligence (AI) practices within the insurance and long-term savings sector. This initiative emerges in response to the rapid advancement of AI technology and its evolving regulatory landscape, underscoring the ABI’s commitment to ensuring that AI development aligns with consumer interests and ethical standards.

ABI’s vision for responsible AI

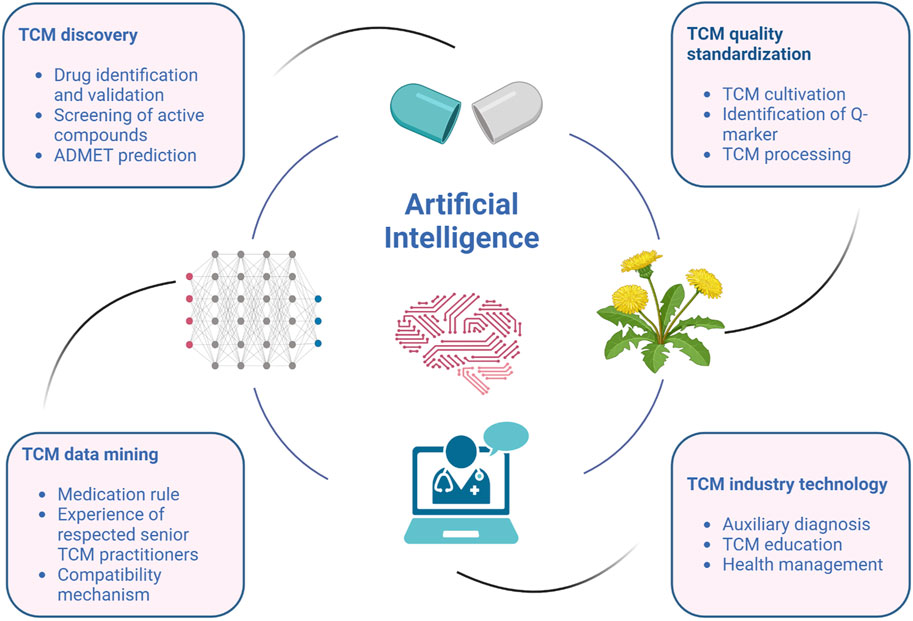

At the heart of this guide is the ABI’s dedication to the ethical deployment of AI across the insurance industry. By emphasizing the UK government’s five principles of AI—accountability, transparency, fairness, safety, and contestability & redress—the ABI sets a clear framework for firms to innovate responsibly. The guide not only highlights the vast opportunities AI presents, such as enhanced affordability, accessibility, and service availability for consumers but also addresses potential risks including bias, discrimination, and consumer exclusion.

Collaborative effort for industry standards

Crafted by the ABI’s AI Working Group, which comprises a diverse team of experts in actuarial science, data science, data protection, legal affairs, and regulatory compliance, the guide represents a comprehensive resource for firms navigating the complex terrain of AI integration. It provides practical advice, key questions for self-assessment, examples of good practices, and an overview of existing regulations that align with the principles of responsible AI use. This collaborative effort underscores the importance of collective action in shaping the future of AI in insurance, promoting a culture of inclusivity, and ensuring that technology serves both consumers and the industry effectively.

A roadmap for AI integration

The guide offers a roadmap for companies looking to harness AI’s potential responsibly. It encourages the development of a robust AI strategy, emphasizing governance, oversight, and the importance of aligning AI use with existing regulatory and consumer protection standards. Moreover, it aims to empower individuals across all levels of the industry to engage with AI technologies critically and without assumptions, fostering a culture of questioning and understanding.

Future directions and collaborations

Charlotte Clark, the Director of Regulation at the ABI, highlights the guide as a stepping stone towards deeper conversations about AI in the industry. It aims to clarify the responsible use of AI, backed by practical resources and regulatory insights. The ABI views this initiative as the beginning of ongoing collaboration between businesses, government, and regulators, essential for adapting to and shaping the evolving AI landscape.

The ABI’s guide is not just a resource but a call to action for the insurance and long-term savings industry to embrace AI with responsibility at its core. As technology advances, this guide serves as a beacon for ethical innovation, ensuring that AI development proceeds with consumer interests in mind and within a framework that promotes fairness, safety, and transparency.