Concerns are growing that the rapid advances in artificial intelligence (AI) technology are making it increasingly difficult for law enforcement agencies to apprehend scammers who prey on individuals in North Yorkshire. Counter-fraud experts warn that fraudsters can now create entirely new images and personas, making it challenging for investigators to identify and track down the culprits.

AI’s alarming capabilities

Andy Fox, a counter fraud coordinator for the Yorkshire and Humber regional crime unit, expresses his concerns about the evolving capabilities of AI technology in aiding scammers. He notes that fraudsters can use AI to generate entirely new images and profiles, posing as someone else. This poses a significant challenge for authorities who traditionally rely on reverse image searches to trace fraudulent identities.

Fox states, “One of the first things when we look at romance fraud victims, we look at the photographs and do a reverse image search to find where that image is on the internet. But if someone has generated a whole new image using AI technology, that image is not going to be there, and that reverse image search won’t work.”

He further adds that AI is rapidly advancing to the point where scammers can create realistic-looking individuals capable of engaging in two-way conversations, answering questions, and even using hand gestures and facial expressions. The sophistication of such technology is both alarming and worrying, and it is expected to continue improving, providing fraudsters with even more tools to deceive victims.

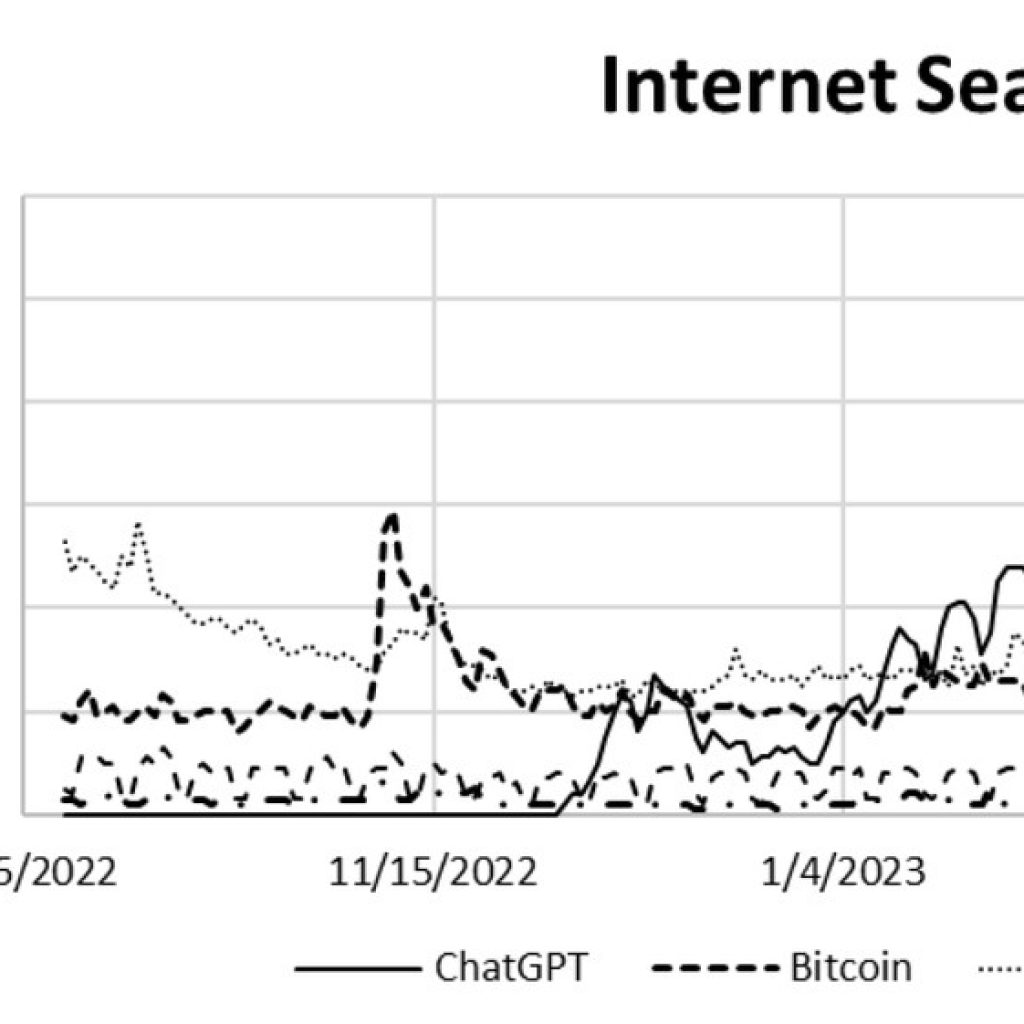

Surge in Romance Scams

These concerns come at a time when reports of romance scams are on the rise. According to data from Lloyds Bank, there was a 22% increase in romance scam reports last year compared to 2022. The average amount lost to romance scams in 2023 was £6,937, a slight decrease from the previous year’s average of £8,237.

The reports highlight that individuals aged 55 to 64 are most likely to be targeted by fraudsters posing as love interests. Notably, men across all age groups were more likely to report falling victim to romance scams, while women tended to report higher average losses, averaging £9,083 compared to men’s £5,145.

The demographic aged 65 to 74 experienced the highest average losses, losing £13,123 to romance scams on average.

The mechanics of romance scams

Romance scams are particularly insidious as they prey on individuals seeking love and companionship. Perpetrators often create fake personas, complete with fabricated photos and elaborate backstories to explain their inability to meet in person. Common excuses include claiming to work overseas in the armed forces or international aid and charity work.

These scams can unfold over extended periods as fraudsters build trust with their victims. Eventually, they request money, typically citing family emergencies, medical bills, or travel expenses to meet their victims in person. The requests often start with small amounts but can escalate over time.

Guarding against deceptive AI-enhanced scams

As technology continues to evolve, individuals must exercise vigilance and caution when interacting with online contacts, especially in romantic contexts. The following precautions are recommended:

1. Verification: Verify the authenticity of online contacts through multiple channels and cross-check information provided by individuals.

2. Questioning: Ask questions during online interactions to gauge the authenticity of the other person. Be wary of vague or evasive responses.

3. Stay informed: Stay informed about emerging scam tactics and educate oneself about potential red flags associated with online interactions.

Individuals must remain vigilant and skeptical, as the convergence of AI and fraud poses an ever-increasing threat to personal and financial security.