Blockchain analysis platform Santiment has reported significant gains in artificial intelligence (AI) and big data projects amidst the recent surge in cryptocurrency prices, particularly Bitcoin (BTC). According to Santiment, investors’ focus on dip buy opportunities for Bitcoin and various meme coins has led to a surge in AI coins.

Santiment data highlights AI coin profit surge

Santiment identified a wallet holding over 100 AI-focused digital currencies from its watchlist, which experienced a notable 30.7% increase in value within the last 24 hours. This surge follows the platform’s creation of a watchlist in late February, prompted by remarkable performances from AI projects such as Delysium (AGI), SingularityNET (AGIX), and Artificial Liquid Intelligence (ALI), as evidenced by significant gains on their weekly charts.

Michael Saylor’s insights on AI and bitcoin

Former MicroStrategy chief executive and executive chairman Michael Saylor recently shared insights into the relationship between artificial intelligence (AI) and Bitcoin. In a recent interview, Saylor highlighted the potential for AI to drive up the demand for Bitcoin, emphasizing the intersection between these two sectors.

Addressing environmental concerns

In addition to discussing the symbiotic relationship between AI and Bitcoin, Saylor addressed concerns regarding Bitcoin’s environmental impact. He pointed out that many AI projects are aiming to scale up to 60 gigawatts within the year and have long-term plans to reach 600 gigawatts within a decade. Saylor believes that as AI projects expand, they will inherit the energy-related concerns previously associated with the digital asset sector.

Implications for the future of AI and cryptocurrency

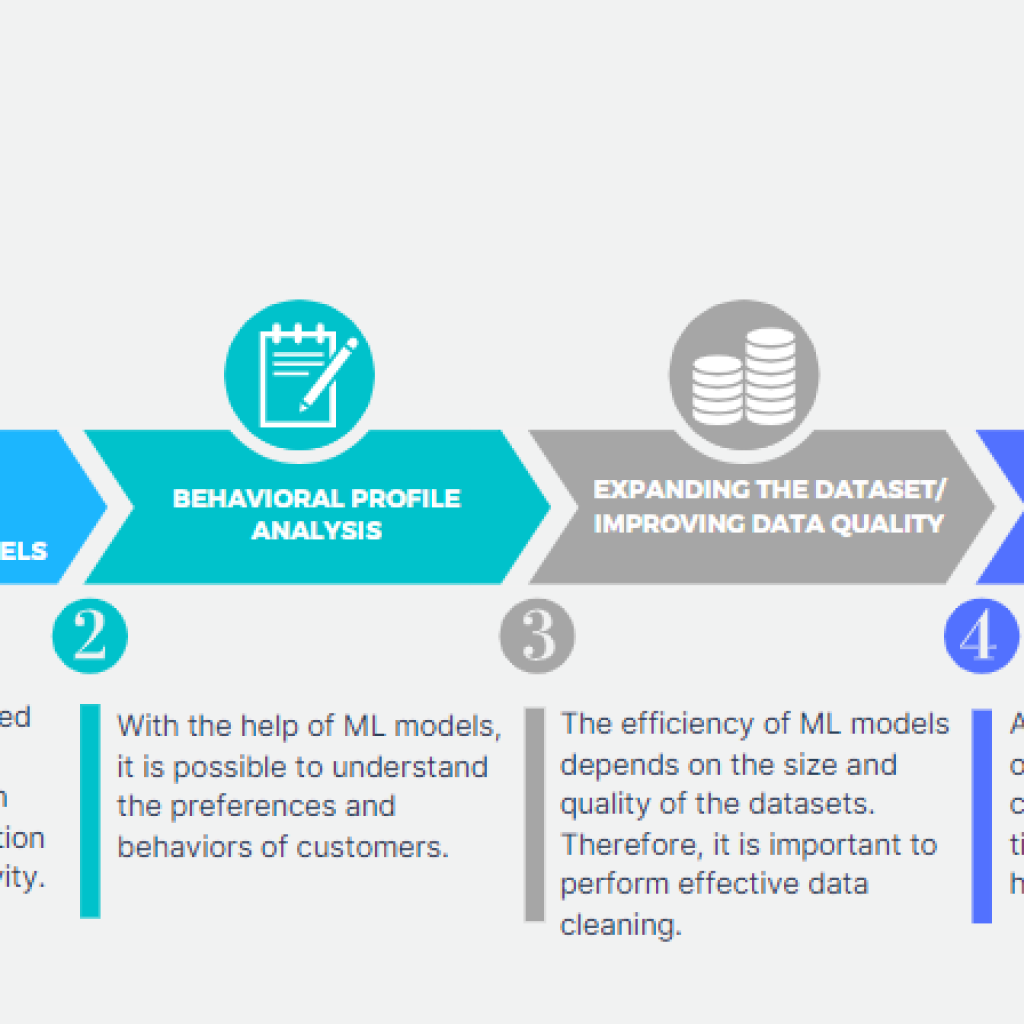

The recent surge in AI coin profits underscores the growing interest and investment in AI projects within the cryptocurrency market. As investors seek opportunities beyond traditional cryptocurrencies like Bitcoin, AI coins present a promising avenue for diversification and potential gains.

The intersection of AI and bitcoin

Saylor’s remarks highlight the interconnectedness of AI and Bitcoin, suggesting that advancements in AI technology could further bolster the demand for Bitcoin. This synergy between AI and cryptocurrency may pave the way for innovative applications and developments in both fields.

Environmental considerations

While the potential of AI-driven demand for Bitcoin is promising, concerns regarding the environmental impact of cryptocurrency mining persist. Saylor’s acknowledgment of the energy requirements associated with AI projects underscores the need for sustainable practices within both the AI and cryptocurrency sectors.

The surge in profits witnessed by wallets holding AI coins reflects the growing interest in AI projects amid the cryptocurrency market’s recent surge. Santiment’s data highlights the significant gains experienced by AI-focused digital currencies, signaling potential opportunities for investors. Michael Saylor’s insights further underscore the symbiotic relationship between AI and Bitcoin, emphasizing the potential for AI-driven demand to impact the cryptocurrency market. However, concerns regarding the environmental implications of both AI and cryptocurrency operations remain, calling for sustainable practices to mitigate adverse effects. As developments in AI and cryptocurrency continue to unfold, the intersection of these two sectors presents intriguing prospects for innovation and investment.